TG Metals wraps up Van Uden acquisition, eyes near-term cashflow

TG6’s new Van Uden project has the potential to deliver near-term cashflow. Pic: Getty Images

- TG Metals wraps up acquisition of 80% stake in the previously producing Van Uden gold project in WA

- Work underway to determine the potential of near-term cashflow using material from existing stockpiles

- Updated resource estimate using existing drill data to underpin mining studies

Special Report: TG Metals has completed its acquisition of an 80% interest in the highly prospective Van Uden gold project on the Forrestania Greenstone Belt in WA.

It paid Montague Resources an upfront cash amount of $2.5m and issued more than 5.7 million TG6 shares subject to a 12-month escrow period.

A 12-month deferred cash payment of $500,000 has been deposited in an escrow account.

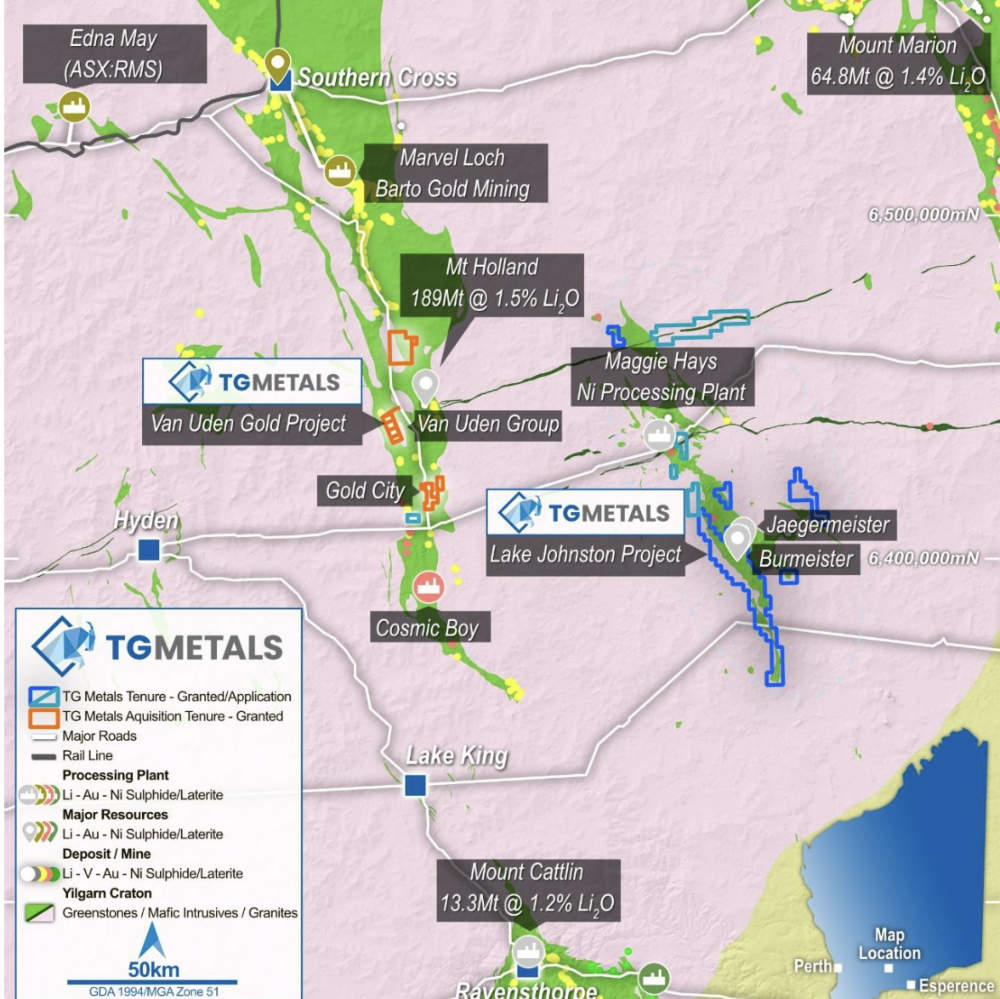

TG Metals (ASX:TG6) has many reasons to be attracted to Van Uden, which consists of four mining leases that sit 90km east-northeast of Hyden and 120km south of Southern Cross.

These leases are also close to the producing Marvel Loch and mothballed Edna May gold processing plants.

Van Uden has recorded historical production of 11,142oz of gold from the Tasman and Diemens open pits as well as surface gold-bearing laterites, providing confidence that a gold system is present.

Existing stockpiles provide near-term cash flow potential through toll treating while the shallow nature of historical mining could allow for a more extensive operation to be carried out given bullish gold prices.

Past exploration drilling by Convergent Minerals and Kidman Resources defined extensive mineralisation at Van Uden and shallow mineralisation at Gold City with Convergent defining a JORC 2004 resource of 5.378Mt at 1.38g/t for 238,000oz of contained gold in 2013.

This historical resource is expected to form the basis for further confirmatory drilling, extensional drilling and bulk density analysis to enable a JORC 2012 compliant resource estimate to be calculated.

Progress towards production

TG6 chief executive officer David Selfe said completing the acquisition allowed the company to progress Van Uden towards production.

“As a priority, the recently submitted POWs allow us to drill test the existing stockpiles and evaluate their potential for near-term treatment and cashflow.

“In consideration of the large amount of drilling completed since the last publicly stated mineral resource estimate, we are in the process of completing a JORC 2012 compliant resource, which will form the foundation of mining studies, focused on a low capital cost startup.”

TG6 has engaged consultants to review and restate the existing JORC 2004 resource to JORC 2012 compliance.

This will include an extensive drilling database over a strike length exceeding 2.5km with the company noting the process is already well advanced with mineralisation interpretations and wireframes constructed.

The new resource is expected to be completed in May 2025.

An immediate priority for the company is assessing the existing stockpiles for potential toll processing at a third-party gold plant.

To achieve this, it has submitted programs of work (POWs) with the state government for drilling the stockpiles to determine gold grade and commissioned LiDAR surveys to determine accurate stockpile volumes, which will aid in preparing future mining proposals.

This article was developed in collaboration with TG Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.