Tesoro’s road to El Zorro gold just became a highway with major funding following rich intercepts

Tesoro Gold is just starting to realise the beauty out at El Zorro in Chile. Pic Via Getty

Special Report: Tesoro Gold has received binding commitments to raise circa $9.7 million at 3c per share as it looks to advance the El Zorro Gold Project in Chile.

The offer price represents a 6.3% discount to the last closing price of 3.2c on 15 July, 2024 and a 10.9% discount to the 5-day volume-weighted average price of approximately 3.37c.

Earlier this month, Tesoro Gold (ASX:TSO) discovered a major new gold intercept to the east of its 1.3Moz Ternera Gold Deposit within the broader El Zorro Gold Project in Chile.

The discovery was made via first pass drilling of the Ternera East target, which was aimed at assessing high-priority targets near Ternera, which could have potential for future rapid and shallow additions to the existing Mineral Resource at El Zorro.

The Mission

Tesoro says the fresh funds will be injected directly into growing the Resource at its existing 1.3Moz Ternera Gold Deposit through exploration drilling, project studies and regional target generation.

The Ternera East target looks particularly exciting and Tesoro reckons it has the potential to rapidly add substantial ounces to El Zorro’s existing bounty.

Tesoro has an array of high-priority gold targets proximal to Ternera, including discoveries at Drone Hill where recently reported assay results at the target, clocked grades of up to 173g/t gold.

The Company says it also intends to pursue further technical and economic advancements at El Zorro.

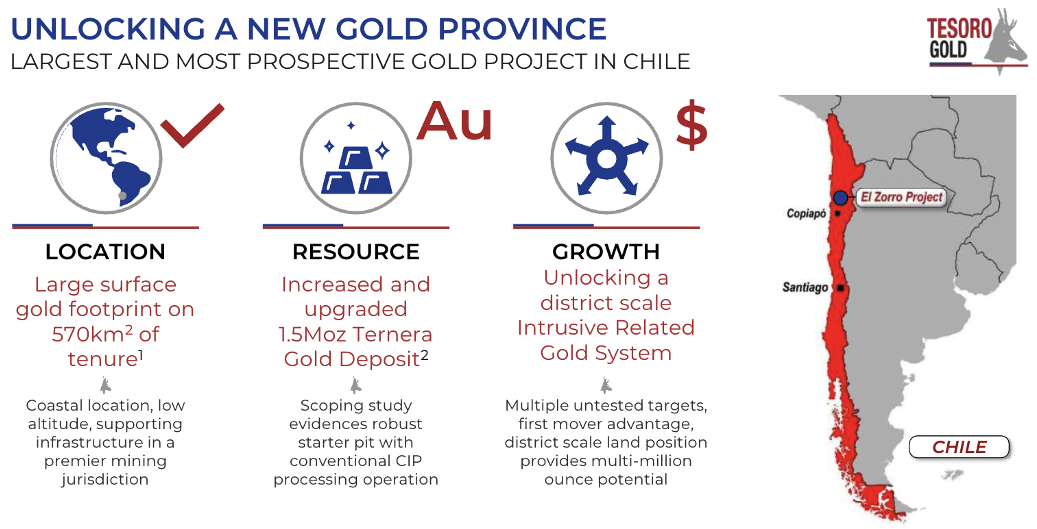

In a presentation to investors earlier this week, Tesoro revealed the extent of untested targets across El Zorro’s massive 570km2 tenure.

Tesoro’s Managing Director, Zeff Reeves said the placement received strong demand from long term specialist in precious metals, institutional and sophisticated investors from the UK, the EU and here in Australia.

Strategic partner, the South African gold major Gold Fields, has also made a cornerstone commitment of some $1.2 million from a second tranche, subject to Shareholder approval.

“We thank our existing shareholders for their continued support, including our strategic investment partner, Gold Fields,” Tesoro managing director Zeff Reeves said.

“We continue to work closely with the Gold Fields technical team, who have provided valuable support since their initial investment in November 2022.

“Their ongoing commitment to Tesoro strongly validates our view that the El Zorro Gold Project has potential to become a significant asset, demanding further exploration and advancement to unlock its full value.

“This additional funding will allow us to continue to advance and grow Ternera, undertake target generation and regional exploration drilling, and progress technical and economic study optimisation and more over the coming twelve months,” Reeves added.

The Placement

The Placement comprises the issue of approximately 323.3 million new fully paid ordinary

Tesoro shares to professional and sophisticated investors at an issue price of $0.03 per Placement Share.

Proceeds measure up at approximately $9.7 million (before costs), comprising:

- Tranche 1: Approximately $8.5 million via the issue of up to 283,333,334 Placement Shares, comprising of 160,375,263 Placement Shares

- Tranche 2: Approximately $1.2 million via the issue of up to 40,000,000 Placement Shares to Corporate International Holdings BV, a wholly owned subsidiary of Gold Fields, subject to obtaining Shareholder approval at an Extraordinary General Meeting (EGM) to be held in September 2024.

Unified Capital Partners and Morgans Corporate have been appointed joint lead managers and Tamesis Partners LLP as co-manager to the Placement

The joint lead managers will receive a 6% fee on all funds raised under the placement.

This article was developed in collaboration with Tesoro Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.