Ten Bagger: John Forwood says Kazakh tax rules have uranium explorers back on song

Pic: Stockhead/supplied

Welcome to Ten-Bagger, where Lowell Resources Fund chief investment officer John Forwood gives us his take on a sector of the ASX resources market full of value.

This month, John tells us why uranium stocks are back on the winner’s list.

Niger and Kazakhstan are two countries with few similarities. Except, they’re both big uranium producers and erratic government policies from each of the (largely) autocratic regimes have provided tailwinds for yellowcake producers elsewhere.

The African nation’s takeover by a military junta last year has stirred concerns about major nuclear power market France’s ability to feed its reactors with a nationalistic stance that included last month the effective expropriation of an undeveloped project held by the European nation’s uranium miner Orano.

Niger is the second largest of France’s uranium suppliers after Kazakhstan, ahead of Namibia, Uzbekistan and Australia, but Orano’s activities in the country are unpopular with a government tapping into sentiment against the presence of the former colonial power in its political landscape.

Earlier this month, the Niger junta also revoked GoviEx Uranium’s rights over the perimeter of the Madaouela mining permit. TSX.v-listed GoviEx has done an enormous 650,000m of drilling to define one of the world’s largest uranium mineral resources.

Yet the real rocket for uranium stocks came when Kazakhstan’s government last week delivered a surprise tax hike on uranium producers.

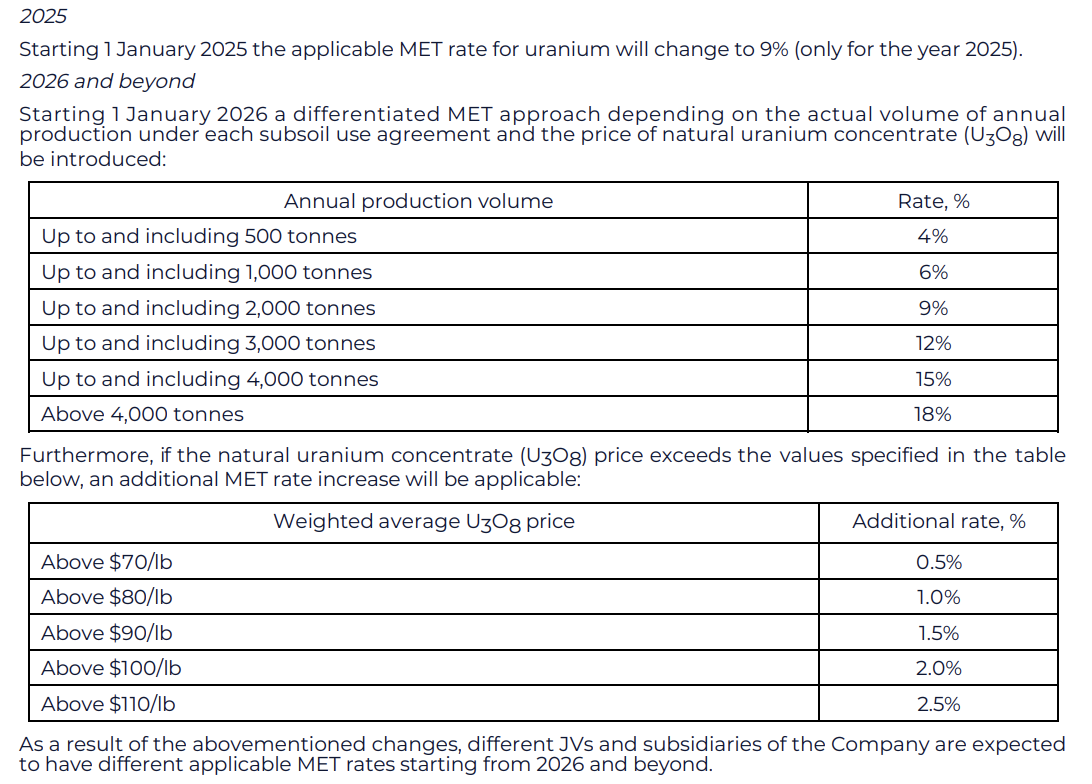

Producers in the country, which generates around 43% of the world’s U3O8 supplies, currently pay a 6% royalty on their output.

That will rise to 9% in 2025. But that’s not all. From 2026, the rate will become tiered in a similar vein to Queensland’s cash cow coal royalty system. Mines producing less than 500t will cop a rate of just 4%, but those producing upwards of 4000t will send 18% of revenue to the State, with a staggered list of tiers in between.

An additional tax of up to 2.5% could be paid if the weighted average price of sales from the mine exceed US$110/lb.

Lowell Resources Fund (ASX:LRT) CIO and Ten Bagger expert John Forwood told Stockhead that could curb output further from an already underperforming Kazatomprom, Kazakhstan’s state producer and the largest exporter of yellowcake globally, and push prices higher amid a shortage of the nuclear fuel.

“It’s a disincentive. You’ve got Kazatomprom, where everyone is questioning whether they’ll actually be able to meet their production targets – they’re having construction issues, and they’re also having issues in sourcing sulphuric acid,” Forwood said. “It seems highly unlikely that they’ll be able to produce the maximum that they’re allowed to.

“What is the OPEC of uranium, Kazakhstan, has got two significant headwinds in terms of increasing production. And so that just plays more into the hands of the Western producers and developers.”

Renewed interest in yellowcake stocks

While uranium spot prices have fallen from a 16-year-high of US$107/lb in January to around US$86/lb at the end of last week, contract prices, ceilings and floors are catching up to the more constrained spot market.

Although uranium stocks already enjoyed their initial bull run in last year’s market surge, spurred by increased demand from utilities who contracted uranium oxide from miners at a decade high of 160Mlb, Forwood said long lead times to getting projects into production would likely see deficits swell.

“In the West, we know that it takes twice as long to bring a new uranium mine into production as it does for the Chinese to build a new nuclear reactor, and that’s where the lion’s share of the new nuclear reactors are being built,” he said.

“The squeeze is on. And these moves in Niger and Kazakhstan will exacerbate the squeeze.

“The uranium explorers do seem to very much trade on the spot price, although spot is really a very small amount of the 180Mlb of uranium that is used every year. Most of it is under a term or contract price..

“I would expect that these factors will start flowing through pretty quickly to new contracts. I would expect that for utilities, this makes them even more nervous.”

The American push to displace Russian-sourced enriched uranium will also help Western producers, Forwood said, with the US Department of Energy setting up a fund to procure locally enriched uranium for US utilities following the sign off of bipartisan legislation to eventually ban Russian enriched uranium sales in the States.

“Now we’re hearing US$70-75/lb term contracts as the level being negotiated and I wouldn’t be surprised to see that gap between spot and term start to narrow or for both to go up together,” he said.

Take me down to Uranium City

Forwood is an avid tracker of uranium explorers with the potential to make a big new discovery.

His two this month are both in Canada.

One is $28 million capped Infini Resources (ASX:I88), which is up over 350% in the past month after reporting soil samples at the Portland Creek project so rich in uranium they fell outside the detection limits of conventional testing technology.

While they remain no substitute for drill samples, a swag of samples returned from the Portland Creek project in Newfoundland have set yellow hearts a flutter.

Seven of the 17 samples from a 235m x 100m zone coinciding with a historic radon gas anomaly returned assays of more than 3% U3O8 using stronger assay tech.

The best came in at 74,997ppm U3O8, or 7.5%, the kind of concentrations normally only seen in Saskatchewan’s freakish Athabasca Basin.

“It’s not a geology which is widely known as being prospective for uranium,” Forwood said.

“Canada is host to the highest grade uranium projects in the world in the Athabasca basin.

“So I think explorers in the Athabasca and possibly eastern Canada as well have some really good potential.”

Forwood is also tracking the northern Athabasca explorer Aero Energy (TSX-V:AERO), which is searching in an under-appreciated area of the famous uranium district, home to the vaunted Cigar Lake, Rabbit Lake, McArthur River and Arrow uranium deposits.

“The closest town to their project is called Uranium City, which is quite a good sign,” Forwood said.

“They’ve got numerous high grade rock chips at surface.

“They’re on the edge of the Athabasca, so they’re not under hundreds of metres of sandstone, which (often) presents problems in terms of both exploration and mine development.

“It’s shallow cover and outcrop and like many at the Athabasca explorers they’ve got a drilling program underway at the moment.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.