Tasmania’s overlooked mineral wealth shines bright amid stormy seas

The mining industry is shining bright for Tasmania. Pic: Getty Images

- Tasmania’s been in the spotlight for all the wrong reasons of late

- But its mining scene is continuing to hold strong amid the storm

- Octava Minerals is the latest junior to throw its hat in the ring, planning to drill an overlooked copper discovery in the Apple Isle

Tasmania’s political class has been undone by, of all things, an argument over a football team and it would be obvious to all and sundry that the last word to describe the Apple Isle would be stability.

But even amid the fog – clearing slightly with re-elected Liberal Premier Jeremy Rockliff beating off a no-confidence motion from his Labor Opposition this week – a dispute over a stadium in Hobart can’t cloud the rich geological potential of its hard-working west coast.

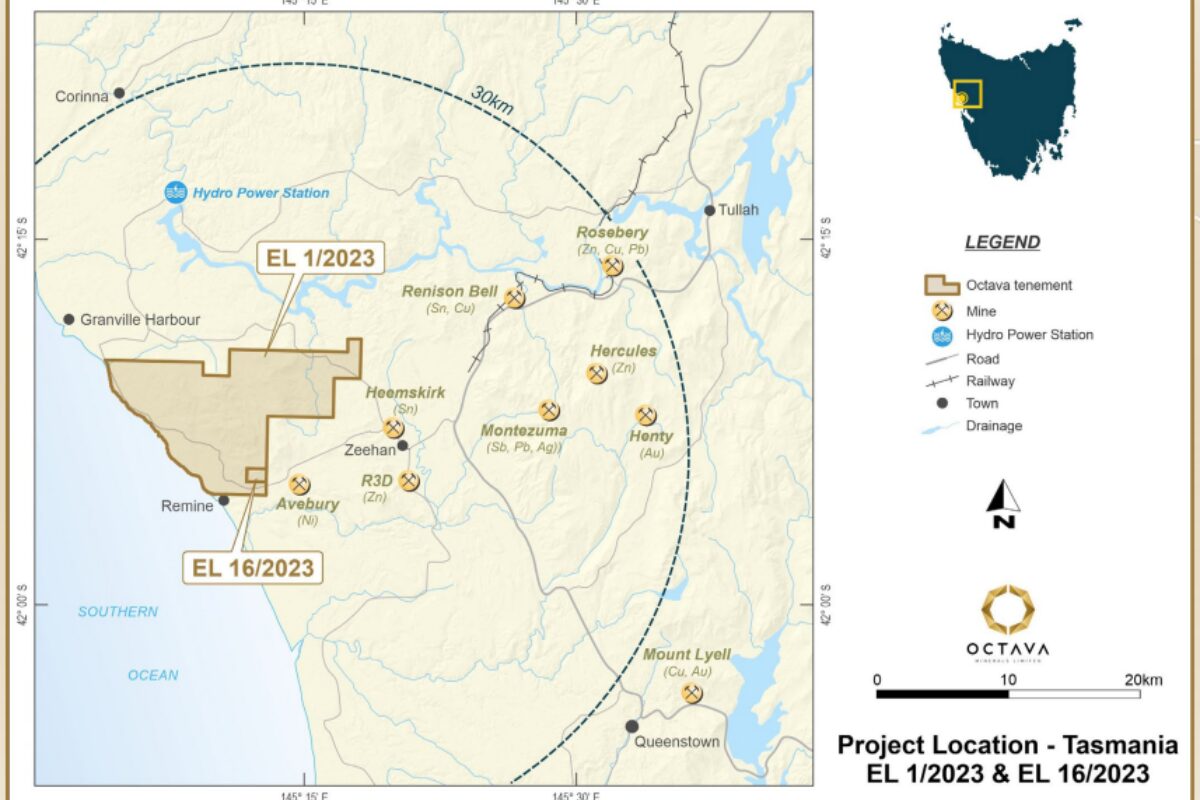

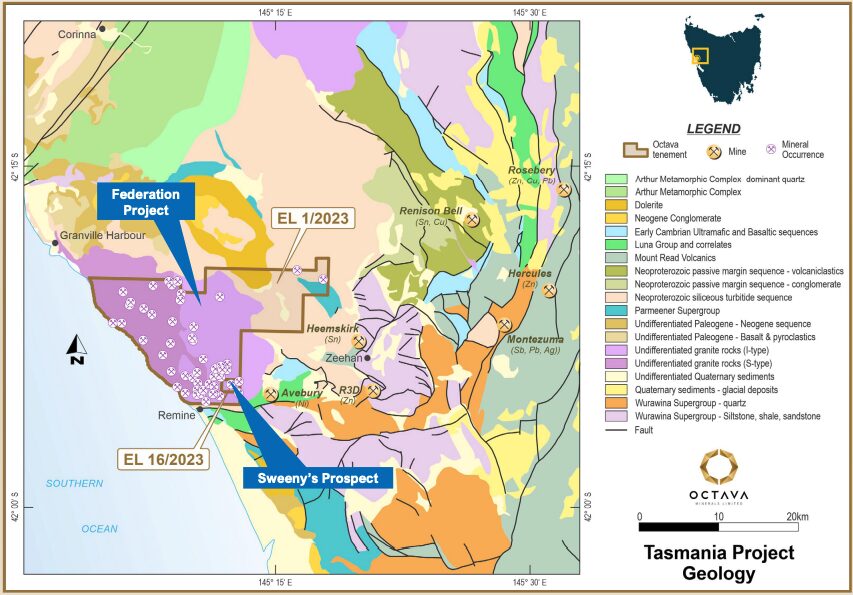

There, sitting in a radius smaller less than half the distance of the greater Sydney region, are a host of major mineral deposits along with prospects that have gone mysteriously undrilled for decades.

It may be small and remote, and better known for its logging industry and salmon farms, but Tasmania has been a minerals powerhouse as well. In fact, mining makes up more than 50% of the state’s mercantile exports, making it Tasmania’s largest export industry.

The state plays host to one of the world’s largest zinc smelters in Hobart, the basis for the establishment of its rich hydroelectric scheme – the cornerstone of an energy system that runs at close to 100% renewable penetration.

The 280,000tpa plant, run by Trafigura subsidiary Nyrstar was given a new lease on life this month with the announcement of a government subsidy and plans to extract critical minerals germanium and indium as a by-product.

But Tasmania is rich in raw materials as well.

Australia’s longest running magnetite mine, Grange Resources’ (ASX:GRR) Savage River project, has exported high-grade iron ore to Asia for around six decades.

It also hosts one of the western world’s largest tin operations, the Renison Bell mine 15km north-east of Zeehan, which has gone through various iterations since the discovery of alluvial cassiterite in 1890 by prospector George Renison Bell.

Now 50% owned by $520 million capped Metals X (ASX:MLX), the underground operation produces close to 3% of the world’s annual output of tin metal and close to 4% of mined supply.

But if new explorers and miners moving into the scene in Tasmania have their say, its mining sector could be on track to rapidly diversify in the coming years.

Copper opportunities

Among the most exciting but commonly overlooked developments in Tasmania’s mining sector in recent years was the takeover of New Century Resources by Sibanye-Stillwater.

The South African gold and platinum giant has been diversifying into base and battery metals in recent years.

And while its acquisition of New Century was largely focused on the tailings retreatment project at Queensland’s Century zinc mine, it brought with it an option over the shuttered Mount Lyell copper deposit near the tourist haven of Queenstown in Tassie.

Little reported, Sibanye signed off on the option to pick up the Mount Lyell mine from Vedanta and kick off a feasibility study in late 2023.

The prospect of the mine’s reopening, more than a decade after safety issues led to its 2014 mothballing in a far different copper price environment, is now very real.

The US$10m deal netted Sibanye a resource of 79.4Mt of ore containing 1.6Blb of copper and 500,000oz of gold.

And that development has thrust a spotlight on other potential copper resources nearby.

China’s MMG Metals owns the Rosebery mine, where copper is a by-product of zinc and lead mining.

And over near Zeehan, ASX explorer Octava Minerals (ASX:OCT) has recently announced an option to acquire the Federation project, a legacy site that has gone untouched for decades despite strong hints of copper, zinc and silver mineralisation.

At a market cap of $3m and with the region’s largest copper deposits controlled by global miners, it could offer the cheapest exposure to any narrative around Tasmania’s mineral resurgence.

The Federation era

Despite the name, the architecture around the Federation project was put together substantially more recently.

Located a stone’s throw from the Avebury nickel mine, mothballed due to low prices in 2024 by Mallee Resources, Federation was once part of the Renison Bell portfolio in the 1970s.

Drilling at its Sweeney’s prospect picked up 23m at 1.19% copper, 1.7% zinc, 121g/t silver and 1.17% tin in one hole reported in 1977.

Another collected 24m at 0.25% copper, 0.52% zinc, 42g/t silver and 0.27% tin with accessory antimony and fluorite, both critical minerals today.

It may not have sung to a company seeking additional tin supply.

But copper now holds significant allure. It fetches US$4.50/lb, is set to see a 70% ramp up in demand by 2050 amid a rapid lift in electrical infrastructure development and is on track to displace iron ore as the main value driver for the world’s biggest miner BHP.

A discovery in Tasmania would no doubt prick the ears of investors, especially with Mount Lyell’s reopening on the agenda.

“I think back in the in the late ’70s, tin was the focus,” Octava managing director Bevan Wakelam said.

“They did the drilling and then they had alternative targets they also wanted to test and follow up and the copper side of things was not really in the mix at the time.”

Octava has 12 months to complete due diligence on the project, which has only been subject to a handful of historical drill holes.

“Our geos are on the ground right now, actually. They’ve gone to site and they’re going to be checking out the area at Federation, especially around Sweeney’s,” Wakelam said.

“They’ll be checking out some of the old workings there and also scoping out options for drilling.”

A geophysical survey is the likely first step for the company, which has previously been exploring for rare earths, lithium and antimony in WA.

The key will be diamond drilling to infill the holes sunk by Renison in the ’70s, seeking evidence of a deeper volcanogenic massive sulphide system, the kind that typically hosts high-grade copper mineralisation. There remains a sense of unfinished business, especially given the infrastructure advantages for developers like Tassie’s hydro network and rail infrastructure to the port of Burnie.

“In the Renison drilling, they were seeing mineralisation from 50-70m down to 210m and it’s still open at depths and along strike,” Wakelam said.

“A couple of companies in more recent times had picked it up and were planning drill programs … but due to a number of reasons it just never got done.

“It’s certainly worth following up that drilling and we’re also looking at the potential for a larger system.”

Regulatory support

While at the high level, Tasmania’s political scene has been shambolic in recent times, Wakelam says Octava and other explorers have enjoyed strong support at the departmental level from its minerals department and EPA.

“They’re certainly keen to encourage, you know, people to look for new projects and get new operations up and running,” he said.

Octava is not the only junior playing the field in west Tassie.

One of the better micro cap movers this year, Lode Resources (ASX:LDR) has seen its shares run 78% higher in 2025, in part on the back of high grade antimony, silver and tin results at its Montezuma project.

A 50-60 hole program covering 8000-10,000m of core is currently ongoing at the site.

In the gold space, Kaiser Reef (ASX:KAU) brought certainty to the future of the Henty gold mine with its $31.6m deal to acquire the mine from WA-focused Catalyst Metals (ASX:CYL) accompanied by a ‘robust’ five year mine plan to generate upwards of 30,000ozpa from the operation.

Further afield, Flynn Gold (ASX:FG1) has taken the early stage route, looking for large scale gold discoveries akin to those across the Bass Strait in Victoria at its Golden Ridge project, a site located in the island’s less well mined northeast.

Its tenements also include one surrounding the Beaconsfield gold mine, now the site of a museum paying tribute to the state’s mining history.

One of the world’s highest grade undeveloped tin deposits also sits within an ASX explorer, with $32m capped Stellar Resources (ASX:SRZ) currently running a pre-feasibility study on its Heemskirk project on Zeehan’s doorstep.

Led by former Oklo Resources MD Simon Taylor, who led the African gold explorer into its takeover by B2Gold, Stellar’s Heemskirk could eventually become a 3000-3500tpa producer off the back of a resource of 7.48Mt at 1.04% Sn for 77,870t of tin metal, if its aspirational target can be proved up.

SRZ’s separate North Scamander discovery delivered a significant polymetallic find of high-grade silver, tin, zinc, lead and indium from initial drilling in September 2023.

Farther flung is Group 6 Metals (ASX:G6M), which runs one of just two active tungsten mines in Australia at Dolphin on King Island.

G6M has been suspended since late last year amid a plan to recapitalise the business, but has continued operating the Dolphin mine in the meantime, benefitting from rising prices for tungsten oxide.

It wrapped up open-pit mining in July, with stockpile processing to continue over the next 12 months as the company shifts to underground mining methods.

At Stockhead, we tell it like it is. While Octava Minerals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.