Tanzania gets behind Black Rock’s Mahenge graphite project with grant of mining licence

Getting the green light Pic: Getty Images

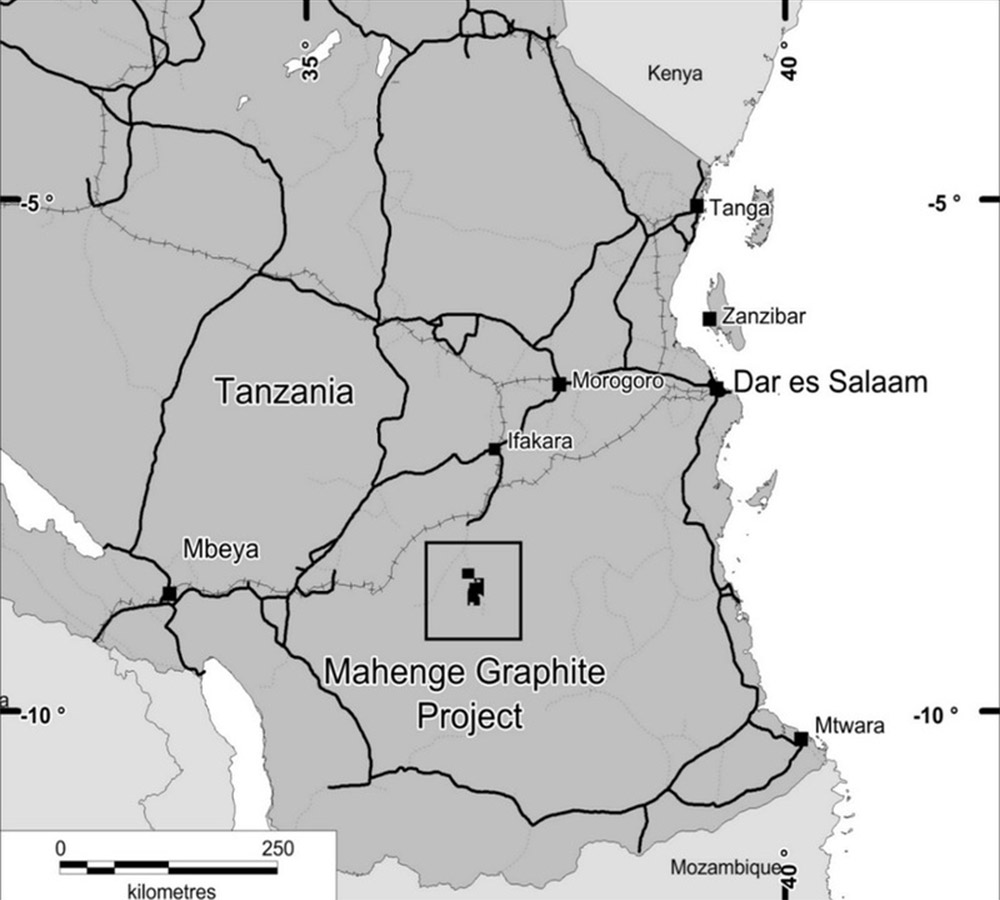

Special Report: Tanzania has shown its support for emerging graphite producer Black Rock Mining with the grant of the all-important mining licences for its Mahenge project.

This means that the junior explorer (ASX:BKT) is now in a position to start construction, subject to the completion of detailed engineering and financing.

The mining licence also covers the Epanko area and intermediate areas considered as prospective for extensional mineralisation not included in definitive feasibility study mine development.

“This milestone is a significant step in delivering the Mahenge graphite mine,” managing director John de Vries said.

“Licencing gives all stakeholders comfort that Tanzania wants this project to be developed.

“Securing the mining licences is the final step in allowing us to obtain financing to construct the mine.”

Mr de Vries says the Mahenge project is the only project capable of delivering a concentrate grade of over 99 per cent without using acid.

And Black Rock has already proven it can do it via a large-scale 90 tonne pilot plant.

“We’ve done a large pilot plant in Canada, the biggest in the sector by an order of magnitude and that took us 15 iterations to get it right,” he told Stockhead.

“And just to prove it wasn’t a fluke, we’re repeating that with a second pilot plant in China to demonstrate real consistency of product quality to key off-take partners.

“That’s the sort of the detail, the rigor and the execution that we’re bringing. I think that really does differentiate us from the others.”

Progress in the making

The Mahenge project is also the second largest graphite reserve supporting a 32-year mine life at 250,000 tonnes per annum, with a study already underway to increase that.

In January, Black Rock signed on the third buyer of its graphite with a 100k tonne by year 3 offtake agreement.

Two of these supply deals are believed to be the largest signed by any graphite company, either in production or development.

The three off-take deals take the total graphite to be supplied to customers from the Mahenge project so far to 205,000 tonnes per annum by year three.

The agreements represent about 85 per cent of the proposed steady state annual production.

A comprehensive DFS on the Mahenge project conservatively anticipated a post-tax net present value (NPV10) of $US895m ($1.26 billion), and an internal rate of return (IRR) of about 43 per cent.

IRR and NPV are used to estimate the profitability of a potential operation.

Orior Capital analyst Simon Francis says these numbers are very good.

Mahenge’s NPV is about seven times larger than the project’s initial development costs of $US115m.

As a broad rule of thumb, projects that are one year or less away from cash flow, fully financed and fully approved, can attract valuations of between 30 to 50 per cent of NPV, Mr Francis says.

Ahead of the pack

All indicators point to the battery revolution being bigger and coming more quickly than previously thought.

“The mechanisms in the battery industry are clearly dominated by real industry, by real demand, not based on speculation. The governments are in, it’s a mega-trend that is not stoppable,” small cap expert Stefan Müller, CEO of Frankfurt-based consultancy DGWA, told Stockhead this week.

You just have to look at what the majors are doing.

Petroleum giant Shell announced last week it was buying German household battery maker Sonnen, and mining heavyweight Glencore said it would cap its coal production so it could be a bit greener.

On top of that the big carmakers are ramping up their production of electric vehicles.

“While we talk about the great battery revolution, we are starting to see the sort of behaviours that tells us this is no longer a good thing to talk about but that this is actually here, real and now,” Mr de Vries noted.

“Our timing could not be better because if this thing really begins to move, we’re in a position to step in and fulfil that wave, because we’ve got product and we’ve proven the product, we know what it’ll do, and we know how to do it.”

Funding talks well underway

Black Rock is now working hard to secure funding for the Mahenge project and is in talks with multiple potential financiers.

The company is the only graphite developer with a bankable definitive feasibility study and is construction ready.

“The fact that we are having the conversations suggests that the work we’ve done has been recognised around de-risking the project,” Mr de Vries said.

“The awarding of the licence will go a long way to re-setting perceptions of political risk associated with Tanzania.

“Our next steps are to close out ongoing financing discussions and to complete the detailed engineering to enable the commencement of construction.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

This story was developed in collaboration with Black Rock Mining, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.