Taking a moment: GTI Resources reflects on the year that was

Pic: Getty

As GTI Resources executive director Bruce Lane reflects on the year that was, a few stand-out moments come to mind…

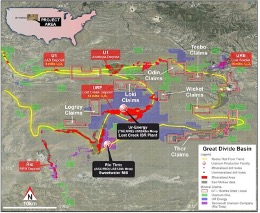

Like when GTI Resources (ASX:GTR) decided to bulk up its uranium portfolio in Wyoming by 85 square kilometres deep inside the famed Great Divide Basin.

The August acquisition of underexplored mineral lode claims and two state leases handed GTI control of the largest non-US, Russian or Canadian-owned uranium exploration landholding in the region, and the company’s first foray into low-cost in-situ recovery (ISR).

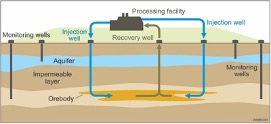

ISR is the process in which an acid or alkaline solution is injected and extracted into an area using a series of wells drilled from surface to leach targeted subterranean uranium ores.

ISR accounts for around 90% of US uranium production and has been used in Wyoming since the 1960s, accounting for 100% of the state’s production since 1993.

It’s the lowest cost uranium mining method in the world, with less environmental impact than hard rock mining.

The land GTI picked up is highly prospective for front roll uranium amenable to ISR, and sits in fine company adjacent to TSX-listed UR Energy’s Lost Creek ISR production plant and Rio Tinto’s (ASX:RIO) Kennecott Sweetwater Mill.

The Wyoming properties were carefully selected to include areas proximate to known mineralisation, and to fill gaps between UR Energy and Uranium One’s mineral holdings.

Exploration highlights

Lane says, raising more than $6m to fund the acquisition and exploration of the newly acquired ISR uranium properties was another big win.

GTI deployed the funds to evaluate additional opportunities to grow its uranium portfolio in the US just as market conditions for the energy metal got interesting.

Since then, the GTI has made it 40% through its 100-hole maiden drilling program at the Thor ISR uranium project where results have been very “encouraging.” Lane says GTI has kicked off its drilling with some exceptional results.

Typical economically viable in-situ recovery (ISR) grade and Grade Thickness (GT) cut‐offs are: 0.02% (200ppm) uranium and a grade thickness factor of 0.2GT or put another way 3m at 0.02% (200ppm) uranium.

Around 49% of the holes returned a better than the minimum economic GT cut-off with an average of 0.60GT.

More results are expected after Christmas when the balance of the drill program should be completed. The final results, conclusions and recommendations set to be developed once the program wraps up in early 2022.

Embracing shift towards decarbonisation

To end the year on a high, GTI’s commitment earlier this month to become carbon neutral was particularly important.

As part of its transition to develop clean energy ISR Uranium projects, GTI said it had acquired 450 Australian Carbon Credit units, each of which is equal to a tonne of carbon dioxide emissions from the Nyaliga Fire Project – an eligible offset project registered in 2017 by the Nyaliga Aboriginal Corporation – in Western Australia’s Kimberley region.

Nyaliga Fire was chosen due to the numerous co-benefits generated by the creation of these ACCUs, including environmental, social, and cultural, whilst the credit generation is verified and governed by the Clean Energy Regulator.

The number of ACCUs acquired by GTI Resources (ASX:GTR) is based on an internally generated estimate of its carbon emissions during 2021-22 and is expected to ensure its recently commenced maiden uranium drilling program in Wyoming is carbon neutral.

Lane outlined the goal of being able to accurately report carbon emissions by 2022 and to retire sufficient credits to offset these emissions.

This carbon neutrality initiative is part of its move to adopt the internationally recognised ESG Stakeholder Capitalism Metrics framework as announced in November.

“The GTI board is committed to best practice governance as defined by the World Economic Forum,” Lane said.

So why will GTI be a good investment in 2022?

Nuclear power has emerged as a leading emissions-free base load power source in a world striving to reach NetZero emissions.

Lane says resource investors have turned their attention to uranium as a way to benefit from nuclear power’s rapid renaissance.

“The US nuclear power industry in particular is re-awakening, and we believe, supported by government and the climate lobby, it will start to aggressively expand both domestically & overseas,” he said.

“In doing so US mined sources of uranium will become critically important to their strategy to retake the mantle of the global leader in nuclear technology.

“We plan to define an economic ISR uranium resource in Wyoming – one of the most favourable locations in the world to develop and commercialise ISR uranium resources and we believe that our timing is right to accelerate this process with our high-quality discovery and development team.”

Market outlook

“The outlook for uranium is incredibly positive,” he added.

“Demand is accelerating with a constant stream of new announcements regarding nuclear reactor build programs – the most significant of which is China’s plan to build 150 additional reactors on top of its already strong build program.

“Numerous countries have announced their intention to restart, defer shutdowns or grow their nuclear power reactor fleets including Japan, France, the US, Saudi Arabia, Kazakhstan, Poland, India, Russia and the UK.”

He said this increased primary electricity generation demand for uranium sits alongside transformational financial uranium buyer demand with the likes of the Sprott physical uranium fund (SPUT) alone having acquired, in just a few months so far this year, an amount of uranium which represents one third of total annual global uranium production.

“All this is occurring against a backdrop of falling uranium supply due to years of subeconomic uranium pricing and recent COVID shutdowns.”

Lane reckons that term contact uranium price will rise to a long-term incentive price of at least circa US$70 – $80 per lb and spot market uranium price could surpass that.

This article was developed in collaboration with GTI Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.