Swedish nickel explorer Bayrock eyes an age of opportunity in historic transition to green energy

The chairman of the next nickel explorer looking to list on the ASX says the accelerated shift to green energy is opening up a breathtaking opportunity for battery metals, which rivals the early days of the oil and gas industry.

“We’re playing in a subset of a much larger structural shift that is happening, which is no different than what transpired in the oil industry one and a half centuries ago,” says Joseph Naemi.

Along with experienced geologist Dr Ian Pringle, Naemi is one of the main names behind Bayrock Resources (ASX:BAY), which is seeking $12 million in a recently launched IPO aiming to turn prospective nickel, cobalt and copper projects in Sweden into mines to satisfy demand from the electric vehicle and energy storage industries.

“In terms of the requirements for these minerals, such as nickel and cobalt, graphite and lithium and so forth, you know, it’s mind boggling,” he says.

“And if you look at the forecast, in order to achieve this net zero pathway that appears to be the objective amongst most of the advanced industrial nations, the supply of all of these green energy materials would have to increase by 700% to 4,000% during the next two decades.

“So the scale of this transition to a decarbonised global economy is just stratospheric, it’s beyond the conventional promotion of ‘oh, we need more class 1 nickel, or we need more copper.’

“We need more of everything, and we don’t just need it, but we need at a much faster pace than is conceivable.”

Age of opportunity

That situation creates a huge opportunity which puts the ball in the court of miners and explorers with nickel resources like Bayrock.

Sweden as a tier-1 mining jurisdiction is an economy which, positively in terms of its ESG credentials, is largely powered by clean hydroelectric power.

That places a company like Bayrock in pole position to respond to the green energy transition, which Naemi says will require replicating the growth of the oil industry between 1930 and 1980; in just 20 years, instead of 50 years.

It is not just EVs as well. With the growth of electricity generation from wind and solar, grid scale battery storage will become increasingly important to store intermittent renewable energy production.

Each 100MW wind fram that supplies electricity to just 75,000 residential properties, will need, Naemi says; 10,000t of Tesla class batteries for energy storage, and that’s a lot of nickel and cobalt to satisfy demand as national energy systems are decarbonised worldwide.

“If we’re going to be doing everything twice as fast, we need to have more of these green energy materials, and nickel and cobalt are two of them,” he says, “and we need to do it sustainably, and that’s where the opportunity is.”

“During the next three decades to 2050, there is US$150 trillion to US$275 trillion that are estimated to be invested globally, in order to achieve the net zero ambition and within those financial flows; obviously, there is going to be a tremendous participation from the mining industry as the supplier of green energy materials enabling the UN’s Race to Zero initiatives.”

Northern highlights

Bayrock is the owner of the Lainejaur deposit in northern Sweden, a shallow underground mine which operated during World War 2 and has since been drilled to around 350m, bearing a small deposit rich in a host of high-grade battery minerals.

It hosts 460,000t of ore within an area that equates only one percent of the total licensed area which Bayrock holds, containing a tasty 2.2% nickel, 0.7% copper and 0.15% cobalt along with 0.68g/t palladium, 0.2g/t platinum and 0.65g/t gold.

With nickel currently worth an elevated US$25,000/t, a continuing supply issue for nickel sulphides and extraordinary future requirements for these metals from battery makers, the development potential of Lainejaur has been transformed.

But Naemi says quality nickel targets across the company’s 340.7sqkm of tenure known as the Northern Nickel Line projects could be significantly larger.

The Northern Nickel Line is a collection of five projects acquired from EMX Royalty Corporation, which were discovered several decades ago during various exploration campaigns to find copper.

“What we have in Sweden, in terms of what is known as the northern nickel line portfolio, is that these were nickel discoveries that were made by some of the larger companies such as Boliden, which is Scandinavia’s equivalent of BHP or Rio Tinto,” Naemi says.

“And these nickel discoveries were made in the 1970s, they were made in the 1980s. But the problem is that in the 1970s and 80s, they weren’t looking for nickel, they were looking for copper.

“In each of these tenements within the Northern Nickel Line portfolio a dozen holes were drilled, they all had fantastic assay results in terms of nickel and cobalt, but very poor results in terms of copper.”

With that in mind, modern exploration is expected to begin after listing, to follow up historic hits of nickel and other metals, with drilling planned across the entire Bayrock portfolio.

“We basically have a full-on drilling campaign, not only in the Northern Nickel Line portfolio, but also at Lainejaur planned during 2023,” Naemi says.

“It’s actually a lot easier for us than the majority of juniors when they go public, as in our case, the discoveries have already been made.”

“We need to continue drilling and assessing these tenement areas, so that we can achieve JORC compliant resources and move onto a feasibility study, and then obviously funding and supply of saleable products.”

Major potential

Naemi says any of the five Northern Nickel Line projects, Vuostok, Nottrask, Skogstrask, Fiskeltrask and Kukasjarvi could boast major potential.

“Believe it or not any single one of them has the potential to be very similar to some of the larger nickel mines, like Sakatti in northern Finland, or Eagle in Michigan in the US, or even Nova in Western Australia,” he says.

“Any one of them has that signature, I think – Vuostok because it is so close to Lainejaur, it’s only 60 kilometers north and it had 2.3% nickel (aircore intersection) which is obviously a fantastic high grade and an amazing opportunity for simultaneous development as a unit with Lainejaur.”

“Even at Lainejaur there’s only one hole that has ever been drilled deeper than 450 metres. Across the Northern Nickel Line portfolio, same thing – all these holes were shallow holes that were drilled anywhere from 50m to 150m, all of these discoveries were at shallow depth. Effectively, all of our nickel & cobalt plays in northern Sweden are open at depth and along strike.”

The intensity of the platinum group elements found at Lainejaur tend to get stronger at depth as well, similar to the Kola Peninsula in northwest Russia and South Central Greenland.

Given sanctions against the world’s largest palladium producer Russia, a discovery of that nature would be of added benefit to Bayrock, Naemi says.

Scandinavia – An EV ecosystem

Much has been made of the fact that Lainejaur sits just 90km up the road from Northvolt’s Swedish battery factory, the first Gigafactory scale lithium ion battery facility owned and built by a European company.

But Naemi says Bayrock will be sitting smack bang in the middle of what is a European battery and green energy ecosystem.

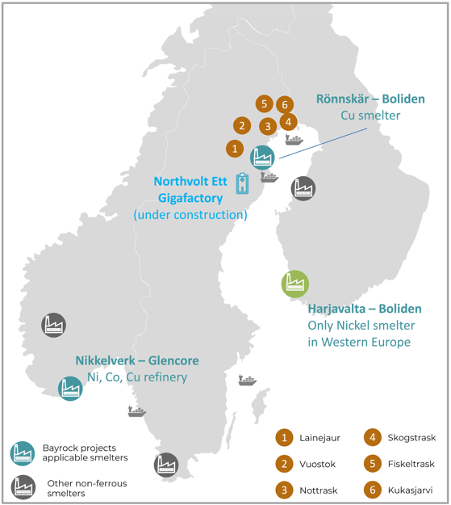

Alongside Northvolt’s Skelleftea plant, three major refineries of nickel, copper and cobalt lie within only a few hundred klicks of Lainejaur on the Scandinavian mainland.

“It wasn’t just about the asset quality in and of itself, but it was also the availability of what I like to refer to as the ecosystem for the company to thrive,” Naemi says.

“Sweden has three companies that are at the forefront of the mining equipment and services industry, and they have ahead of Caterpillar and Komatsu, moved into electrifying their equipment and fleets. Nowadays, when battery manufacturers source their raw materials, they look at the carbon footprint throughout the supply chain. In that sense, Bayrock’s future supplies will rank quite favourably.”

“Sweden derives 70% of its electricity from sustainable and renewable sources, again that goes into (lowering) the carbon footprint of Bayrock’s operations in Sweden.

“Gigafactories? There is one just 90km away. Refineries? There’s a choice of three or four that are either accessible by rail or road or by barges across the Gulf of Bothnia,” he says.

“And then you look at the end user market, the European automotive industry is going to be more proactive in terms of the electrification of passenger cars and trucks, and three of the largest European automotive manufacturers are in Germany just next door.”

The Bayrock IPO is expected to close on July 29, with the stock planning to list on the ASX in the second week of August.

This article was developed in collaboration with Bayrock Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.