Supply constraints and consumer demand have fuelled massive rises in diamond prices in 2021. Now, can it continue?

Pic: Boris SV/Moment Collection via Getty Images.

“Throw your diamonds in the sky if you feel the vibe”, quoth the modern day prophet Kanye West.

The diamond sector is certainly feeling the vibe coming out of the pandemic, as news emerged last month De Beers had lifted prices for rough diamonds at their sales for the fifth time in eight months in July.

Alrosa, the Russian diamond giant that rivals Anglo American subsidiary De Beers as one of two global majors, lifted its own prices 7% at a sighting last week according to industry insider and price reporting agency Rapaport.

De Beers is now selling at around US$135 per carat, with sales tripling from a bit over US$1 billion in the first half of 2020 to US$3.04 billion in the first six sightings of 2021, Rapaport said.

The two biggest diamond mining and selling entities in the world, De Beers and Alrosa price their product to reflect ‘midstream demand’.

It certainly shows the industry, which was staring down the barrel as the pandemic struck and consumer confidence waned across the world, is on the turnaround.

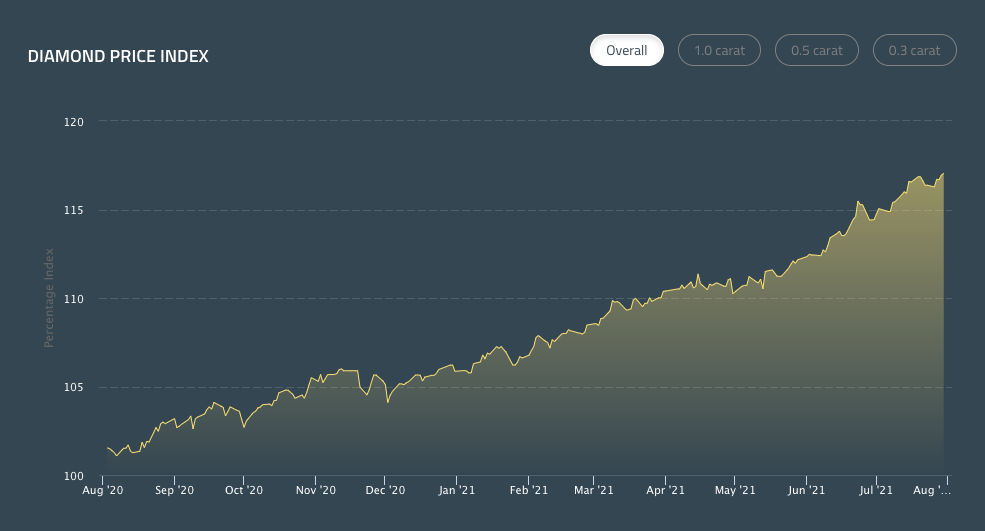

Polished diamond prices are also rising steadily.

The question now is whether a bubble is beginning to emerge, as it did around the beginning of the decade when prices began to climb, or whether the fundamentals are there to support longer term strength in the listed diamond mining space.

Price rises reflect rising demand, supply constraints: Lucapa

Lucapa Diamond Company (ASX:LCP) owns stakes in the Mothae and Lulo diamond mines in southern Africa and, like De Beers and Alrosa, has seen prices on the up.

As opposed to De Beers and Alrosa, who set prices for their customers, Lucapa places diamonds up for tender which are bid on based on what customers are willing to pay.

It recently sold seven precious stones at auction from the Lulo mine in Angola for $28.3 million, garnering a take of US$34,548 for each carat on offer.

While managing director Stephen Wetherall said those were uniquely valuable stones, in general the company is seeing prices up around 23% this year as consumer demand recovers from the pandemic.

“It’s difficult to draw a straight line there because we sold seven unique stones, so you can’t look at a straight price and draw a line to our other production because those were very, very special stones,” Wetherall said.

“But most certainly through the course of this year diamond prices are up significantly for us. We’re tallying about a 23% increase on the pre-pandemic price of last year.

“We have seen through our tenders and through our negotiated sales with preferred buyers that the prices are very, very strong, and we haven’t seen prices this strong since 2014.”

Significantly, diamonds and jewellery down the supply chain were both being purchased during the pandemic as major cutting and polishing centres from Israel to Antwerp, New York to India were shut.

Wetherall said this has brought a double whammy for diamond miners, both positive. Large inventories have been removed from the system while online sales have opened a new market for what was seen previously as a largely tactile luxury purchase.

That is corroborated by jewellery retailers like Perth manufacturing jeweller Linneys, which originally set up an online retail business to market jewellery to FIFO workers in Australia.

“Both the gold and the diamond prices were slightly up so that did have an impact on the prices when the initial impact of the pandemic did hit, but I wouldn’t say it has deterred buyers,” Linney’s creative director Justin Linney said.

“I’m trying to use a different word to unprecedented because it’s been used far too much, but we’ve seen an abnormal amount of demand for jewellery coming out of the initial scare that we had.

“Once we got through that initial lockdown, probably from June 2020 onwards, we’ve seen abnormal levels of demand at times of the year that would normally be quieter.

“In the past financial year our online sales have doubled, but it wasn’t just Covid-related sales.

“It’s still a very small component of our business given jewellery is quite a tactile business, but the pieces that I’d say are under a few thousand dollars people seem to be a lot more willing to transact online and we can ship it straight to the door.”

Lucapa Diamond Company share price today:

Rough supply constraints after the Argyle mine closure

Rio Tinto’s (ASX:RIO) Argyle mine in the Kimberley produced 90% of the world’s fancy pink diamonds, probably the best marketed fancy colour diamonds in the world.

Their rarity is one factor. In a typical year the total number of fancy pinks from Argyle could fit in the palms of your two hands, according to Justin Linney, whose family jeweller is an Argyle select atelier.

More significantly for the state of the industry as a whole, Argyle was a large scale producer as well, accounting for up to a sixth of global diamond production.

There are no like for like mines in the pipeline to replace Argyle’s production directly. That means that, unlike in 2011-12 when the last major price spike happened in the rough diamond sector, there are supply constraints that could help current producers.

“I think we will always have a slightly volatile price, you will have your ups and downs and you do have your cycles through the years, but on the whole I believe our price line will be trending upwards,” Lucapa’s Wetherall said.

“Of course we will have a little blip here and there, but on the whole I think we’re going to have an upward trend in rough and polished prices for the foreseeable future.

“The rough supply when Argyle was open back in 2012 was very close to 140-150 million carats per annum. I think where we stand today is a little over 100 million carats.

“So you see a significant drop in overall rough supply over the last 8-9 years. Argyle is now closed and it has taken out a minimum of 15 million carats of rough supply out of the system so it will be a difficult hole for any pending or new mine to fill.”

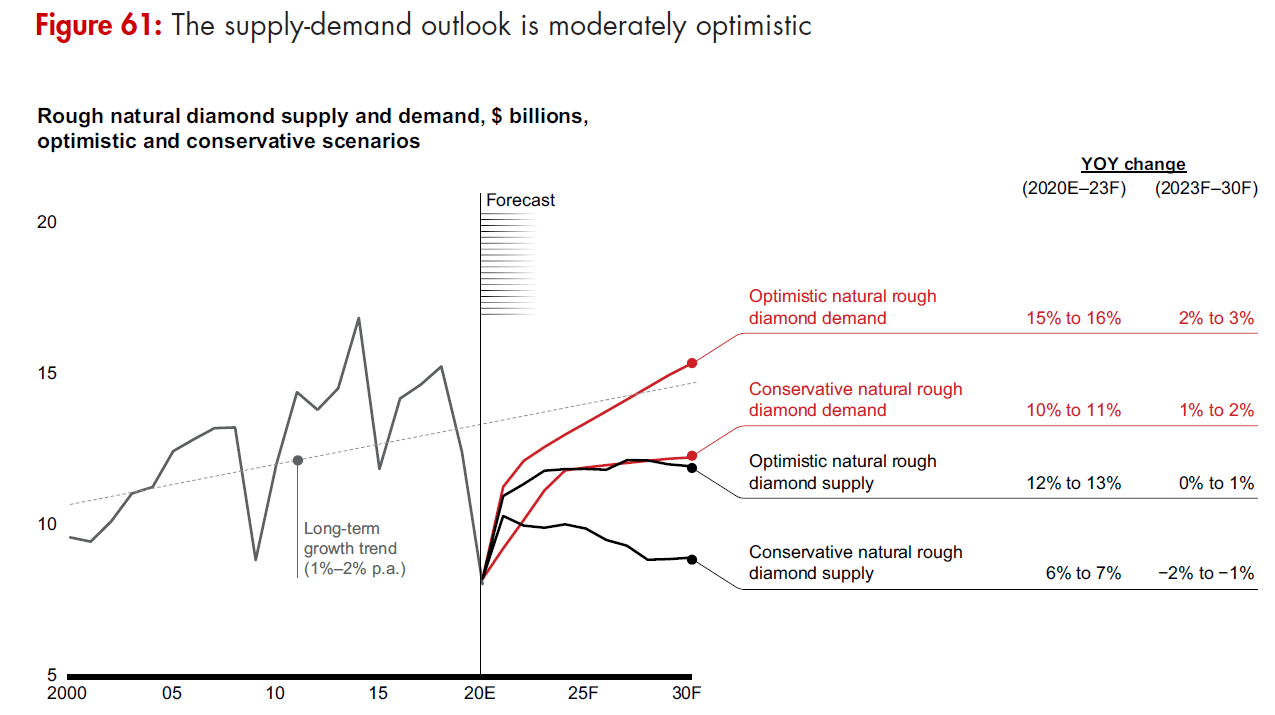

Consultants Bain and Co. are “moderately optimistic” on the supply-demand situation. Their research suggests even optimistic supply scenarios in 2030 will not meet conservative diamond demand forecasts.

Supply is expected to remain relatively flat, with the 5.7Mcpa Luaxe mine in Angola the only producer of scale anticipated to enter the market over the coming years.

Long term demand growth sits at 1-2% p.a., with the market potentially climbing 15-16% by 2030, or 10-11% in conservative estimates.

Bain sees supply growth only at around 0-1%, turning negative over the coming years under more conservative scenarios, with a range of 6-7% to 12-13%.

“We’ve seen rough prices rise like this in days gone by as well, but with the ability of the bigger producers to supply into it it’s always ended up with them supplying more into it,” Wetherall said.

“If you look at the recent articles De Beers and Alrosa have put out they are at minimum level of rough supply and even Alrosa say they are reaching a critically low level of rough inventories.”

“There are no alternative sources to meet that rough demand, so I think the fundamentals for the diamond industry today are far more positive than they were years ago when we did see a rough rising price in 2011-12,” Wetherall said.

New Australian mines to focus on niche markets

Lucapa is one of two Australian companies which wants to reopen mines in Australia, which has gone from one of the world’s largest producers through Argyle to no production with its closure by Rio last year.

Burgundy Diamond Mines (ASX:BDM) meanwhile tapped positive investor sentiment in the diamond industry to raise $49.7 million last week.

It is planning to bring the Ellendale diamond mine in the Kimberley back to production in 2022.

The mine is famous for its brilliant yellow stones, but was the subject of controversy when the company that owned it, Kimberley Diamonds, shut the mine in 2015 and placed its subsidiary into administration after the WA Government had retired its environmental bonds.

New owner Burgundy, which also owns the Naujaat project in Canada along with diamond and precious metals exploration projects in Botswana and Peru, plans to cut and polish yellow diamonds from Ellendale in WA and sell them under a house brand.

“We were also very excited to expand our strategy into downstream operations during the quarter,” Burgundy MD Peter Ravenscroft said in the company’s quarterly last week.

“This represents a pivotal step as we develop Burgundy into a vertically integrated end-to-end diamond business, focused on the niche high-value Fancy Diamond market segment.”

Burgundy Diamond Mines share price today:

Final Rio Argyle sale delayed by Covid

The final tender of Argyle pinks, which were to be showcased in Perth, Antwerp, Singapore and Sydney, is due to take place this year.

While Covid concerns have disrupted the schedule, the rising prices of diamond tenders generally coupled with the closure of the Argyle mine means bids will be closely watched.

A 2.00 carat fancy purplish pink diamond held by Brisbane collector Di Fitzpatrick recently went for an Australian record $2.2 million at the first private auction of Argyle pinks in July.

The whole set of 37 stones were expected to fetch around $11 million.

Argyle pinks are among the few diamonds that can be safely regarded as an investment asset class.

“It’ll be interesting to see what prices are achieved and where those final stones end up,” Justin Linney said.

“A lot of collectors might have a 1 carat round-cut brilliant pink diamond and they’ll be looking to make a matching set with what’s in this pink diamond tender.

“That could increase the value of their existing stone as well, so it’s an exciting and interesting time.

“We’ve seen a lot of our clients maybe looking into it for Self-Managed Super Funds, also maybe an older demographic looking to diversify their portfolio.

“They might get a little investment property and a few different things, but then also they like the fact that a pink diamond is tangible, they can see the colour and understand the value.

“Then it will become something that might be looked at as an investment but also as a family heirloom, so it is a bit different in that respect to other things they might be looking to invest in.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.