Sun Silver gets more high grade hits in Nevada

Constant hits of high-grade silver for Sun Silver at its Maverick Springs project in Nevada.

- Sun Silver intercepts 106m of silver with a section of up to 440g/t (pXRF) at its flagship Maverick Springs project

- The results come from pXRF technology used to accelerate drilling strategy decisions

- Independent lab work will check the results as Sun Silver works on updating Maverick Springs’ globally significant resource

Special Report: Sun Silver is continuing to find thick zones of silver mineralisation using a method to speed up drilling decisions at its globally significant Maverick Springs Silver-Gold Project in Nevada.

The latest results from the company’s flagship project include up to 440g/t silver with mineralisation over 106m averaging 54g/t from 196.6m downhole. That’s based on portable X-ray fluorescence (pXRF) readings in one hole with grades of up to 440g/t silver over 1.52m from 297.18 metres.

Sun Silver (ASX:SS1) is using pXRF technology to analyse drill samples in real time and confirm mineralisation in the field.

While they can’t be relied on to quantify resources, they do allow for immediate on-site decisions on any necessary adjustments to drilling strategies by suggesting where significant accumulations of the target mineral could be found.

All drill intercepts will also be sent to an independent laboratory to check for accurate analysis.

Resource growth upside

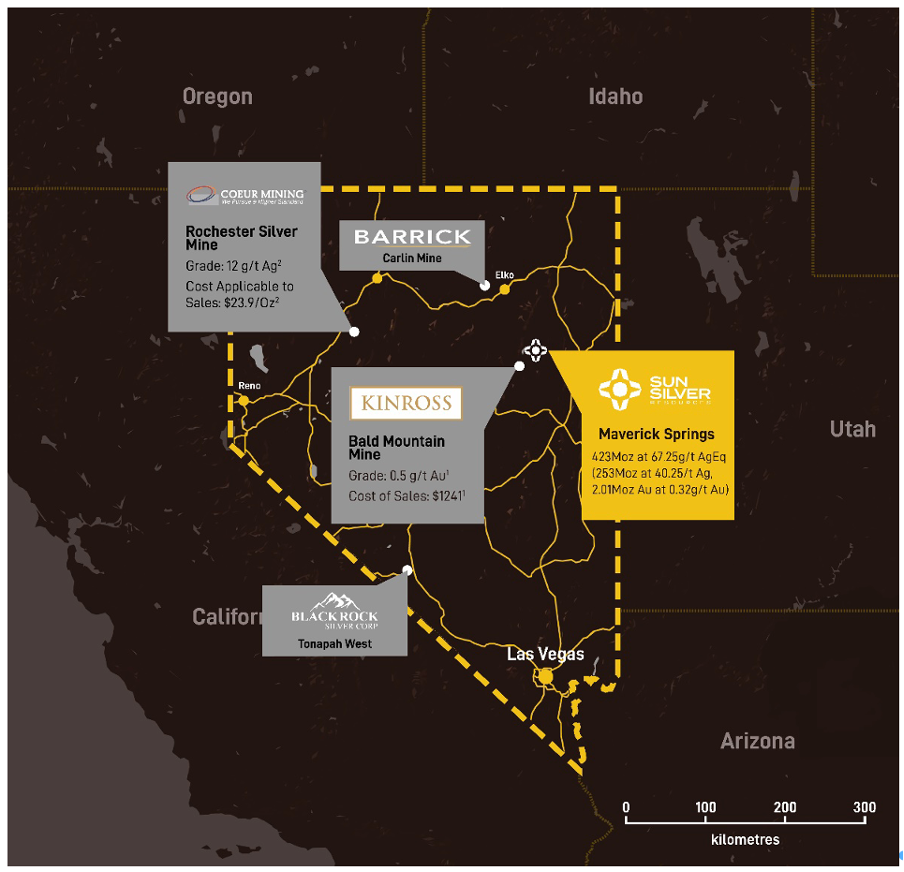

Already the largest development-ready silver resource on the ASX, Maverick Springs hosts a JORC inferred mineral resource of 195.7Mt grading 40.25g/t silver and 0.32g/t gold for 253.3Moz of contained silver and 2Moz of contained gold (423Moz of contained silver equivalent).

But the rigs are still revved up as part of the inaugural drilling campaign and the deposit remains open along strike and at depth as Sun Silver plans to release an updated mineral resource estimate later this year.

The silver price has shot up by more than 30% in 2024 as it faces accelerating demand growth from the clean energy transition, especially for its use in solar panels.

Close to the prolific Carlin Trend, a ~90km-long gold belt that has been mined over the past 60 years, the project is also yielding multiple mineralised intercepts from outside of the current resource constrained model.

The latest pXRF analysis has revealed anomalous readings of red hot critical mineral antimony both within and outside the current resource, with results of up to 2168ppm (.22%) antimony (Sb) over 1.52m from 198.12m.

SS1 executive director Gerard O’Donovan said: “We are pleased that our drilling campaign has continued to intersect thick zones of silver mineralisation as part of our inaugural drilling campaign.

“With multiple targets yet to be drilled we are enthusiastic about the prospectivity of the north-west section of the project and look forward to future drilling results.”

In September, Sun Silver sealed a $13 million capital raising with support from cornerstone investor Nokomis Capital, giving it plenty of funds for Maverick Springs’ development.

Maverick Springs is just 85km from the fully serviced mining town of Elko in the mining friendly US state of Nevada, and surrounded by several world-class gold and silver operations including Barrick’s Carlin Mine.

This article was developed in collaboration with Sun Silver, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.