Sultan is in the right neighbourhood to make the next big discovery

Special report: Sultan Resources has a promising gold and base metal-prospective land-holding in the same neighbourhood as big existing mines and new discoveries.

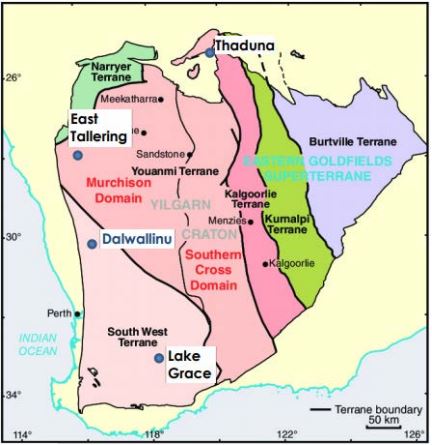

The junior explorer (ASX:SLZ), which made its ASX debut in August, has amassed significant land in under-explored Yilgarn greenstone belts and is on the verge of drilling at its Thaduna project.

The project is 190km northeast of Meekatharra and adjacent to the Lodestar Minerals (ASX: LSR) Ned Creek gold discovery.

Over the past year, Lodestar has uncovered what appears to a be a major intrusion-related gold system with similar characteristics to a number of 1-million-ounce-plus gold deposits elsewhere in the Yilgarn Craton.

Lodestar has uncovered gold grades of up to 74 grams per tonne (g/t) at the Neds Creek prospect. Anything over 5g/t is considered high-grade.

Sultan believes Lodestar’s discovery continues into its Thaduna landholding.

“From a district point of view, it looks like a really significant mineralising event and that same geology appears to trend right into our ground,” managing director Steve Groves told Stockhead.

“We’ve got the granite contacts, we’ve got the same geological setting as they’ve got and right next door to our ground they’ve got a couple of pretty significant gold discoveries.”

Sultan’s other neighbours include Sandfire Resources (ASX:SFR), which owns the DeGrussa and Thaduna copper, gold and silver mines.

Sultan has the same host rocks in its ground as Sandfire, which has so far produced 403,000 tonnes of copper and 232,000 ounces of gold from its DeGrussa mine.

Australian Mines’ (ASX:AUZ) spinoff Norwest Gold has also got land adjacent to Sultan’s ground where it is exploring for high-grade gold mineralisation.

Norwest has launched a $6.6 million initial public offer to list on the ASX that is already almost fully subscribed — a good indicator of the strong investor interest in gold players at the moment.

Drill ready

Sultan’s Thaduna project already has walk-up, drill-ready targets.

“The main tenement we’re looking at is only a small block. So rather than having to start with regional discovery techniques like geochemical, surface sampling and geophysics, we are going to jump straight into aircore drilling and just do a grid pattern across that whole block,” Mr Groves explained.

“We can start with that and be quite aggressive in our approach and that will have a double focus – telling us a lot about the geology and regolith, and also testing for the distribution of gold mineralisation.”

Sultan already has about 1.5km of granite contact in one of its tenements along strike from Lodestar’s Boundary Fence prospect.

Lodestar has already uncovered high-grade gold of up to 10.5g/t at the Boundary Fence prospect.

Value upside

Sultan has a low enterprise value of $1.6 million, which is leveraged to exploration upside.

Mr Groves says its share price of 19.5c represents a good value entry point.

Sultan is well funded with $4.3 million in cash after it successfully completed its IPO, and it has projects right next door to major new discoveries and established mines.

The company also has an experienced board and management team that are focused on building shareholder value.

This special report is brought to you by Sultan Resources.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.