Successful PEA drives forward Power Minerals’ offtake partnership for its Rincon lithium

Power Minerals is looking to get a binding offtake agreement over the line. Pic via Getty Images.

- MoU with battery maker Xiamen Xiangu to progress

- Preliminary economic assessment (PEA) recently completed at Rincon

- Power Minerals expects Rincon to produce 7,000tpa LCE over a 14-year LOM

Special Report: On the back of completing a successful PEA for the Rincon salar at its Salta lithium brine project in Argentina, Power Minerals and potential offtake partner Xiamen Xiangyu have moved to the next stage of their memorandum of understanding (MoU).

Power Minerals’ (ASX:PNN) recently completed PEA for its Rincon salar produced some very decent numbers, such as its potential to produce high-purity, battery-grade lithium carbonate (LCE) at an impressive internal rate of revenue (IRR) of 42%.

Rincon is to be developed as a low-cost, 7,000tpa operation with US$194.8m annual revenue over an initial 14-year operation.

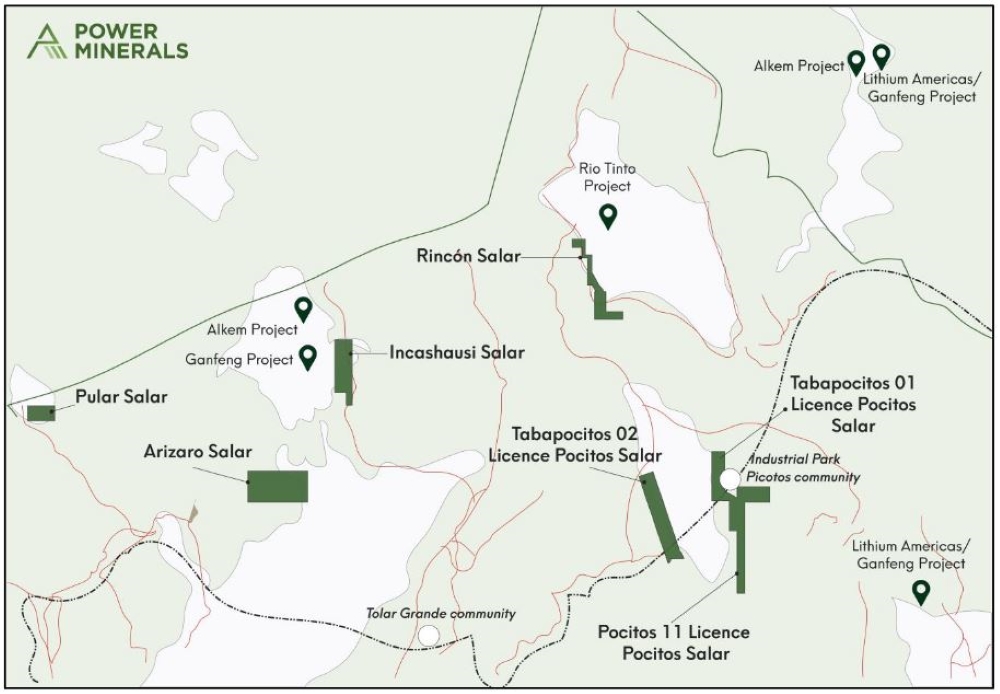

This confirms the Rincon salar’s potential to become a significant long-life supplier of LCE from Argentina’s slice of South America’s prolific lithium triangle salt flats, which it shares with Bolivia and Chile.

PNN is in good company with miners Allkem, Ganfeng, Lithium Americas and Rio Tinto all have major operations and developments in the region and therefore gives the advantage of existing infrastructure and access to power and water.

Other key metrics include:

- Rincon salar development to cost just US$216.5m

- Total LCE production measured at an 87.5% DLE processing efficiency

- Proposed well field to consist of seven production wells

- Ramp up to full production is estimated to be two years, with LCE production scheduled to commence in the third year of operation

Progressing to a binding agreement

Based on the successful outcomes of the PEA, the parties have now moved to the next stage of the MoU, where Xiamen Xiangyu has taken samples of brines from three salars at its five-salar Salta project to its battery manufacturer in China for qualification testing.

This will assist in future funding and offtake negotiations with a view to executing binding agreements for development and offtake for the Rincon salar.

PNN MD Mena Habib says the company is excited to progress its relationship with Xiamen Xiangyu.

“The final piece of the due diligence process was the delivery of a successful PEA for the Rincon salar, and with the PEA delivering robust project economics, Xiamen Xiangyu is keen to advance the MoU, with independent third-party testing of the Rincon brines.

“Successful outcomes from this work would represent another step towards securing binding funding and offtake agreements for the Rincon salar.”

This article was developed in collaboration with Power Minerals , a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.