Strike makes $16m bid for Perth gas minnow UIL

East Coast gas takeover activity has started moving down the food chain, after mid-tier explorer Strike Energy’s move on minnow UIL Energy for $16.1 million.

Strike (ASX:STX), a $163m company working in the Cooper Basin, is offering 0.485 of its own shares for every UIL share (ASX:UIL) — valuing that stock at 7.03c.

The deal is conditional on Strike raising $13m from investors.

The offer is a 16 per cent premium to where UIL closed on Friday, but 26 per cent above the five-day average.

UIL stock jumped from 5.5c on Thursday to 6.5c by the end of Friday.

The large bids for Aussie gas companies have offered investors much higher premiums for a change of control.

Harbour’s bid for Santos was a 30 per cent premium to the share price, while China Energy Reserve and Chemicals Group’s (CERCG) initial offer for AWE was also 30 per cent higher than the pre-offer share price.

AWE ended up being acquired by Mitsui in April for 95c a share, or a 90 per cent premium to the pre-bids share price.

The UIL board, which owns about 25 per cent of the company, is recommending the offer unless a better deal comes in.

Strike shares are in a trading halt, last trading at 14.5c. UIL stock is flat at 6.5c.

It’s all about Perth

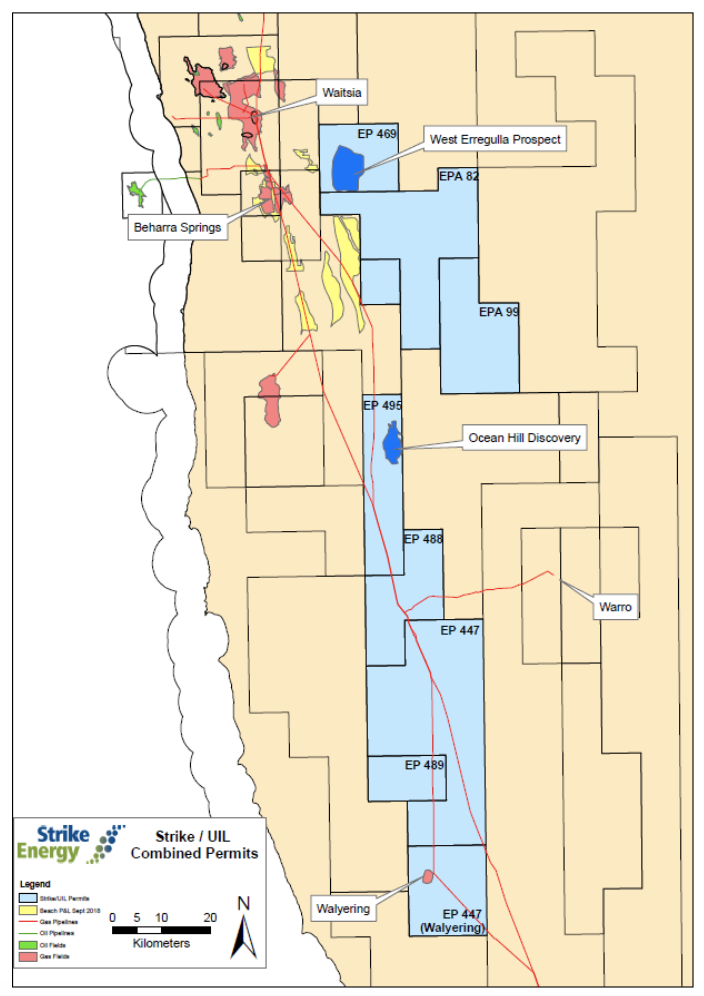

It has operations in the Perth Basin next door to Strike’s recently acquired Erregulla exploration permit there, which itself is next to the Waitsia gas field discovered by Beach Energy (ASX:BPT).

Also in the area are Triangle Energy (ASX:TEG), Key Petroleum (ASX:KEY) and Mitsui after taking over AWE’s assets.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

“The Perth Basin continues to show signs of a heavily under-explored hydrocarbon system and the addition of UIL Energy’s acreage will result in Strike being set to influence the Western Australian domestic gas market over the coming decades,” Strike chairman John Poynton said.

“The additional exploration potential in the extensions of the Kingia-High Cliff sands sequence is set to be high graded through our near term high impact drilling at West Erregulla, and has the potential to release further large scale gas opportunities.”

East v West

Mr Poynton says the deal fits with a strategy to target East and West coast gas.

While the East coast gas markets are hot the West is a much less attractive gas market right now.

The ACCC is predicting East Coast LNG netback pricing over the coming year to move between $10 per gigajoule in the low season over winter, and over $13 in the summer.

An LNG netback price is a measure of an export parity price that a gas supplier can expect to receive for exporting its gas.

East Coast gas prices are expected to now match the Asian market, where demand is forecast to rise, thanks to the three LNG terminals sucking up gas from Australia for export.

On the West coast however gas hovers between $4 and $5 a gigajoule.

But Strike managing director Stuart Nicholls says the opportunity lies in possible problems at the big offshore WA LNG projects, and in exports to NSW.

He says the WA gas market is in a “delicate balance” for supply and demand. If the big LNG projects run into delays or incur project management problems there will be a shortage of supply.

He is also pegging his hopes on LNG exports to NSW care of Andrew Forrest and his Port Kembla LNG import terminal plan.

Mr Nicholls says they’ll need the cheapest source gas to supply an LNG market on the East coast, and that will likely be from WA.

He says Strike will be in the position of being a “price maker” in the 2020s if that plan comes to fruition.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.