Star Minerals finds potential for additional gold in Tumblegum South pit extension

More gold please as drilling finds a potential repeat structure at Star Minerals’ Tumblegum South project. Pic: Getty Images

- Star Minerals’ drilling hits shallow gold 120m west of known high-grade lodes

- High-grade intersections indicate potential for repeat duplex structure

- Further drilling planned as the company progresses mining approvals application

Special Report: Shallow gold intersections point to the potential for additional resources within a pit extension at Star Minerals’ Tumblegum South gold project in WA.

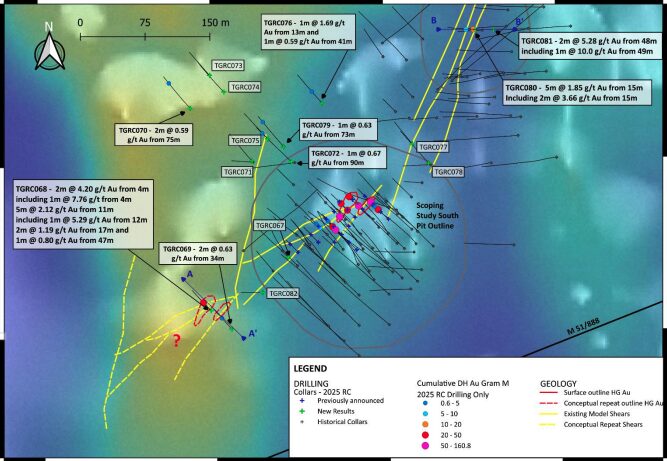

Hole TGRC068 was drilled 120m west of known high-grade lodes to test a possible repeat duplex to the main east-west strike of gold mineralisation.

It intersected 2m grading 4.2g/t gold from a down-hole depth of 4m including 1m at 7.76g/t from 4m and 5m at 2.12g/t from 11m including 1m at 5.29g/t from 12m with a further two mineralised zones beneath in crackle breccia.

Star Minerals (ASX:SMS) interprets the intersections to be analogous to the structural setting of mineralisation in the existing mineral resource, a finding that demonstrates potential for the existence of a repeat duplex structure west of the resource.

Managing director Ashley Jones said the significant shallow intersections 120m away from the main area indicated the potential for a pit extension that would increase resources.

Drill results

Besides the exploration drilling, the infill drilling portion of the program returned intersections of up to 5m grading 30.91g/t Au from 21m (TGRC055), which bodes well for optimisation of the southern pit in the updated scoping study.

Meanwhile, drill testing of conceptual targets identified during a structural review of the project in the proposed waste rock dump confirmed there’s no significant mineralisation and therefore no re-design of the landform footprint required. This paves the way for the company to further progress environmental approvals.

The results also support the company’s plan to bring the Tumblegum South project into production by early 2026 to capitalise on spot gold prices that are significantly higher than the assumed prices used in its scoping study.

At gold prices ranging from $3000 to $3800 per ounce, the updated production target ranges from 167,000t at 2.43g/t, or 11,800oz of contained gold, to 255,000t at 2.16g/t, or 15,900oz.

This is expected to generate free cash flow of between $9.4m and $19.6m whilst pre-mining capital and start-up costs are estimated to be just $700,000 to $1.5m.

Star Minerals, like other gold developers and explorers on the ASX right now, are enjoying record gold prices on the spot market. In just over the past year, the spot price has rocketed from around US$2,500 (~A$3,800)/oz to more than US$3,380 (~A$5,200)/oz – and it shows no signs of slowing.

This record pricing for the yellow metal means projects like Tumblegum South become significantly more attractive to get into production, and will enjoy premium margins once churning product.

SMS has already reached a memorandum of understanding with MEGA Resources for mine development and mining, while ResourcesWA has been appointed to undertake the mine approvals process.

Watch: High-grade gold assays at Tumblegum South exceed expectations

Next steps

The company is now planning further drilling to evaluate the potential of the western area for significant shallow mineralisation and potential of a repeat duplex structure west of the currently defined mineral resource.

It also expects to update the current JORC resource of 45,000oz gold.

Jones adds the company is on track to submitting its application for mining approvals in September which will enable production to start in Q1 next year.

As part of this, SMS is progressing the MoU with MEGA Resources to a binding agreement.

This article was developed in collaboration with Star Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.