St George Mining to hit world stage with top Brazilian niobium play

St George Mining has already secured strong investor support to fund the acquisition. Pic: via Getty Images.

- SGQ is picking up the Araxá niobium-REE-phosphate project in Brazil

- The project is next to the world’s largest niobium mine

- St George plans to complete up to 5,000m of diamond drilling near-term

Special Report: St George Mining is gearing up to acquire the world-class Araxá niobium-REE-phosphate project in Brazil in a move that will propel the company onto the global niobium stage.

Historical drilling at Araxá has already defined extensive high-grade niobium, REE and phosphate mineralisation with:

- More than 500 intercepts of high-grade niobium, >1% Nb2O5

- Ultra-high grades up to 8% Nb2O5, 33% TREO and 32% P2O5; and

- Mineralisation commencing from surface and open in all directions

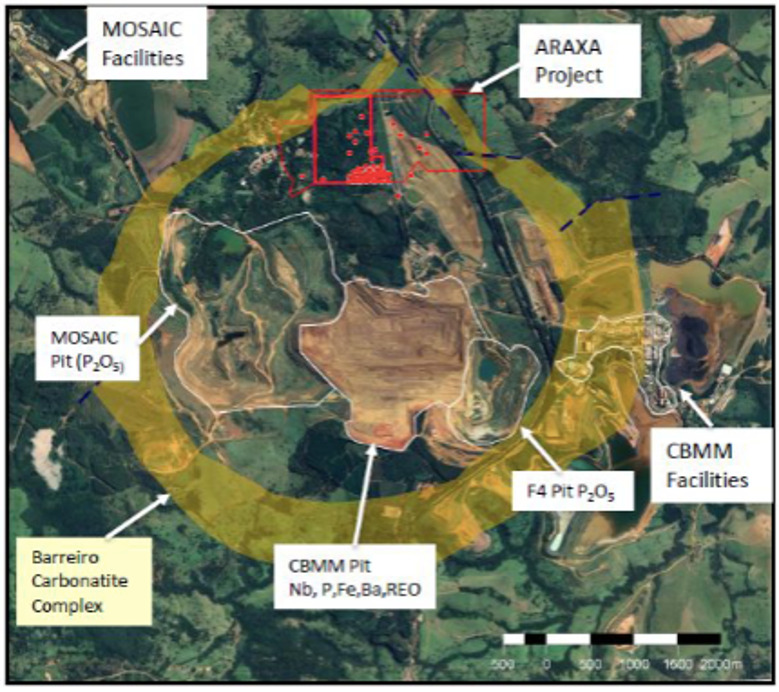

Notably, the project is in Minas Gerais, adjacent to and in the same carbonatite complex as the world’s largest niobium mine owned by CBMM, which produces around 80% of the world’s niobium.

“Together with abundant high-grade mineralisation, the project’s strength is its location in an established mining district with potential to access infrastructure and labour – factors that are favourable for near-term development potential,” St George Mining (ASX:SGQ) executive chairman John Prineas said.

“CBMM’s flagship niobium mine abuts the south-east border of our project, whilst Mosaic’s world-class phosphate mine is immediately to the south-west of our project.

“Minas Gerais is a first-class mining jurisdiction, and we are excited to be adding such a high-quality project in Brazil to our attractive exploration portfolio of clean energy metals projects in Western Australia.”

Potential to become a global player

“The Araxá Project is located in the world’s ‘dress circle’ for niobium production and presents a tremendous opportunity for St George to become a global player in the niobium market,” Prineas said.

“Extensive high-grade niobium mineralisation has already been discovered at the project – with more than 500 intercepts of niobium grades above 1% – providing a strong foundation for St George to quickly progress to potential resource definition.

“In addition to niobium, high-grade rare earths mineralisation has been confirmed by drilling over a widespread area.”

Upside potential on the cards

On completion of the acquisition, SGQ intends to undertake up to 5,000m of diamond drilling focused on further confirmation of historical drill results, exploration along strike of known high-grade mineralisation and testing the depth extent of mineralisation.

New results will also be used in conjunction with historical results to complete a mineral resource estimate for the project.

“The high-grade mineralisation commences at surface and is open in all directions, providing St George with excellent prospects to substantially expand the known mineralised footprint,” Prineas said.

“Significantly, less than 10% of the project area has been effectively drilled and there has been limited drilling beyond 50m from surface.”

Strong investor support

The company has entered into a binding agreement to acquire all the issued capital of Itafos Araxá Mineracao E Fertilizantes S.A (Itafos Araxá), which owns the project, for a cash payment of US$10m at closing of the transaction and deferred cash payments of US$6m and US$5m nine months and 18 months after closing, respectively.

The company has already received firm commitments from investors to raise new funds of $21.25m at $0.025 per share for application towards acquisition costs, the planned drilling program and working capital.

“We are delighted with the strong investor support for the Araxá acquisition with firm commitments received for our $21.25 million fund raising,” Prineas said.

“St George will be fully funded to leverage the advanced status of the project and to progress to being a globally significant player in the niobium and rare earths sector.

“We also welcome Itafos Inc (TSX-V:IFOS), a global fertiliser company and the vendor of the Araxá Project, as a new and substantial shareholder of St George.”

This article was developed in collaboration with St George Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.