St George looks to become a ‘dominant player’ in Mt Ida lithium belt with Woolgangie acquisition

St George says it’s choosing its moves wisely, snapping up a slice of WA’s booming lithium targets. Pic via Getty Images.

St George Mining has sealed an acquisition which immediately stamps the junior as a dominant player in one of WA’s fastest growing lithium districts.

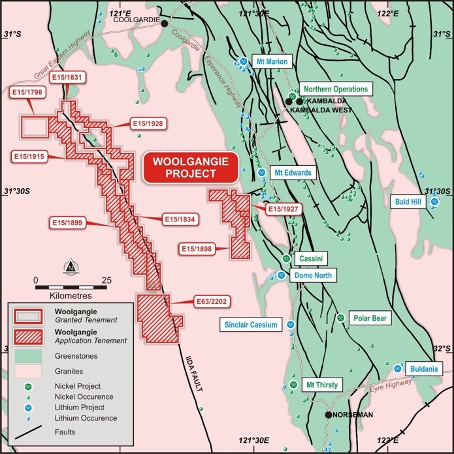

The lithium and nickel explorer has entered into an option agreement to acquire the Woolgangie project, which consists of nine exploration licences either granted or in application over a total area of 1200km2.

Seven of the exploration licences being acquired by St George Mining (ASX:SGQ), two of which have already been granted, cover a 70km strike of the Isa Fault with large sections of an adjacent outcropping and concealed greenstone belt hosting pegmatites with lithium potential.

Two other licences under application already have observed pegmatite occurrences and extend around 25km along the western margin of a region hosting the Mt Marion mine, soon to be producing 900,000t of spodumene concentrate a year for owners Mineral Resources (ASX:MIN) and Ganfeng.

Also in the region are the Buldania project, held by Liontown Resources (ASX:LTR), the Bald Hill mine and the Dome North project of Essential Metals (ASX:ESS), the centrepiece of a recent $136 million cash acquisition by lithium giants Tianqi and IGO (ASX:IGO).

St George says only superficial exploration for lithium bearing pegmatites has taken place to date.

Riding record prices

Record prices which have seen producers pull in excess of US$6000/t for 6% lithium concentrate have placed previously overlooked ground in a new light as electric vehicle sales have surged worldwide.

It follows St George’s growing lithium exploration efforts at its Mt Alexander project in WA’s northern Goldfields, which saw the junior attract investment from Chinese battery companies Sunwoda, Shanghai Jayson New Energy Materials Co and SVolt Energy Technology Co. in recent months.

“This acquisition expands our project portfolio in Western Australia into a highly prospective but largely overlooked region and stamps St George as a dominant player in this area,” St George executive chairman John Prineas said.

“The option over Woolgangie provides a strategic and cost-effective pathway to grow St George’s already substantial lithium and critical metals opportunities in Western Australia, complementing our success at Mt Alexander and the potential of our other projects including Paterson, Ajana and Broadview Projects.

“We are excited by the potential for systematic exploration at Woolgangie to deliver a major discovery at this highly prospective but underexplored landholding.”

Terms of the deal

The deal will see SGQ subsidiary Destiny Nickel enter an option agreement to acquire the tenements from Belres Pty Ltd and WA Mining Partners Pty Ltd, which must be exercised no later than February 2 2025.

The western tenements along the Ida Fault cover around 70km of strike, while the eastern tenements surround some of WA’s largest lithium deposits.

The western tenements contain numerous mapped pegmatites and sit in a geological setting with analogies to the Mt Ida district including Red Dirt Metals’ (ASX:RDT) Mt Ida (12.7Mt at 1.2% Li2O) as well as St George’s own Jailbreak prospect.

Liontown’s Kathleen Valley mine, containing 156Mt of ore at 1.4% Li2O and 130ppm TaO5 is also located along the Ida Fault to the north of Mt Alexander.

Meanwhile, historical drilling by Mincor Resources (ASX:MCR) in 2010 identified several wide zones of rare earth anomalism in nickel sulphide exploration, with a preliminary interpretation that the REE anomalism is more likely to be ionic clay-hosted mineralisation than Mt Weld style carbonatite hosted mineralisation.

Historical drilling by Emu NL also encountered extensive near surface copper sulphide mineralisation warranting follow up exploration.

SGQ will pay $400,000 plus GST including $200,00 cash and $200,000 in St George shares as an option fee. It can exercise the option by paying $1m in SGQ shares on or before February 2, 2025.

A 0.5% net smelter royalty and $1m plus GST milestone payment in a 50-50 mix of cash and shares will apply on the delineation of a JORC-compliant resource for any mineral on one or more of the acquired tenements within 5 years of the completion of the option agreement.

This article was developed in collaboration with St George Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.