St George fully charged at Mt Alexander after another battery giant increases stake

Shanghai Jayson New Energy Materials is set to become St George Mining’s largest shareholder after agreeing to subscribe for $3 million. Pic via Getty Images

- Chinese clean energy giant Jayson increases its stake in St George Mining via $3 million investment

- Second recent major investment in the lithium explorer following strategic position taken by ATL last month

- Mt Alexander fast becoming a project to watch given its proximity to Mt Ida

Special Report: Another big-name battery materials investor has upped its stake in St George Mining as interest continues to grow in the company’s Mt Alexander lithium project.

Leading cathode precursor materials producer Shanghai Jayson New Energy Materials is set to become St George Mining’s (ASX: SGQ) largest shareholder after agreeing to subscribe for $3 million.

St George has also received commitments from sophisticated investors for a placement to raise an additional $2 million for ongoing exploration work at Mt Alexander as well as its other lithium project in Western Australia.

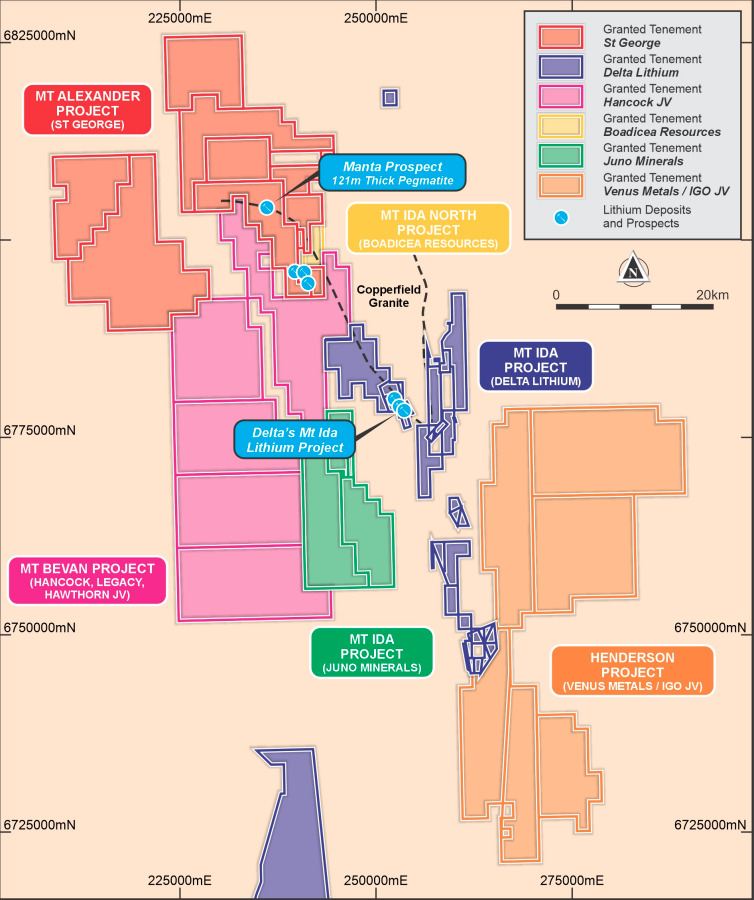

Mt Alexander is part of the same regional LCT corridor which hosts Delta Lithium’s (ASX: DLI) 14.6Mt resource at Mt Ida and abuts the Mt Bevan project joint venture between Gina Rineheart’s Hancock Prospecting, Legacy Iron Ore (ASX: LCY) and Hawthorn Resources (ASX: HAW).

Jayson will emerge with a 11.73% holding in St George which already boasts the likes of Amperex Technology (ATL), Sundwoda Electronic and SVOLT.

ATL took a strategic position in St George’s subsidiary company Lithium Star last month via another $3 equity million investment.

Jayson is no small player in the battery materials game

St George and Jayson will now collaborate on various commercial opportunities which leverage off the latter’s substantial financial and technical capabilities.

In addition to precursor manufacturing operations, Jayson boasts significant mining, smelting and processing units for copper, cobalt and nickel. It has also developed technology for recycling lithium-ion batteries.

Jayson is majority-owned by its chairman, Feng Liang, a senior investor in the clean energy sector who is also the major shareholder and chairman of the US$7 billion Shanghai Putalai New Energy Technology enterprise.

St George executive chairman John Prineas said he looked forward to working with Jayson to accelerate the development of St George’s critical minerals business.

“This is a group with deep financial capacity and technical capabilities in lithium-ion battery technologies, mining, chemical engineering and battery materials manufacturing,” Prineas said.

“St George is delighted at this additional investment – a clear demonstration of Jayson’s faith in the potential of the company’s lithium projects that builds on its initial investment in St George a year ago.

“Jayson has a long-term investment focus with a history of successful global partnerships across the battery sector supply chain, including upstream mining assets.”

As part of its additional investment, Jayson will also have the right to acquire 25% of any lithium products from St George’s projects, subject to finalisation of offtake agreements once a JORC compliant resource is defined and any applicable regulatory requirements are secured.

Jayson can also appoint one director to the board of St George, so long as it continues to hold at least 10% of the register.

‘Exceptionally well-positioned’ – interest growing in Mt Alexander

At Mt Alexander, St George controls more than 16km of a prospective pegmatite corridor which is parallel to what is known as the Copperfield Granite.

Drilling to date has confirmed widespread high-grade lithium within fractionated pegmatites, including a flat-lying pegmatite up to 121m thick which the company believes demonstrates potential for large volume mineralised pegmatites.

Current exploration work at Mt Alexander is focused on soil sampling, pegmatite field mapping and outcrop sampling. St George is particularly interested in the 8km long zone around the Manta prospect where the aforementioned 121m thick fractionated pegmatite was intersected, as well as the 4km long zone at Jailbreak where drilling hit multiple lithium-bearing pegmatites with values up to 1.8% Li2O.

“We believe there is excellent potential for further exploration and drilling to discover significant lithium mineralisation,” Prineas said.

“Our strategic relationship with Jayson will strengthen our capacity to advance Mt Alexander and unlock the full potential of our large landholding in this lithium province where major mining companies like Hancock, Mineral Resources (ASX: MIN) and IGO (ASX: IGO) continue to make substantial investments.

“Together with the recent investment by global battery company ATL in our Lithium Star group of projects, St George is exceptionally well-positioned to deliver lithium exploration success in Western Australia – the world’s best hard-rock lithium address.”

This article was developed in collaboration with St George Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.