SSH eyes acquisitions to ramp up growth in FY23

The company snapped up Karratha Machinery hire in May of this year. Pic: Fiona Jackson-Downes and Nick White / Image Source via Getty Images.

This time last year SSH Group was listing on the ASX and since then, its growth has been phenomenal, MD Daniel Cowley-Cooper says, with over $100 million in pro forma revenue in year one.

“Over the past 12 months and since listing, we’ve taken our time to be able to properly solidify our holding company’s platform, so we are geared up for acquisition as well as organic growth,” Cowley-Cooper said.

“We’ve been able to organically launch a business, as well as acquire our first acquisition since listing and now we’re just looking at speeding that up with a strong focus on targeting higher margin and Earnings Per Share (EPS) accretive businesses.

“We’re going through and identifying high return on investment opportunities and scalable business units and predominantly, it’s all within the People and Equipment Market servicing, construction, civil and mining.”

Acquisitions fuel growth plans

SSH Group (ASX:SSH) already had businesses including a Safety division, and a People division in Bridge Resources which covers servicing, recruitment, and workforce planning for the construction, civil, mining sector.

And since listing, they have bolstered their offerings, entering the equipment market, which also services the construction, civil, mining sector, with the acquisition of Karratha Machinery Hire in May, as well as the launch of Tru Fleet.

“While we’ve always offered fleet vehicle hire, we’ve now got a strong margin generating dedicated brand in Tru Fleet that sits out there in the market servicing a large amount of civil and mining clients across the state,” Cowley-Cooper said.

Both were smart moves, with the company’s year-on-year growth of 36.3% mainly due to the resource shortage in Western Australia spread across civil, construction, government and especially the mining sector.

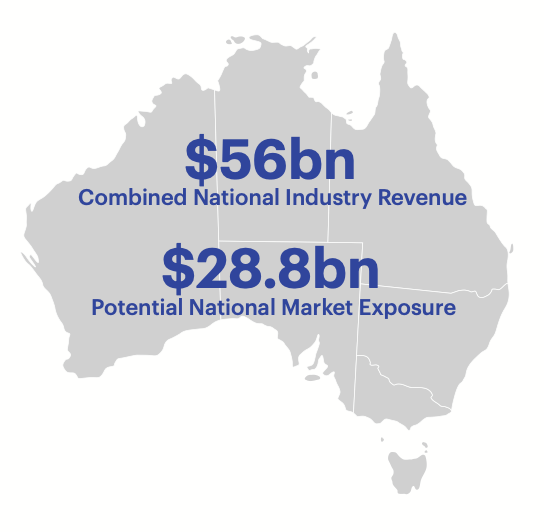

Eyes on a slice of a $56bn market

Nationally, SSH Group estimates that it can address a highly fragmented market of $56 billion, of which current services sit within a $28 billion market.

That’s where the company’s growth strategy comes in.

“Within that $28 billion, it’s highly fragmented,” Cowley-Cooper says.

“It’s filled with a lot of small to midsize operators and the major market holders own 5-8% of the market.

“With our growth strategy, the focus was on identifying how can we actually accelerate our growth and listing has really sped up our growth and our ability to go down that M&A path with that focus on high-margin generating businesses.”

And Cowley-Cooper says the company is well placed to deliver on its strategy, with over $5.35m cash in the bank at the end of FY22.

This article was developed in collaboration with SSH Group Ltd, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.