Spotlight on the Athabasca: Is more yellowcake M&A on the way?

92 Energy's three-way merger could prompt more M&A activity in Canada's Athabasca Basin. Pic via Getty Images

- ASX-listed 92 Energy to merge with two of its Canadian peers, creating a leading uranium exploration company with a big presence in the Athabasca Basin

- More M&A could be on the way as uranium prices continue to soar amid a supply scramble for new sources of yellowcake

- Other Australian explorers such as Basin Energy and Valor Resources also have strong ground positions in the prolific uranium-producing district of Saskatchewan

Australian explorer 92 Energy is joining forces with two of its Canadian peers to create a new uranium exploration powerhouse – could a host of other explorers in the prolific Athabasca Basin be in the mix for some M&A at a time when the market is mustering up a greater appetite for yellowcake?

In what could be the first of many major uranium transactions to play out over the coming months as interest in the revitalised yellowcake sector continues to surge, 92 Energy (ASX: 92E) has entered into a scheme implementation deed to merge with Canadian-listed ATHA Energy.

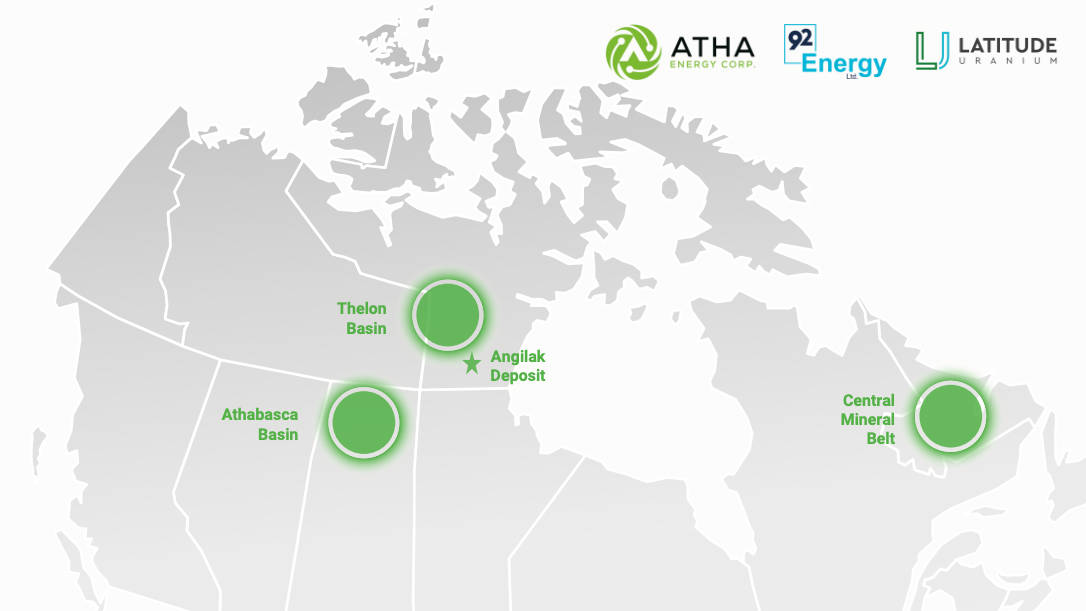

ATHA has also struck a separate definitive arrangement agreement with Latitude Uranium, making it a three-way merger of companies with multi-asset exposure across Canada’s top three uranium jurisdictions.

92E was one of the first movers in the Athabasca Basin in early 2021 and its exploration success so quickly after listing on the ASX – the company made the Gemini discovery on just the fourth hole drilled in its maiden exploration campaign – prompted an influx of other explorers from Australia and elsewhere into the yellowcake-rich region.

Today’s merger announcement comes barely three weeks since the uranium spot price broke through US$80/lb for the first time in more than 12 years, suggesting sentiment has well and truly returned to the sector.

In a sign a new uranium bull cycle has commenced, some 160Mlb of yellowcake has been contracted this year despite now new mines being developed in the past decade.

Three of a kind to become one of a very unique kind

The 92E board has unanimously recommended shareholders vote in favour of the scheme.

If approved, 92E shareholders are set to receive 0.5834 new ATHA commons shares for every one fully paid ordinary share they hold on the record date, tentatively scheduled for April next year.

The scheme carries an implied value of approximately 65c per 92E share, representing a 78% premium to the company’s 30-day VWAP and a 70% premium to yesterday’s closing share price.

Upon completion of the three-way merger, 92E is expected to hold 25% of the combined group on a fully diluted in-the-money basis.

Two of 92E’s largest shareholders, IsoEnergy (~10.1%) and Sachem Cove (~4.92%), have indicated they will vote in favour of the scheme in the absence of a superior proposal and subject to the independent expert report concluding the merger is in the best interest of shareholders.

92E managing director Siobhan Lancaster said the merger would create “substantial, rapid value” for shareholders.

“The deal will deliver a significant premium to 92E shareholders, while also giving them the opportunity to be part of the premier Canadian uranium explorer with outstanding growth potential underpinned by a significant discovery, immense exploration upside, robust funding, highly regarded management and extensive local contact network,” Lancaster said.

ATHA is expected to have 282.6 million shares on issue upon implementation of the merger transactions with 92E and Latitude. It is also seeking to raise C$22.8m to support the three-way business combination.

Gemini will now become part of a portfolio which also includes historical resources of 43.3Mlb U3O8 at the Angilak project in Nunavut, 3.6 million acres of exploration land subject to the largest ever EM program in the Athabasca Basin and 1.3 million acres of greenfield exploration assets in the Thelon Basin.

ATHA holds the largest cumulative exploration package in the Athabasca Basin with 3.4 million acres, along with a 10% carried interest in claims operated by IsoEnergy and the triple-listed NexGen Energy (ASX: NXE).

Angilak belongs to CSE-listed Latitude, which is also exploring the CMB uranium project in Newfoundland and Labrador.

The combined group, to be led by Latitude’s Troy Boisjoli as CEO and Lancaster as an executive director, is expected to be emerge with a pro forma cash balance of +C$64 million upon completion of the merger transactions.

The world is hungry for more yellowcake but who has the ingredients?

The creation of a major uranium exploration company comes as several major economies around the world have openly committed to adoption of nuclear energy. But they will require new sources of uranium to fuel those ambitions.

It also puts an increased spotlight on the ASX uranium players in Canada’s Athabasca Basin.

Basin Energy (ASX: BSN) managing director Pete Moorhouse believes today’s merger announcement has brought long overdue recognition to the region, especially among ASX uranium investors.

“The Athabasca has long been known as the home to the best uranium mines in the world, it’s been mined consistently for 65 years and a top producer for 45 of those,” Moorhouse told Stockhead.

“That hasn’t changed, but what we haven’t really seen up until recently is a huge amount of exposure on the ASX. I think the success of 92E, Basin and others has brought that recognition to the ASX investors and shown how hot this part of the world is for uranium.”

BSN holds an interest in three projects in the Athabasca Basin, including Geikie which is just a stone’s throw from 92E’s Gemini discovery. It is also exploring at North Millennium, just 7km north of Cameco’s 104.8Mlb @ 3.76% U3O8 Millennium deposit.

Moorhouse expects to see more M&A activity involving the Athabasca Basin, describing it as an “exceptionally active space” for uranium exploration.

“It’s becoming seriously hot property and that’s because it is prospective for these big, high-grade uranium deposits in the east, previously not recognised for basement-hosted mineralisation until recently,” he said.

“There’s a lot of moving parts. We’ve had the Consolidated Uranium and IsoEnergy deal recently and now you’ve seen the 92E news today. And I daresay there will be more on the way as we move into this exciting uranium space over the next few years.”

Other ASX-listed companies in the region include Valor Resources (ASX: VAL) which recently expanded the exploration footprint around its Surprise Creek uranium-copper project within the Beaverlodge Uranium District, and Terra Uranium (ASX: T92) which is currently drilling a number of advanced targets across its HawkRock, Pasfield and Parker projects but is also on the lookout for large farm-in and joint venture partners.

Formerly known as Okapi Resources, Global Uranium and Enrichment (ASX: GUE) is predominantly focused on the 49.8Mlb Tallahassee project in Colorado but also has portfolio of six exploration assets in the Athabasca Basin.

At Stockhead, we tell it like it is. While Basin Energy and Valor Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.