S&P is bullish about nickel prices on supply concerns and these stocks are in the game

Pic: Getty

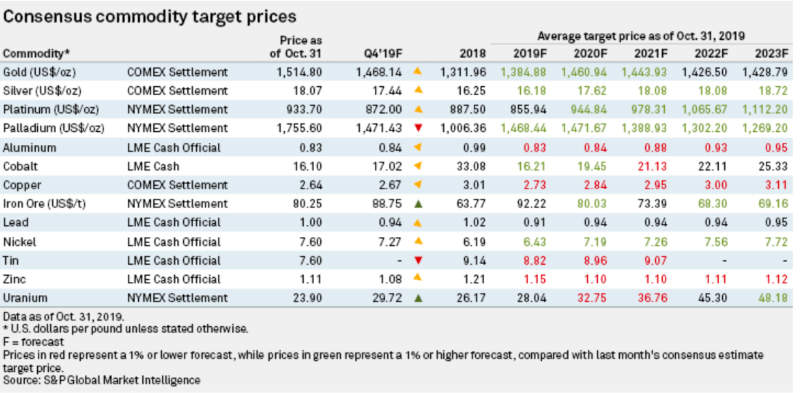

Base metal prices are forecast to remain flat for the rest of 2019 as the sluggish macro environment is offset by renewed sentiment on the prospect of a resolution to the ongoing trade dispute between China and the US.

This is due to the slowing demand outlook for industrial commodities in China as the economy of the world’s most populated country moved towards a more sustainable 5 per cent GDP growth rate.

Despite this, S&P Global believes that nickel will be one of the best performing commodities going forward.

“LME three-month nickel hit a five-year high of $US18,850 ($27,750) per tonne after Indonesia confirmed the early ore export ban, but the prices have since fallen sharply mostly on large scale selling,” head of metals and mining research Matthew Piggot said.

“Prices have been exceptionally volatile this year, recently supported by a substantial reduction in LME stocks, which reached their lowest level since 2012 in October.”

Piggot said Indonesia’s ore ban should remove significant tonnage of raw material from China’s nickel pig iron industry, resulting in the potential need for higher purchases of LME refined metals to fulfil the needs of the stainless steel industry.

He added that various factors would potentially limit the ability of the Philippines to act as the swing producer and fill that demand gap.

“We therefore expect elevated prices in 2020 to remain in play due to the considerable primary deficit,” Piggot said.

“And while prices have come off significantly in recent days on the resumption of ore exports temporarily before the ban comes in again, we expect nickel to average $US16,500 per tonne in 2020.”

However, he was more bearish about copper, noting that prices will remain depressed until the macroeconomic environment recovers in the second half of 2020, when S&P expects the market to return to deficit.

“Copper is characterised in our view by the fine balance between slowing mine production growth and lower smelter consumption,” Piggot added.

“Within this market, lower scrap imports into China due to quotas coupled with rising Chinese smelter capacity are driving concentrate import demand up.

“Concentrate markets should remain tight, this will help offset some of the impact of lower refined metal prices for miners.”

Piggot also said that higher levels of pricing were needed to incentivise the development of new supply from what S&P considered to be a depleted project pipeline.

Read: S&P confirms – the world is struggling to find more copper

“The recent price action has seen prices rise above January levels, news of a potential phase one trade deal resolution helped sentiment, but we still have some way to go yet,” Piggot added.

“We expect copper to average $US6,033 per tonne in 2020.”

Piggot also had little love for zinc, noting that in the third quarter prices had fallen below the levels seen at the beginning of 2019.

“This came by overall improved levels of production of galvanised steel up 9.8 per cent year over year in the first half of 2019, strong demand from construction that was offset by weak demand from Chinese vehicle production which fell 13 per cent January to August,” he said.

“Against this backdrop, mined zinc supplies grew strongly, we estimate by 4.7 per cent this year as a whole.

“This has meant in the second quarter we assess the market entering surplus and remaining there in the third.”

S&P expects that 2019 will see a surplus of 99,000 tonnes of zinc, increasing stock levels and putting pressure on zinc price.

“We expect prices to remain under that pressure through to 2021 with refined production outpacing growth in refined demand. We expect prices to average $US2,341 in 2020,” Piggot added.

“That will be second consecutive year of decline.”

Nickel beneficiaries

So who are some of the small cap nickel plays that could benefit from the positive outlook?

Blackstone Minerals (ASX:BSX) is pushing ahead with development of its Ta Khoa project, which includes the Ban Phuc nickel mine and its associated 450,000-tonne-per-annum nickel concentrator.

This represents more than $130m in sunk costs, allowing the company to focus on funding the remaining downstream facilities to produce a finished nickel product suitable for the battery sector.

The company is currently looking to define a maiden resource and complete a scoping study within the next six months.

Neometals (ASX:NMT) recently announced an updated resource for its newly acquired Munda mining lease, which forms part of its Mt Edwards project, which sits in a historically prolific nickel sulphide producing region near Kalgoorlie.

The resource of 320,000 tonnes at 2.23 per cent nickel for 7,140 tonnes of contained metal bolsters the Mt Edwards resource by about 5.8 per cent to 130,400 tonnes of contained nickel.

Auroch Minerals (ASX:AOU) is currently focused on completing a diamond drilling program at the Saints nickel project in Western Australia.

The first hole at the project has already returned a very high-grade nickel intersection of 1.77m at 6.72 per cent nickel, 0.27 per cent copper and 0.13 per cent cobalt from a depth of 227.31m that includes a 0.5m zone grading just under 10 per cent nickel.

Auroch is also looking at drilling at the Leinster project to define a JORC 2012 resource.

Meanwhile, Carnavale Resources (ASX:CAV) recently expanded its nickel footprint in the Kurnalpi region about 80km east of Kalgoorlie by exercising its option to acquire up to 80 per cent of Mithril Resources’ (ASX:MTH) tenement portfolio in the area.

The tenements are immediately adjacent to its Grey Dam nickel-cobalt deposit, which has a current resource of 14.6 million tonnes grading 0.75 per cent nickel for 110,000 tonnes of contained nickel.

St George Mining (ASX:SGQ) has been laying the groundwork for the next round of exploration drilling for more nickel-copper sulphides at its Mt Alexander project in the northeastern Goldfields region of Western Australia.

A comprehensive soil survey over the Fish Hook prospect has identified a large geochemical anomaly that is consistent with the interpreted surface position of the southern ultramafic unit.

The company has uncovered shallow, high-grade nickel and copper sulphides across a 5.5km section of its 16km-long Cathedrals Belt project in WA.

Tyranna Resources (ASX:TYX) has picked up the Dragon and Knight tenements that are located just 26km east of St George’s Mt Alexander project.

Its initial focus will be on exploring that 36km strike for nickel massive sulphide mineralisation because of the “significant exploration upside”.

Read: Tyranna gets into nickel next door to St George in WA

At Stockhead, we tell it like it is. While Blackstone Minerals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.