Sovereign’s giant Kasiya project could be a rutile gamechanger

Pic: John W Banagan / Stone via Getty Images

Sovereign is betting that its very large-scale and high-grade Kasiya rutile project in Malawi can meet the expected growth in demand for natural rutile.

Natural rutile is the rarest and highest grade source of titanium that is favoured by pigment producers due to its lower carbon footprint and lower levels of impurities.

It is also used in the titanium metal industry and as a welding component, which aligns it with the industrial sectors and construction.

As such, the ongoing stimulus for construction and industrial infrastructure is widely expected to drive demand.

However, the global supply of rutile is in a structural deficit with output from mature mines declining and a lack of major rutile-rich discoveries made in the past 20 years to fill the gap.

This has led to the development of high energy, high carbon methods to convert ilmenite into synthetic rutile or titanium slag.

While these methods go some way towards meeting demand for titanium oxide, Sovereign Metals (ASX:SVM) believes its large, high-grade and at surface Kasiya rutile project offers a far more compelling option for pigment manufacturers and other titanium oxide consumers.

The use of natural rutile could also reduce global titanium pigment industry emissions by displacing and substantially reducing the use of carbon-intensive upgraded alternatives.

Life Cycle Assessment Studies by UK based consultancy Minviro Ltd found that up to 2.8 tonnes of carbon dioxide equivalent could be saved for every tonne of natural rutile used instead of ilmenite that has been upgraded into high grade titanium feedstocks like titania slag and synthetic rutile through the use of smelting and chemical processes.

Kasiya Rutile Project

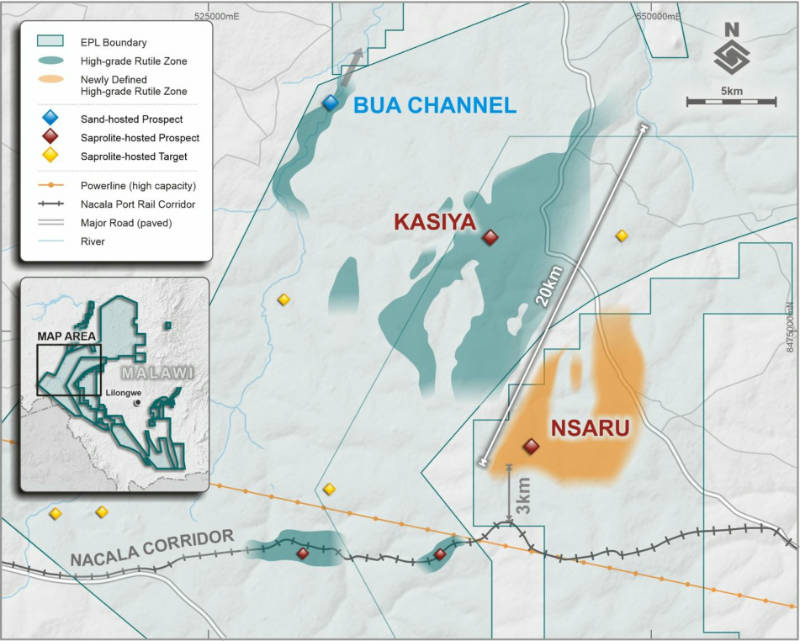

The flagship Kasiya project was discovered about 15 months ago and has been very rapidly delineated over a 66sqkm area.

Notably, the very-high grade mineralisation commonly occurs from surface to a depth averaging about 4m and up to 10m.

Managing Directors Julian Stephens told Stockhead that the Kasiya rutile mineralisation likely extends deeper than it had already defined.

“That’s the capacity of our drill equipment we’ve mainly used, but there’s very strong indications that mineralisation will occur down to about 25m vertically” he noted.

“However, we have such an extensive footprint of high-grade rutile at surface that we have focused on defining and developing what we have found to date rather than drilling deeper.”

Processing of Kasiya rutile is also a simple process that does not require the use of hazardous materials, acids, bases or high energy components.

The first stage involves the use of a low energy processing plant that will wash, dis-aggregate and deslime the material, which is essentially the removal of ultrafine waste material to produce a sand fraction.

This sand will then be put through a gravity spiral to produce a heavy mineral concentrate that will undergo magnetic separation to remove magnetic particles such as iron rich minerals and electrostatic to remove other impurities to produce a high-end rutile product.

The size and simplicity of producing rutile are what could make Kasiya a game changer in the titanium sector.

“It is really providing (consumers) an opportunity to displace the synthetic rutiles, titanium slag and other inferior alternatives that have been invented to make up for the shortages in natural rutile,” Stephens added.

Sovereign’s project and process allows for the generation of a ~96 per cent purity titanium oxide product that meets three key factors.

Firstly, it has a purity of more than 95 per cent that allows it to tap the premium market, secondly it has low levels of critical impurities while the third factor is the highly favourable sizing of the product.

“If you tick all those boxes, you then allow your product to be usable in all major markets which would likely draw huge demand and allows you to sell across all of those markets,” Stephens explained.

And there is more.

While Kasiya is already an extensive deposit, the company recently discovered the Nsaru deposit during initial wide-spaced drilling in the same geological domain as Kasiya, which is just a couple of kilometres to the northwest.

Nsaru features high-grade rutile mineralisation from surface with widths of up to 5.5km across and a current strike length of around 9km that remains open to north and south at its widest zone.

The area of drilled mineralisation to date at Nsaru is about 25sqkm and combining that with Kasiya’s footprint of 66sqkm takes the total mineralised area up to about 91sqkm.

Strategic funding

Northern Hemisphere-based investors have also endorsed the company and its projects, committing to a $8m placement of new shares priced at 40c each.

The placement includes one free attaching option exercisable at 50c with a 12-month expiry for every two shares subscribed.

Proceeds from the placement will be used to fund exploration and development activities for its rutile province in Malawi.

Milestones ahead

Sovereign is focused on getting a maiden resource for Kasiya, which it expects to be extensive base on the footprint that it has been able to define.

The company will then fast track the project into a scoping study with mining and tailings studies already underway.

This will in turn lead to a pre-feasibility study.

Metallurgical variability test-work is in the final planning stages on three separate samples representative of the different regolith units from Kasiya.

Additionally, the success of initial drilling has led Sovereign to start a more systematic drill program aimed at bringing the drill spacing at Nsaru down to at least 800m by 400m in order to incorporate the results into a future mineral resource estimate.

The company will also continue its step-out and extensional drilling at Kasiya, Nsaru and the broader surrounding area to identify extensions and discover new regional mineralised zones.

Separately, it will also investigate and test for a potential coarse flake graphite by-product from Kasiya.

Rutile market

The current market for rutile is about 700,000t and is expected to grow up to 1Mt by 2025. This itself makes up just 10 per cent of the entire titanium dioxide market.

“There is extremely large room to move and room to displace,” Stephens added.

“We have taken a fairly bullish approach to it and we are in open dialogue with a lot of end users already, giving us the confidence that the market is there.

“It’s unlikely we’ll be constrained in terms of market size – we aim to fulfil the growing large market gap for natural rutile.”

This article was developed in collaboration with Sovereign Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.