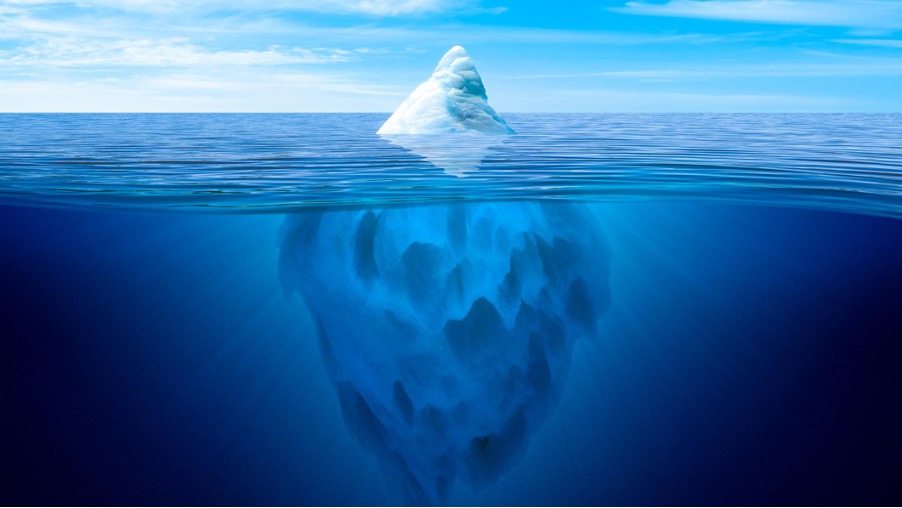

Sovereign’s giant 18Mt Kasiya resource just the tip of the iceberg as drills hit rutile at up to double the depth

Sovereign’s exploration has uncovered a surprise, as its already beyond-massive Kasiya discovery gets deeper and deeper and deeper again. Pic via Getty Images

Sovereign Metals’ Kasiya mineral sands discovery is already the world’s largest ever natural rutile deposit, and don’t be surprised if it continues to grow.

After unloading a bumper mineral resource of 1.8 billion tonnes at 1.01% rutile earlier this year, Sovereign’s (ASX:SVM) 18Mt bounty is the biggest agglomeration of the high purity titanium dioxide feedstock ever uncovered. Now new drilling shows it is likely to go far deeper.

Existing pit shells continue to an average of 15m depth across the large Kasiya ore body.

But a major aircore drilling campaign earlier this year has returned thick and deep intersections of high-grade rutile that shows there is extensive rutile mineralisation beyond the proposed mine’s previously known limits.

Highlights include:

- 28m at 1.05% inc. 5m at 1.78% rutile

- 25m at 1.06% inc. 13m at 1.15% rutile

- 20m at 1.26% inc. 16m at 1.37% rutile

- 22m at 1.15% inc. 8m at 1.51% rutile

- 20m at 1.29% inc. 6m at 1.27% rutile; and,

- 26m at 1.18% inc. 6m at 1.66% rutile.

PFS on the way

This is all positive stuff ahead of a new mineral resource update targeted for the first quarter of 2023 and a landmark pre-feasibility study due in the second quarter of next year.

An expanded scoping study in June put a NPV of US$1.567b and IRR of 36% after tax on the project, which would generate US$323m in EBITDA annually over a 25 year life of mine.

The resource has grown substantially since then, with new results suggesting Sovereign continue mining in several areas at Kasiya down to the saprock layer at 20-30m depth.

“The early results from this deeper drilling re-asserts the truly remarkable Tier 1 nature of Kasiya in terms of size, grade and mineralisation consistency,” Sovereign MD Julian Stephens said.

“We have now answered the question on the potential to deliver additional tonnes for the mineral resource at depth.

“Kasiya continues to grow and will likely become a multi-generational project capable of supplying a reliable and sustainable source of high-purity titanium as natural rutile.”

A total of 191 aircore holes were drilled at Kasiya in two phases from May to August this year on a 200m by 200m grid, targeting the upgrade of resources to indicated levels which can be placed in a probable ore reserve for next year’s PFS.

Only the first 32 holes have been reported from an initial sighter program designed to show mineralised continued deep into the saprolite layer at Kasiya to up to 30m.

More results are on their way for another 159 holes for 3846m, drilling to target planned pit areas.

Coarse flake graphite, a major co-product at Kasiya, was also present in all aircore holes associated with rutile mineralisation. Pleasingly, graphite grades improved with depth, averaging more than 2% total graphitic content in numerous holes.

Work in progress

Sovereign has numerous technical work packages in progress for Kasiya, with further drilling to refine and extend the MRE and the final PFS mining inventory, preliminary hydrogeological pilot and test boreholes, met test work focused on the first decade of mining, site visits and product marketing.

More MoUs are expected to be executed after Sovereign this year announced offtakes for premium bagged rutile for the welding industry with Hascor and with Japanese trading giant Mitsui to target the Asian titanium feedstock market.

Natural rutile is a rare but prized lower carbon alternative to other titanium feedstocks used in the pigment sector, aerospace, titanium metal and welding among other things.

In line with the extended schedule to complete its PFS and DFS after choosing to expand its scoping study in June, SVM is also seeking support from shareholders at its upcoming AGM in November to extend the performance rights plans for key executives.

This article was developed in collaboration with Sovereign Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.