Sovereign Metals targets the lucrative lithium-ion battery market

An aspiring lithium miner, backed by a former executive of Normandy Mining, believes the lithium-ion battery industry will be a significant target market for graphite concentrates produced from its world-class Malingunde project in Malawi.

Tests on graphite concentrates from the project show strong potential for use as lithium-ion battery feedstock, Perth-based Sovereign Metals (ASX:SVM) said on Monday.

Sovereign’s managing director Dr Julian Stephens said the lithium-ion battery market provided attractive future value upside for the company.

“We are in an enviable position of being able to compete with traditional graphite supply by virtue of our very low cost of production, while also retaining significant upside to the exiting future growth in energy storage,” Dr Stephens said.

“When combined with Sovereign’s very low capex, this strategy provides the lowest-risk path to development and most compelling investment case among all peers.”

Aside from the battery market, the company’s primary focus was sales to traditional markets such as refractories, foundries and other industrial applications.

Earlier this year, Sovereign announced a maiden resource for Malingunde, confirming it as the world’s biggest reported soft saprolite-hosted graphite resource.

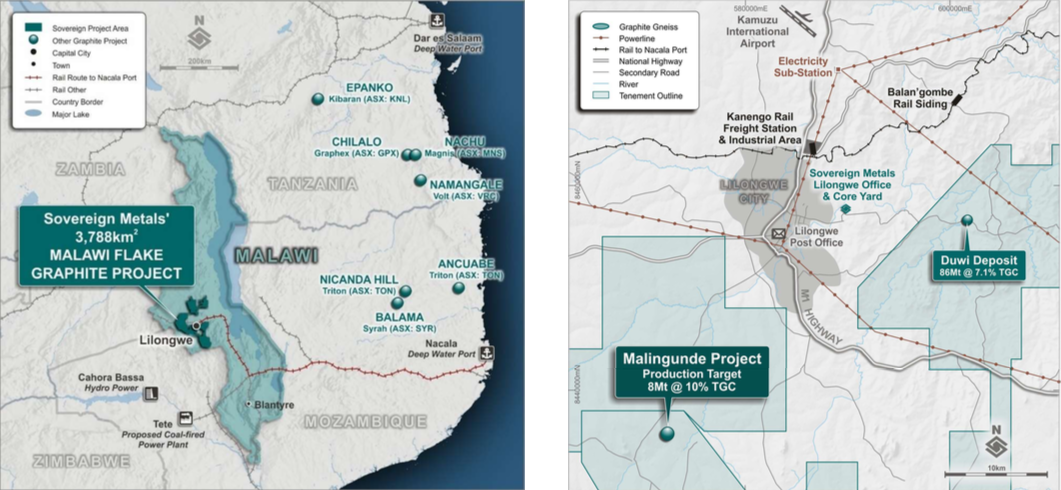

Location of Sovereign’s Malingunde graphite project in Malawi.

The project has an indicated and inferred resource of 28.8 million tonnes at 7.1 per cent total graphitic carbon (TGC) at 4 per cent TGC cut-off, including a high-grade component of 8.9 million tonnes at 9.9 per cent TGC at 7.5 per cent TGC cut-off.

Preliminary economics show the project has capital and operating costs per unit at the bottom of the graphite supply cost-curve, with production rates supported by current market conditions.

A recent Scoping Study into the Malingunde Project highlighted a low capital cost of $US29 million and operating cost of $US301 per tonne concentrate with annual graphite concentrate production of approximately 44,000 tonnes over an initial mine life of 17 years.

Sovereign is chaired by mining entrepreneur Ian Middlemas who was previously senior group executive for Normandy Mining, Australia’s biggest gold miner before merging with Newmont Mining.

Mr Middlemas owns 2.8 per cent or 6 million shares in Sovereign through his private company Arredo Pty Ltd.

Shares in Sovereign closed unchanged on Monday at 11.5c, capitalising the company at roughly $26 million.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.