Sovereign Metals reckons it has the “world’s best flake graphite project”

Pic: Schroptschop / E+ via Getty Images

Explorer Sovereign Metals reckons it has a world-beating graphite project on its hands in the African nation of Malawi.

The market’s response was muted on the news, however, with Sovereign (ASX:SVM) shares increasing just over 2 per cent to 8.7c by midday.

The share price has ranged between 6.7c and 15.5c over the past 12 months.

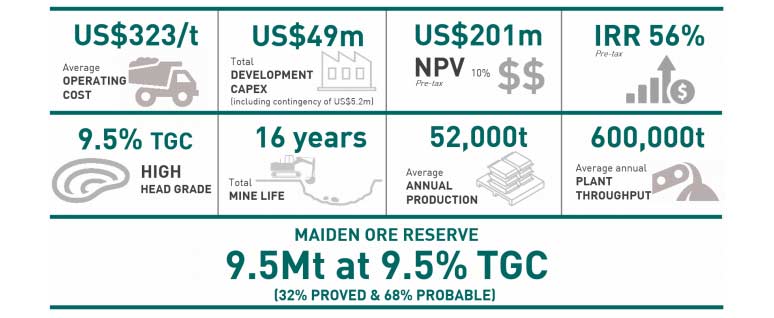

A “pre-feasibility” study of Sovereignon’s Malingunde project showed start-up costs (US$49 million) and operating costs (US$323/t concentrate) were some of the lowest globally.

That’s because the deposit is a high grade 9.5 per cent total graphitic carbon and is hosted in soft saprolite material with good nearby infrastructure.

Soft-saprolite hosted graphite deposits have operating and capital cost advantages over hard-rock deposits because they are easier to mine and process.

Most operating saprolite-hosted flake graphite mines are small and low grade, typically 4 to 6 per cent TGC.

Sovereign Managing Director Dr Julian Stephens, managing director at Sovereign said the company believed it had “the world’s best flake graphite project”.

“The high-grade, soft, free-dig saprolite-hosted ore, requiring no primary crush or grind combined with a simple and proven flowsheet results in low capital intensity and extremely low operating costs,” he said.

“Malingunde is an unparalleled, low technical risk, high margin project that provides significant cashflows with substantial upside scalability into a growing graphite market.”

The company said it intends to kick off a DFS on the project immediately, and that sales negotiations with a number of Tier 1 and other quality offtake partners were “well advanced”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.