Sovereign Metals eyes booming Asian natural rutile market, inking offtake deal with Japanese trading giant Mitsui

Sovereign Metals has signed a new natural rutile offtake deal with Japan’s Mitsui. Pic via Getty Images

One of Japan’s largest trading houses will give mineral sands developer Sovereign Metals a pathway into the booming Asian titanium market, after Mitsui inked a major marketing and offtake deal for its Kasiya mine.

Sovereign Metals (ASX:SVM) is drawing a high level of interest for Kasiya in Malawi, recently established as the largest natural rutile discovery in history.

Mitsui has agreed in what is currently a non-binding, non-exclusive arrangement to take 30,000t of high grade natural rutile from Kasiya each year, once it is in production and jointly market it into Asia with SVM.

The alliance will help Sovereign leverage of Mitsui’s network of trading partners and their market-leading understanding of the titanium industry and global logistics.

The Japanese industrial giant has also shared samples of rutile from Kasiya with end-users on the continent, confirming its premium chemical specifications should be suitable for use in their titanium sponge and pigment processes, as a precursor for high-grade, high-specification titanium metal and pigment production.

Mitsui is well known to the Australian market as well, having been a key backer and marketer of iron ore and coal from Down Under since the 1960s.

SVM managing director Julian Stephens says Sovereign is eyeing off Asia as a key market for its titanium dioxide feedstock.

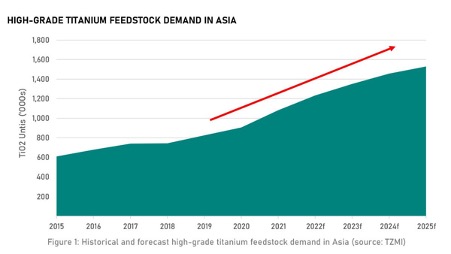

“The Asia region is a key natural rutile market with all major end-use sectors well established and further strong growth forecast,” he says.

“We expect expanding technology developments and increasing environmental awareness to drive greater demand for natural rutile. This marketing alliance with a very high-calibre partner in Mitsui will assist Sovereign to penetrate these ever-growing markets.”

Why Asia?

It is well known that natural rutile is heading into long-term structural deficits, and prices are at long-term highs for spot of around US$2200/t in China.

Bagged rutile for the welding market (which typically draws a 25% premium over general bulk rutile pricing) is expected by industry consultants TZMI to fetch US$500-600/t above general bulk prices and sales in the March Quarter for this product were already upwards of US$2000/t.

For reference, an updated scoping study last month suggested Kasiya would have an operating cost of just US$320/t.

Kasiya already has a 25,000tpa MoU with Hascor for sales of the aforementioned product into the bagged rutile market.

But there are other reasons why the Asian market is so appealing for Sovereign.

Asian customers are currently undergoing a massive shift in their thinking and consumption patterns.

Not only do they need more rutile – the 1.8Bt Kasiya is the first major discovery in over 50 years – but they want titanium feedstocks that are better for the environment as well.

While major western producers of paint pigment normally use high-grade titanium feedstocks for the chloride process, Chinese producers generally rely on low-grade sulphate ilmenite as their main feedstock for the more polluting sulphate process.

With new expectations from community, government and investors alike, that is now changing.

Keen to produce less waste, major Chinese pigment producers like LB Group, CITIC and Yibin Tianyuan have been shifting their production lines to the chloride process.

That has resulted in stronger demand for high-grade titanium feedstocks that Sovereign is well placed to fill. TZMI predicts Chinese chloride pigment capacity to grow at 10% CAGR to hit 1.1Mt by 2030.

Aerospace industry to lead titanium rebound

Demand for natural rutile for titanium sponge and metal is also expected to ratchet up as airliners return from the lows of the pandemic.

Titanium metal is an essential component in the aerospace, military, medical and construction sectors with strong growth coming from the high-performance, clean-tech, and technology industries.

Its combination of corrosion resistance, excellent weight-to-strength ratio, and very high melting point is not found with other metals.

Titanium metal makes up just 10% of natural rutile demand, but is expected to grow at more than 8% CAGR as travel restrictions are lifted globally.

The Asia market is key here as well. The production of titanium metal is highly concentrated in China, Asia and Eastern Europe.

This article was developed in collaboration with Sovereign Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.