Solid state hydrogen storage prompts Australian Mines review of Flemington scandium study

The review of Flemington will also consider a resource update that includes holes drilled in 2019 and 2020. Pic: Getty Images

- Australian Mines reviewing 2017 Flemington scandium scoping study

- Decision sparked by interest in recent advancements of its solid state hydrogen storage project

- Flemington is near Rimfire’s Melrose and Murga North scandium projects

Special Report: Significant interest in the recent advancements of its solid state hydrogen storage project has led Australian Mines to dust off the 2017 Flemington scandium scoping study for review.

The decision to review the capital, operating and revenue estimates from the study was motivated by the potential strategic synergy between the company’s solid state hydrogen storage advancements, the hydrogen economy, and the potential applications of scandium.

Earlier this year, Australian Mines (ASX:AUZ) submitted patents for the promising MH-May24 metal hydride that demonstrated significant improvements in adsorbing and desorbing hydrogen at lower temperatures, which could lead to the development of systems with more storage capacity than either compressed or liquid hydrogen.

Scandium itself is a critical mineral that has seen supply and demand doubling in just two years from 15-25 metric tonnes in 2021 to 30-40 metric tonnes in 2023 according to the US Geological Survey.

Those demand growth rates blow the CAGR of even electric vehicles and lithium out of the water.

This growth – and China’s monopoly over production of scandium feedstock and its refined oxides – has led to renewed interest in developing scandium deposits elsewhere, including Australia.

It’s estimated China controls around 80% of the world’s production, putting the critical mineral in the cross-hairs of trade war export controls recently imposed on gallium, germanium, graphite and antimony, all metals in which western importers are beholden to Chinese suppliers.

Intriguing potential

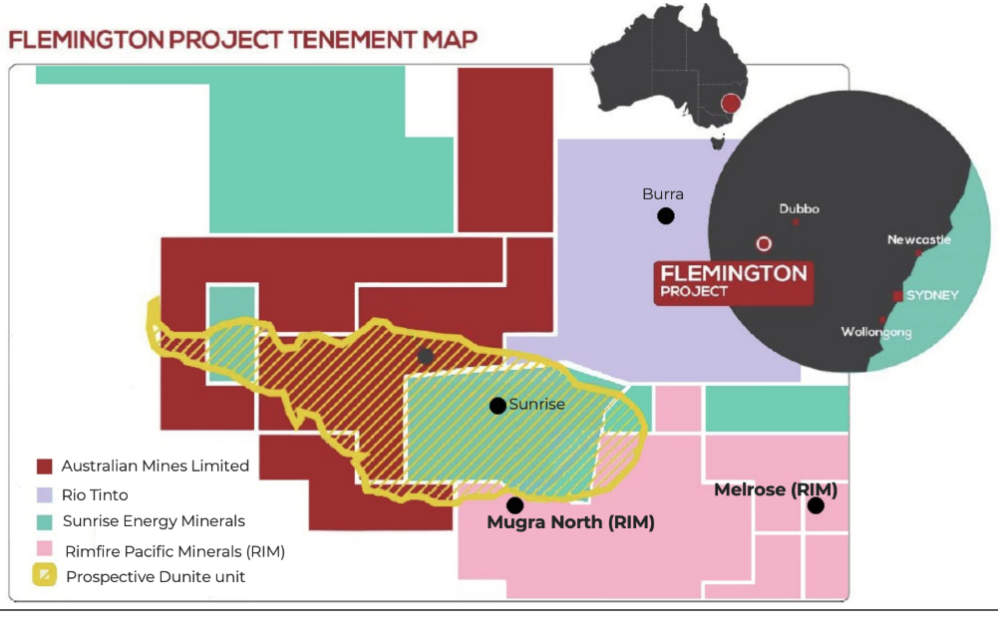

Enter AUZ’s Flemington cobalt-scandium-nickel project about 370km west of Sydney – a project with a resource of 2.7Mt grading 403g/t scandium.

The scoping study from 2017 had estimated project net present value (8% discount) and internal rate of return – both measures of profitability – at $255m and 37.3% respectively using a scandium oxide price of US$1.5m per tonne.

Under the scoping study, Flemington was envisaged as processing 100,000t of ore to produce 50t of scandium oxide annually.

Mine life was estimated at 18 years with the potential for extension to 45 years.

Capex was expected to be a relatively low $74m.

De-risking the project is the success that neighbour Rimfire Pacific Mining (ASX:RIM) has seen at its Melrose and Murga North scandium projects.

RIM recently released maiden resources of 21Mt at 125 parts per million (ppm) scandium (4,050t scandium oxide) at Mulga North and 3Mt at 240ppm scandium (1,120t scandium oxide) at the Melrose deposit. That explorer has flagged that it is only just getting started.

Review goals

The review of the Flemington scoping study is intended to update its capital, operating and revenue estimates.

AUZ will also consider updating the current resource by including ~500 drill holes that were completed between 2019 and 2020.

Scandium plays a key role in solid oxide hydrogen fuel cells, lightweight aluminium alloys and advanced electronic technologies, where it improves the performance of semiconductors and 5G communications tech.

This article was developed in collaboration with Australian Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.