Soaring gold prices bolster opportunity at Norwest Minerals’ Bulgera project in the Gascoyne

High gold prices have allowed Norwest to slash the cut-off grade for Bulgera mineralisation. Pic: Getty Images

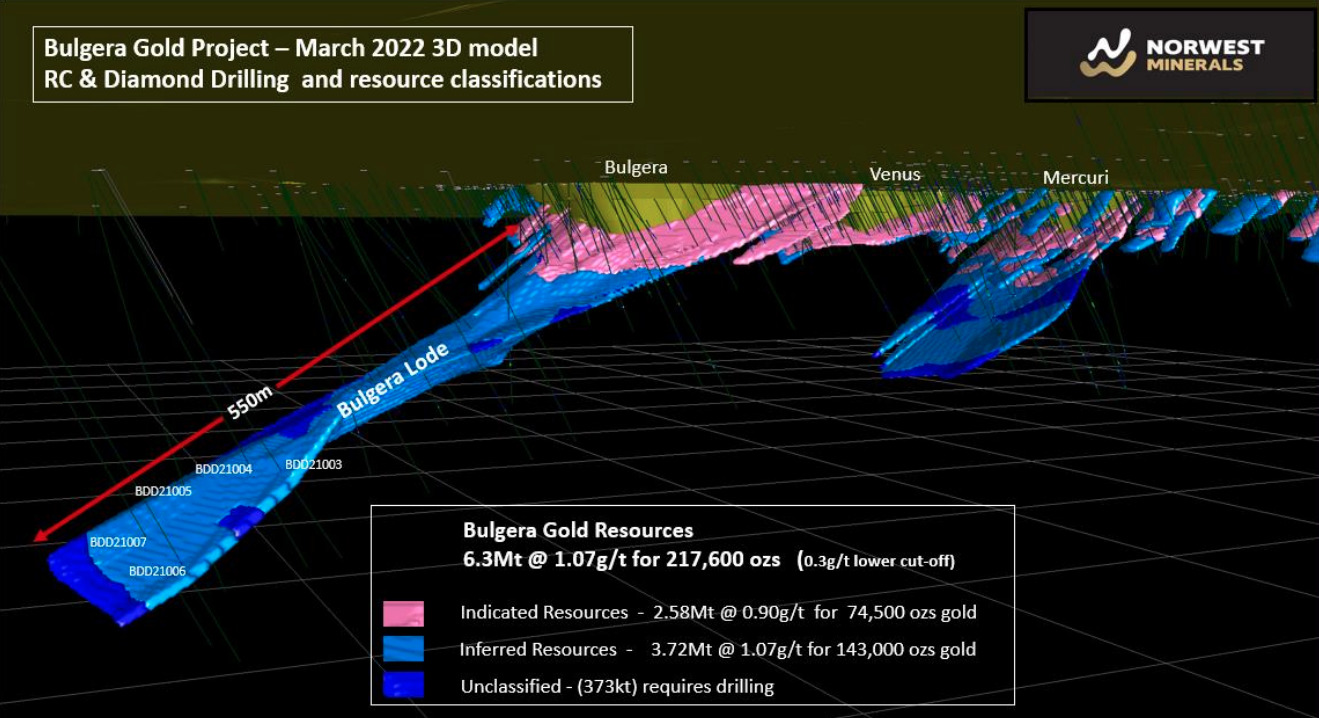

- Norwest Minerals upgrades its Bulgera gold resource after lowering cut-off grade to 0.3g/t due to high gold price

- Further upgrades expected through drilling near-surface mineralisation and gold lodes below the shallow open pits

- Waste dumps also being investigated for their potential to host economic gold at current prices

Special Report: High gold prices have allowed Norwest Minerals to upgrade resources at its Bulgera project in WA’s Eastern Gascoyne region to 217,600oz by simply lowering the cut-off grade from 0.6g/t to 0.3g/t.

Gold has been the darling of the resource industry with uncertainty about inflation, the economic and geopolitical turmoil sending the precious metal up ~16.5% over the year to date to US$2,382.80/oz.

When combined with the Australian dollar weakening against the US dollar, it makes for sky high Australian gold prices of about ~$3,700/oz.

The implication of this high gold price is that it makes previously uneconomic resources economic, which is also why Norwest Minerals (ASX:NWM) has moved to halve the Bulgera cut-off grade.

Bulgera sits within the 7Moz Plutonic Well greenstone that also hosts Catalyst Metals’ (ASX:CYL) Plutonic gold mine and +1Moz Marymia deposit, which places an operating processing plant just down the road from Norwest Minerals.

Adding further interest, Goldman Sachs has flagged the potential for gold to trade even higher across 2024, setting a target price of US$2,700/oz by the end of the year.

Potential for growth

Besides increasing resources by lowering the gold cut-off grade, NWM also believes it can deliver significant increases to the Bulgera gold inventory through drill testing both the near-surface mineralisation and gold lodes extending below the shallow open pits.

The company added that it is investigating the economic potential of the project’s oxide waste dumps after a new aerial survey confirmed they exceed 2Mt while historical records suggest they host economic gold at current prices.

It has submitted a Program of Works to WA’s Department of Energy, Mines, Industry Regulation and Safety to drill test the waste material using a slim-line, truck mounted reverse circulation rig.

“The rising gold price is rapidly improving the Bulgera project economics with the company reviewing all options to exploit this expanding gold asset,” Norwest Minerals CEO Charles Schaus said.

“In the meantime, Norwest will continue near-mine definition work to increase our gold inventory via the drilling of near surface oxide targets and down-dip of the many prospective gold structures identified by recent and historical exploration efforts.”

This article was developed in collaboration with Norwest Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.