Sneak peek: These DSO iron ore juniors are putting themselves in the shop window

Picture: Getty Images

Iron ore explorers have had some big successes in proving up deposits over the years – usually catching the eyes of nearby operations for major paydays.

BHP (ASX:BHP), Hancock Prospecting, Fortescue Metals (ASX:FMG) and Chinese investors have all snapped up iron ore discoveries across WA over the years and there’s nothing to signal that changing lately.

For instance, Red Hill Minerals (ASX:RHI) sold its 40% interest in the Red Hill Iron Ore JV to emerging major MinRes (ASX:MIN) for $200m, a figure which recently doubled to $400m after the latter shipped first ore out of Ashburton last month.

Another example is Mark Creasy-backed CZR Resources’ (ASX:CZR) proposed sale of the 33Mt Robe Mesa iron ore deposit to a Chinese investor for $102m cash – a ~60% premium to the market cap.

The sale has been approved by shareholders, although it’s yet to clear FIRB and Chinese outbound investment approvals.

However, the $20m sale to a linked entity of Strike Resources (ASX:SRK) at the nearby Paulsens East project, which was meant to share port infrastructure in Ashburton with CZR, suggests it’s still on the cards.

If it goes through, the cash sale is around 60% higher than CZR’s current market cap and probably puts dividends on the table.

As is often the trend, Equinox Resources (ASX:EQN) could very likely follow in the footsteps of these juniors with its Hamersley DSO iron ore project.

DSO and quick production pathways

DSO (direct shipping ore) projects offer a clear value proposition for those engaged with small to mid-caps.

The straightforward cost analysis of DSO iron ore is attractive as its simplicity translates to a shorter time between the mine and steel mills across the world, appealing to producers and end-users alike.

That’s ‘cos the deposits require nothing other than the basic mechanical processes of crushing and screening ore to prepare it for export – no complicated and higher-cost beneficiation or treatment necessary.

Hamersley to crush it for Equinox

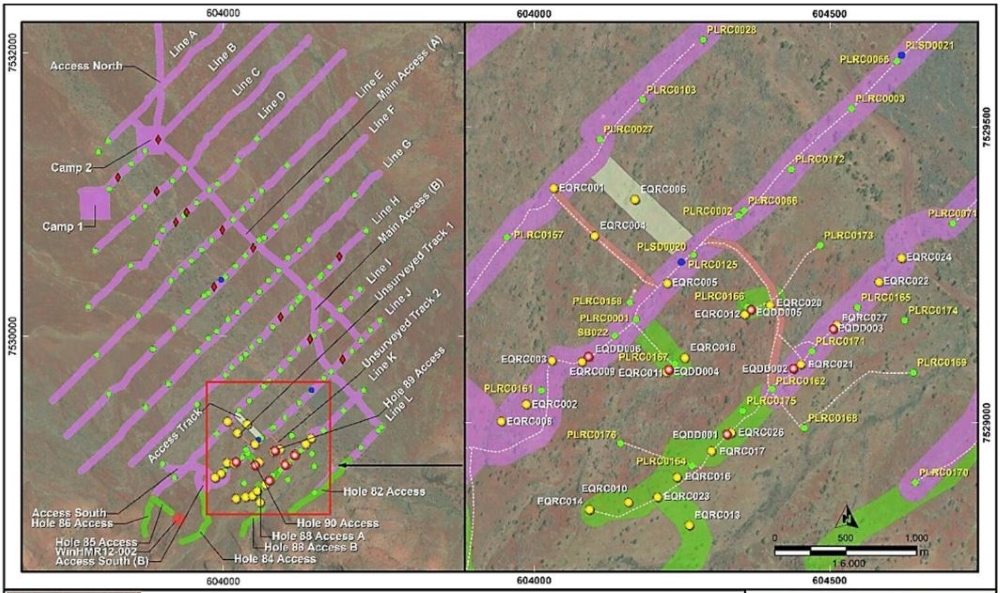

Coming earlier this month at an upgraded 108.5Mt @ 58% Fe, the Hamersley hematite DSO iron ore project is comparable in grade to other Pilbara products such as the Robe River fines, FMG Blend fines and Super Specials fines which are widely traded under the Platts 58% Fines Index.

The size of it makes it one of Australia’s largest undeveloped hematite resources owned by an ASX junior and the deposit sits just ~30km south of FMG’s Solomon Mining Hub, which produces ~65-70mtpa @ 56.9% Fe.

It also sits on a mining lease with a native title agreement in place and “could be rapidly developed against the backdrop of a high iron ore price environment”, EQN says.

Hamersley’s DSO ore starts just 20m below surface and has been delineated over a 2.5km x 1.5km area with open-pit mining prospectivity to the south to boot.

Metallurgical test work also shows that, through post-screening and scrubbing, the iron grades overall can increase to ~60-62% Fe, which would attract a price premium, supported by recent standout drill hole PLRC0167, which ended in mineralisation of 61.6% Fe.

Although impressed with the latest results, EQN isn’t quite satisfied just yet and is looking at a phased approach to improve the confidence and expand the current resource base, with infill drilling and a 27-hole RC drill campaign to explore southward on the cards.

“Our Phase 1 drilling program for the second half of CY2024 is set to unlock this higher-grade region, further enhancing the resource volume and grade,” EQN MD Zac Komur says.

“These efforts will pave the way for a comprehensive scoping study.”

Guinea’s iron ore for Guineas

Could history repeat itself in Africa’s potential Pilbara 2.0?

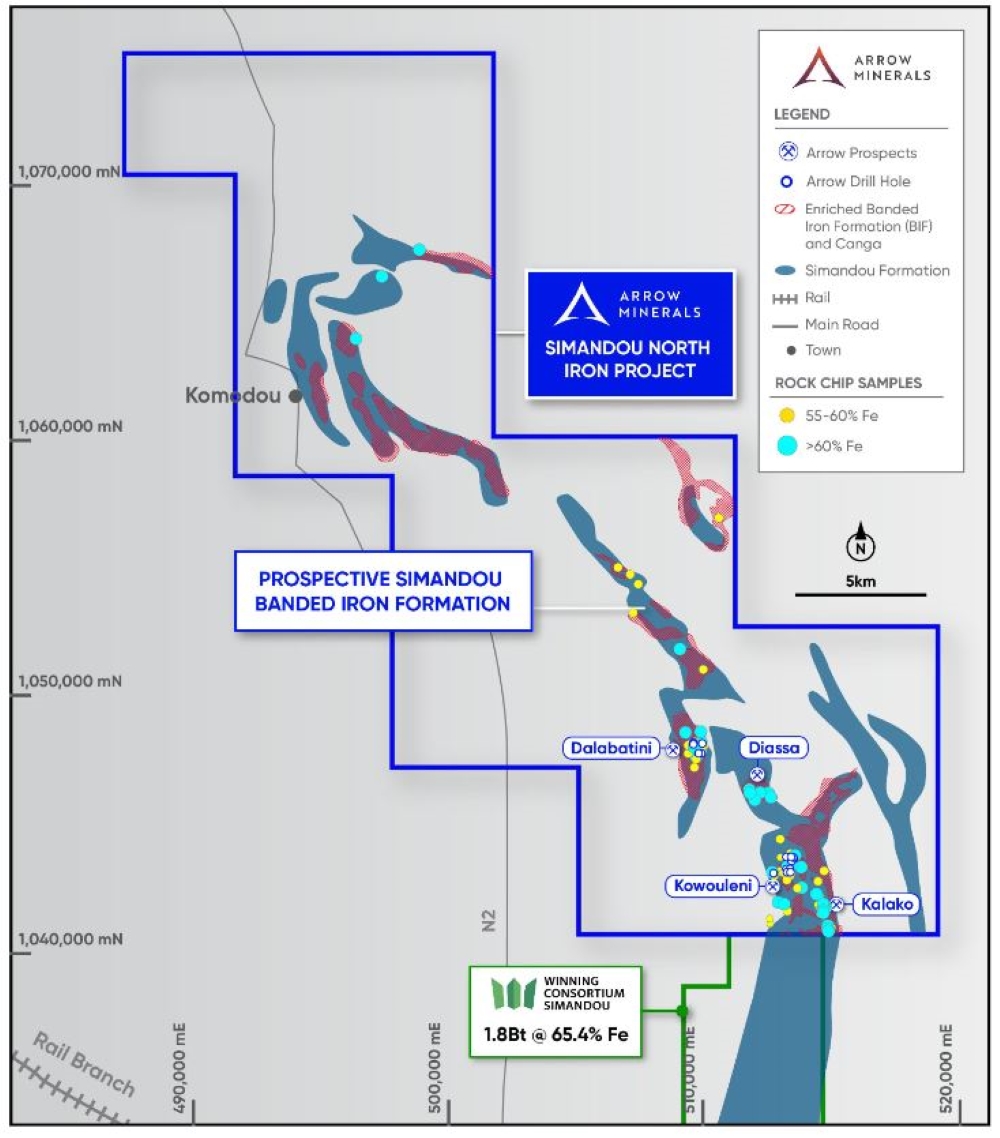

David Flanagan – who is no stranger to iron ore after leading the charge for Atlas Iron in the 2000s – has returned to the bulk commodity with Arrow Minerals (ASX:AMD), looking to prove up the Simandou North project in Guinea.

Flanagan feels there’s another Pilbara in West Africa – specifically with nearology to the multi-billion dollar, 4.6Bt @ >65% Fe Simandou project being developed by Rio Tinto (ASX:RIO) and a host of Chinese JV partners.

An eye-whopping $US27bn in infrastructure is being constructed, including a dual-track railway line connecting pit to port. Over its mine life, Simandou, even at conservative prices, could be worth trillions.

For AMD, it’s all about the surroundings that have been vastly underexplored due to price volatility and historical political instability, kicking off drilling in the hopes of adding Simandou North as an early actor into what could become a significant iron ore district.

5069m has been completed across a 15km campaign that is on track to be completed next month.

About 40km strike of the highly prospective Simandou banded iron formation, has been mapped on the Arrow tenure and six rigs are on site testing DSO targets.

Jumping east across to Madagascar and ASX junior AKORA Resources (ASX:AKO) has its own DSO iron ore deposit to contend with over in Madagascar, where it’s just increased the Bekisopa project’s MRE by 42% to 7.9Mt @ 58.8% Fe.

The results will be incorporated into planned updated scoping and preliminary feasibility studies along the identified 7km-long strike length.

“The increase in shallow DSO tonnage from Bekisopa is expected to increase the Stage 1 mine life of our planned at-surface DSO mine and further improve project economics,” AKO MD Paul Bibby says.

At Stockhead we tell it like is is. While Equinox Resources is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.