Silver price hits multi-year highs as it works to get out of gold’s shadow

Demand for physical silver has touched record levels says Perth Mint: Getty Images

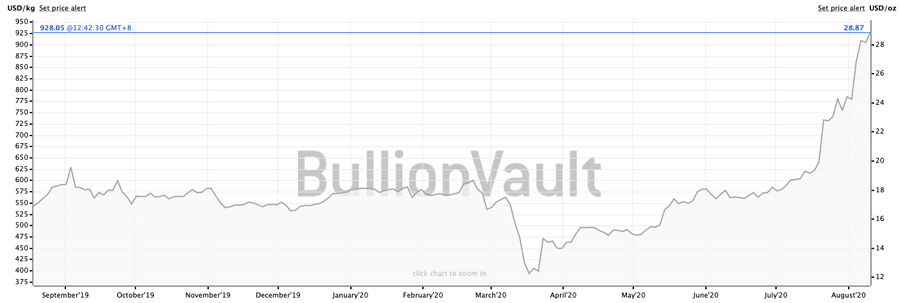

Silver prices hit a seven-year high of $US29/oz ($40.32/oz) this week, as investors rediscover its safe haven status as a hedge against the current economic storm.

The last time silver reached these levels was back in February 2013.

Demand for physical silver is running hot as latest figures from the Perth Mint show.

The bullion seller shipped 1.56 million ounces of the precious metal to customers in July, similar to June’s sales of 1.57 million ounces, but up from around 1 million ounces in May.

“The extraordinary investor appetite for silver coins has been reflected in record sales of our iconic Australian Kangaroo 1-ounce silver bullion coin, with more than 10.7 million sold in the past financial year,” the Perth Mint said in its Bullion Blog.

Last year’s sales volume represented roughly one-third of the 35 million Australian Kangaroo coins sold since the bullion product was launched in 2015.

Silver cheap compared to gold

The list of price drivers for silver keeps getting longer and runs from ongoing China-US tensions, US dollar currency weakness and worrying economic news from the US, while the COVID-19 pandemic is a relatively new bullish factor for silver.

Perth Mint’s manager for listed products and investment research, Jordan Eliseo, said investors were attracted to silver for several reasons.

“The first of those is momentum, with the price almost doubling from the lows seen in mid-to-late March. The second reason is that silver is historically cheap relative to gold,” he said.

Analysts point to the current gold to silver ratio of 70:1, meaning 1 ounce of gold can buy 70 ounces of silver, as an indication of the market’s direction.

At silver’s price peak of $US46.50/oz in March 2011, it took 35 silver ounces to buy one ounce of gold, a ratio of only 35:1.

Higher silver prices feed into ASX share prices

Share prices for silver companies listed on the ASX have been swept along by the precious metal’s roller-coaster ride.

Investigator Resources’ (ASX:IVR) Paris project in South Australia is the country’s highest-grade undeveloped primary silver project with 42 million ounces of contained silver.

Silver prices have sailed past the $28/oz ($US20/oz) mark needed to give the project the green light, as the company indicated last year.

Investigator’s share price was close to a four-year high Tuesday at 5.9c, up 168 per cent since the start of this year.

Silver Mines’ (ASX:SVL) share price was also not far off its four-year high of 26c on Tuesday. Since early March the company has rocketed nearly 300 per cent.

The company’s Bowdens project in NSW — with a mineral resource of 275 million ounces of silver equivalent — is one of the largest undeveloped silver projects in the world.

The company has plans for an open-cut mine feeding a new processing plant with a capacity of 2 million tonnes per annum to produce two concentrates products for off-site smelting.

Silver Mines said in is June-quarter report that life of mine production is planned to be about 66 million ounces of silver, 130,000 tonnes of zinc and 95,000 tonnes of lead.

Equus Mining (ASX:EQE) told the market last week it would restart drilling at its Cerro Bayo project in Chile to target high-grade silver along-strike from silver-grade intercepts at its Droughtmaster prospect.

Previous owner Coeur Mining produced 2.58 million tonnes at 4.2 grams per tonne (g/t) gold and 346.7g/t silver for 348,424 ounces of gold and 28.7 million ounces of silver.

Equus’ share price has surged 425 per cent since the market rout in March.

Rising silver price adds to project value

Mithril Resources (ASX:MTH) has started exploration drilling at its Mexico silver and gold project, Copalquin, and is awaiting assay results due at the end of the month.

“We are very happy to see both gold and silver prices increasing since Copalquin is both a gold and silver mining district,” CEO John Skeet told Stockhead.

“The proportionally higher silver price, however, significantly adds to the potential value of the project.”

Mithril’s share price is up a massive 620 per cent since March.

Another company with silver in its portfolio that is enjoying price gains since March is Pacifico Minerals (ASX:PMY), which is up 170 per cent to 2.7c.

The company is carrying out a prefeasiblity study for its Sorby Hills project in WA that has a contained silver resource of 54.8 million ounces.

Manuka Resources (ASX:MKR), meanwhile, is 88 per cent higher since listing in July. It is sitting just below 50c.

The company’s Wonawinta silver project hosts a 52-million-ounce JORC-compliant resource grading 42g/t silver, and is expected to be in production within the next nine to 12 months.

Manuka also owns the Mt Boppy gold mine in the Cobar Basin in NSW’s Lachlan Fold Belt that started production in April, and is targeting 32,000oz/year of gold production.

EQE, IVR, MKR, MTH, PMY and SVL share price charts

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.