Signed, sealed, delivered: Maximus completes first phase of exploration under KOMIR lithium joint venture

Maximus Resources has wrapped up first phase exploration under the KOMIR lithium joint venture. Pic via Getty Images

- Maximus Resources completes ~3,200m RC drilling and soil sampling at Lefroy lithium JV in WA

- First phase of exploration under US$3m Korea Mine Rehabilitation and Mineral Resources Corporation joint venture

- Drilling intersected Continuous lithium mineralisation across ~600m x ~400m area

- Follow-up deeper and infill drilling is planned for next year

Special Report: Maximus Resources has completed the first phase of exploration under its US$3m Lefroy lithium project joint venture with the the Korea Mine Rehabilitation and Mineral Resources Corporation (KOMIR), reporting high-grade intersections of up to 1.72% Li2O.

KOMIR is a Korean Government agency responsible for their national resource security, including developing overseas mining and processing capacity to supply the Korean market.

The company also has a separate MOU with global battery manufacturer LG Energy Solution, providing an option to acquire KOMIR’s 30% interest, and the right to negotiate the purchase of up to 70% of the project’s future lithium product.

The Lefroy project is in WA’s Eastern Goldfields “lithium corridor”, about 20km south of Mineral Resources’ (ASX:MIN) Mt Marion lithium mine.

Last month, Maximus Resources (ASX:MXR) confirmed spodumene in a high-grade intersection at the Kandui prospect of 6m at 1.11% Li2O including 3m at 1.99% Li2O from 91m.

Now the company has now completed a ~3,200m Reverse Circulation (RC) drill program and tenement wide soil geochemistry sampling.

Up to 1.72% Li2O intersected

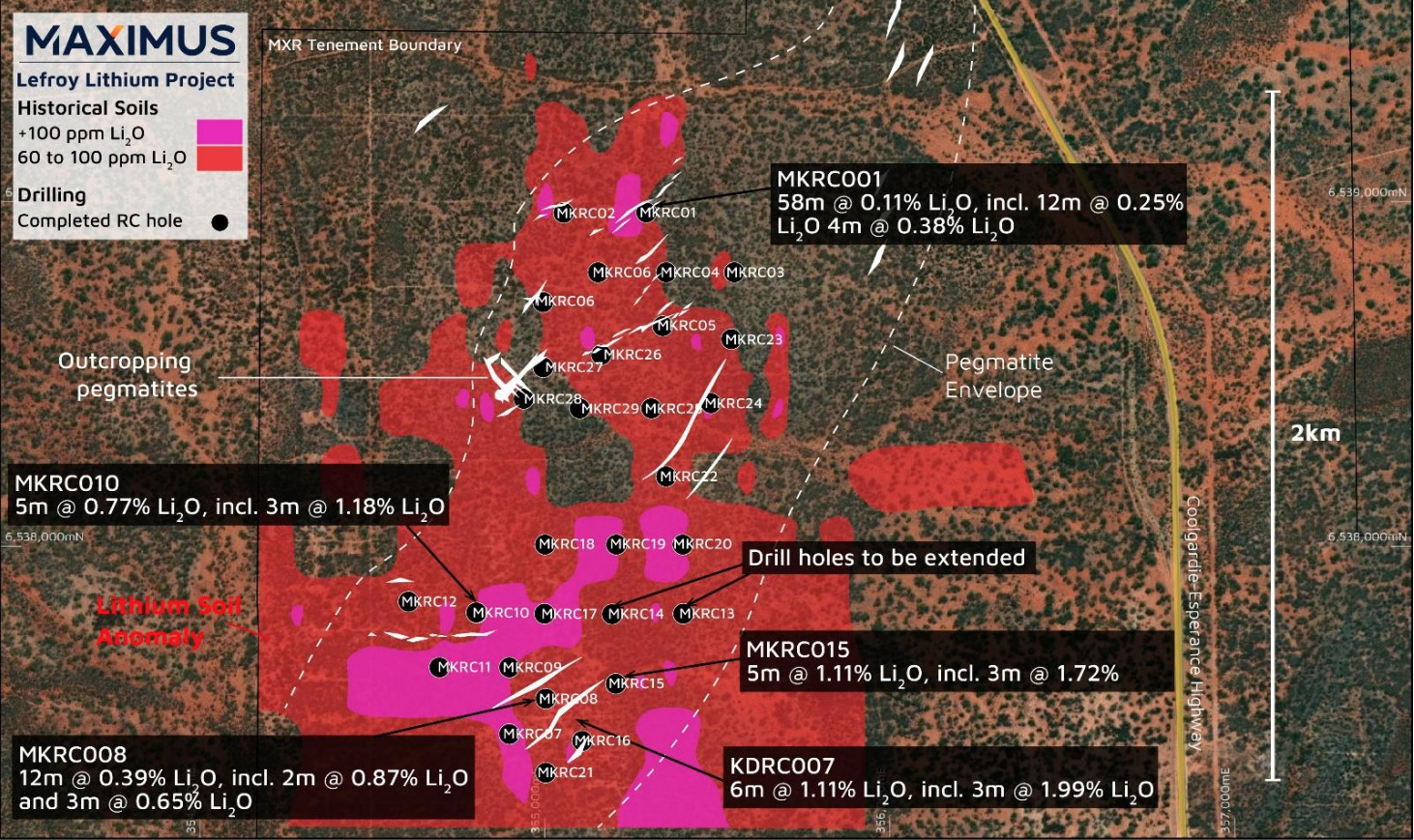

The first phase RC drilling program was designed as a preliminary test of an extensive ~2x1km lithium soil anomaly and to step out from recently identified spodumene-bearing pegmatites at the Kandui prospect.

A total of 23 of the 30 holes intersected fertile LCT pegmatites with strong fractionation, up to 18m thick. Results include:

- 5m at 1.11% Li2O from 111m, including 3m at 1.72% Li2O from 111m (MKRC015);

- 5m at 0.77% Li2O from 59m, including 3m at 1.18% Li2O from 59m (MKRC010);

- 12m at 0.39% Li2O from 78m, including 2m at 0.87% Li2O from 78m and 3m at 0.65% Li2O from 83m (MKRC008); and

- 58m at 0.11% Li2O from 46m, including 12m at 0.25% Li2O from 66m and including 4m at 0.38 % Li2O from 58m (MKRC001).

In addition, supplementary XRD mineralogy analysis has confirmed high spodumene content of up to 22%.

“The company has moved quickly in completing the first phase of the Lithium exploration program, which was designed to evaluate several outcropping pegmatites within a large ~2km x ~1km lithium soil anomaly,” MXR managing director Tim Wither said.

“This first drill program has been a successful start, supporting our geological interpretations of a sequence of stacked pegmatites, aligning to lithium in soil anomalies and importantly providing great direction for follow-up drill programs.”

Follow-up drilling planned in 2024

Initial assay results from the tenement-wide soil sampling are anticipated in 2-3 weeks, and along with soil geochemistry mapping, they’re likely to deliver additional drill targets for follow-up deeper and infill drilling early next year.

“The completion of the first pass drill program only covers a small area of the greater Lefroy area, and demonstrates the outstanding lithium potential, with prime geology in WA’s Eastern Goldfields,” Wither said.

“The company has also completed the fieldwork component of the tenement-wide soil geochemistry program, which is expected to deliver additional drill targets.

“Both the soil geochemistry mapping and the first-phase drill program are utilising the non-refundable deposit from KOMIR, with the larger program to commence in early 2024.”

Wither said the shallow first pass has already highlighted consistent lithium grades across a large ~600x400m area with multiple intersected pegmatites, which remain open down dip and untested at depths greater than ~100m.

“The next phase of drilling is expected to commence in early 2024 and will focus on extension and testing at depth,” he said.

The company also expects to receive approval from the Australian Foreign Investment Review Board (FIRB) during the March Quarter, which will enable the commencement of larger drill programs.

This article was developed in collaboration with Maximus Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.