Shares in copper explorer White Cliff Minerals rocket after explorer achieves monster 175m red metal hit

WCN is well positioned to target potential open pit mining amid the context of global copper supply constraints. Pic: Getty Images.

- WCN reports up to 4.46% copper at its Rae project in Canada

- Drillhole shows potential to expand historic non-compliant resource

- Data will inform a maiden resource estimate with more assays pending

Special Report: White Cliff Minerals says assays from RC drilling have flagged a globally significant copper intersection of up to 4.46% at its Rae copper project in Canada.

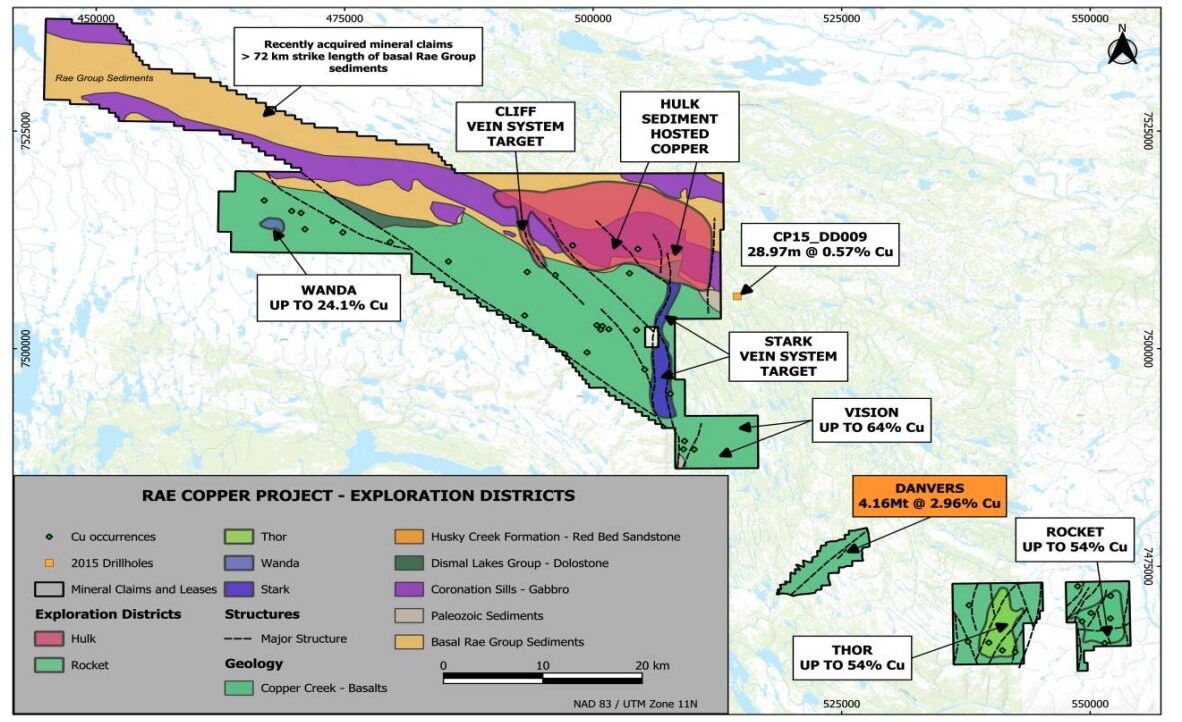

The Rae project is home to numerous historical non-JORC and ‘blue sky’ mineral estimates, as well as up to 64.02% copper from rock chip assays indicating widespread outcropping copper throughout the 805km2 licenced area.

It represents a district-scale opportunity at the pre-discovery stage, underpinned by the presence of high-grade volcanic-hosted copper-silver lodes and the prospect of a large tonnage sedimentary hosted copper deposit.

These assay results have confirmed and validated the company’s strategy to explore previously untested high-grade zones and vertical depth extension of mineralisation at the Danvers deposit.

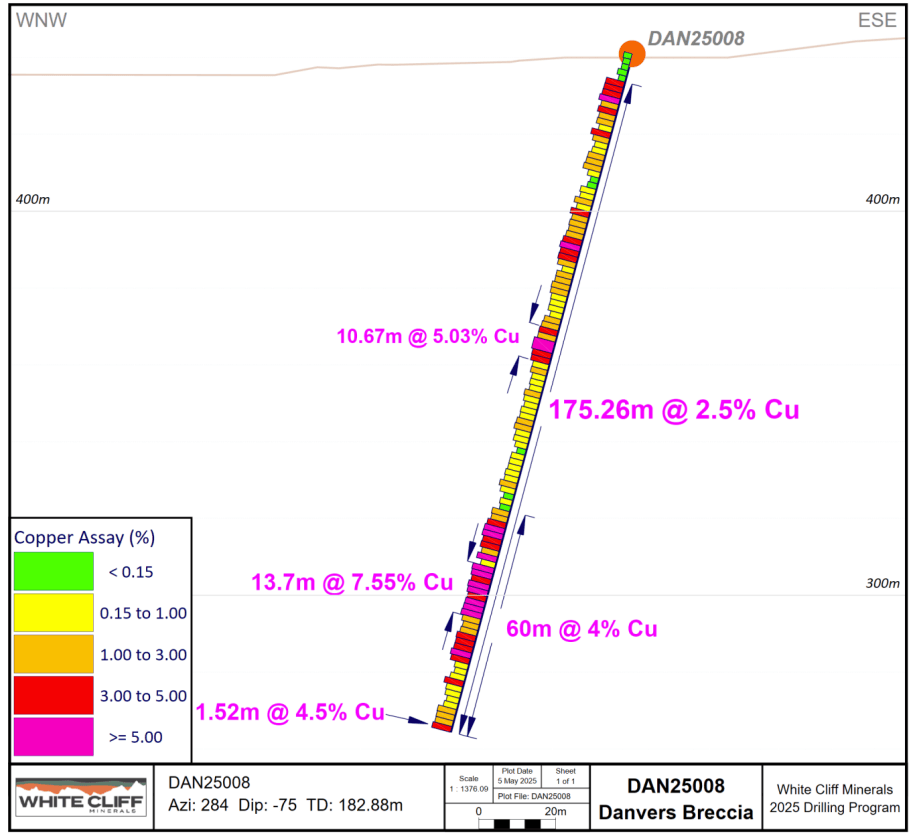

Highlights from hole DAN25008 include:

- 175m at 2.5% copper and 8.66g/t silver from 7.6m, including 14m at 7.55% copper and 25.8g/t silver from 138m

- the last 60m of the hole averaged 3.9% copper and 14.96g/t silver to final depth of 182.88m

- the hole ended in mineralisation with the last 1.5m sample recording 4.46% copper and 11.58g/t silver, open at depth

Hole DAN25001 returned 52m at 1.16% copper and 3.43g/t silver from surface, including 7.6m at 3% copper and 9.5g/t silver from 18.28m.

White Cliff Minerals (ASX:WCN) says the drilling demonstrates the potential for significant expansion to the historic non-compliant resource, with the data to feed into a maiden JORC compliant mineral resource.

Perfect time for a Canadian copper find

Copper futures in the US climbed to $4.90 per pound late last month, marking a 20% rise since April 9 when the US halted a series of reciprocal tariffs.

The copper market is on course for long-term supply shortfalls as major new discoveries dry up and soaring demand from electrification and urbanisation shows no signs of slowing.

That puts a premium on any new discoveries made by companies like White Cliff in the prospective Nunavut region.

“We believe this drill hole [DAN25008] ranks among the most significant copper intersections globally within the last 50 years and comfortably sits within the top 10 globally reported ‘grade-metre’ copper results,” WCN managing director Troy Whittaker said.

“With our work updating the geological understanding at Danvers, we adapted our drill targets and DAN25008 resulted in mineralisation at least 30 metres below historical limits, with the hole terminating in high-grade copper mineralisation – suggesting considerable additional potential at depth.

“The increase in grade toward the bottom of the hole is encouraging and is validation of our methodology.

“To illustrate the magnitude of this result, the DAN25001 intercept of 52m at 1.2% copper – a strong result in its own right – now appears modest when viewed alongside the 175m at 2.5% copper from DAN25008.

“In the context of global copper supply constraints, the company is well positioned to leverage these results with mineralisation from surface, supporting potential open pit mining activities and an open water port less than 80km from the deposit.”

Follow up diamond drilling is now being planned to drill out the mineralisation boundaries at Danvers, while the next five assays along strike from DAN25008 are due in the coming weeks.

This article was developed in collaboration with White Cliff Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.