A disgruntled shareholder has so far cost Indiana more than $300,000

Pic: John W Banagan / Stone via Getty Images

A disgruntled shareholder’s bid to gain control of gold and nickel explorer Indiana Resources has cost the company more than $300,000 so far — and other shareholders are not happy.

“I’ve got a number of shareholders who are very annoyed with what’s been going on and the actions of one particular shareholder,” chairperson Bronwyn Barnes told Stockhead.

“When you put that in context of what Indiana’s current cash balance is, it’s a huge part of our money.”

Tanzania-focused Indiana had $650,000 in the bank at the end of the September quarter.

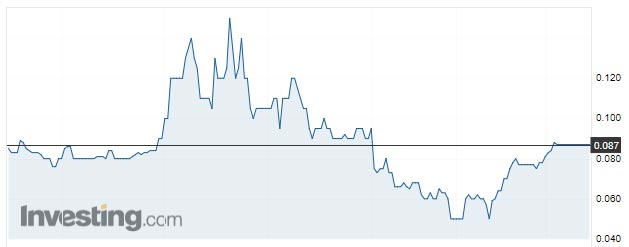

Indiana’s (ASX:IDA) share price has come off a high of 15c in March, hitting a low of 5c in September before recovering some ground to trade at around 8.7c.

In February, shareholder BPM Capital demanded the company call a meeting to vote on the removal of Campbell Baird and Derek Fisher as directors and the election of Brett Montgomery and Heidi Brown as directors in their place.

The move followed a failed deal with Josef el Raghy, who is the chairman of UK-headquartered gold producer Centamin.

Indiana sought the help of the Australian Government’s Takeovers Panel over concerns that BPM, Mr Montgomery, Ms Brown and Mr el Raghy were associated parties and had breached the 20 per cent shareholding limit imposed under the Corporations Act.

The panel determined that the associated parties had breached the Act and were colluding to try and take control of Indiana. BPM subsequently dropped its call for a meeting to vote the two directors out.

Mr el Raghy was unavailable for comment.

Wasted time

Ms Barnes told shareholders at Indiana’s AGM last week that the action had resulted in significant management and director time being dedicated to matters that created no value for shareholders.

Over 40 per cent of shareholders voted against Ms Barnes’ re-election as chair and around 20 per cent voted against the re-election of Dr Fisher as a director at the November 23 AGM.

Indiana has gold and nickel projects in Tanzania, where work is on hold after the Tanzanian Government made major changes to its mining legislation that created uncertainty for resources companies active in the region.

The company is focused on progressing activities in Tanzania, but is also considering new acquisitions as well as a potential joint venture partnership or sale of its Ntaka Hill nickel project.

“I think Indiana has been pretty clear to the market in other releases that we have understood the situation in Tanzania,” Ms Barnes said.

“We’ve determined that we’re not going to continue to spend money on projects there in the short term, notwithstanding we believe those projects are of quality.

“We have previously said to the market that we would look at monetising Ntaka Hill and we’ve also said that we would consider the acquisition of new projects.

‘Not as constructive as we would have liked’

“Now the company is undertaking a very active process in regards to the acquisition of new projects, and we had been seeking to work collaboratively with Josef and BPM on that process and it has not been as constructive as we would have liked.”

Ms Barnes said a number of shareholders are onboard with Indiana keeping hold of its assets in Tanzania until the situation is better understood.

“We have a number of shareholders who really appreciate the nickel asset that we have in Tanzania,” she told Stockhead.

“We do recognise this is a rising nickel market and it’s a quality asset. So there’s a number of people who are very happy for me to sit there and maintain the asset until we have greater clarity around the operating environment in Tanzania with the government moving forwards.

“Likewise with our gold project, we had managed to raise money on the back of those gold projects to explore them.”

Indiana is “encouraged” by the recent appointment of Angellah Kairuki as the new minister of minerals in Tanzania.

Minister Kairuki appears to be more amenable to working with resources companies to advance Tanzania’s mining sector.

“The new minister has stated that her immediate priority is to improve relations with investors and to restore investor confidence, while ensuring that the mining sector meaningfully contributes to Tanzania’s economic growth,” Ms Barnes told shareholders last week.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.