Share price surge for Fenix on promising drilling results

Pic: John W Banagan / Stone via Getty Images

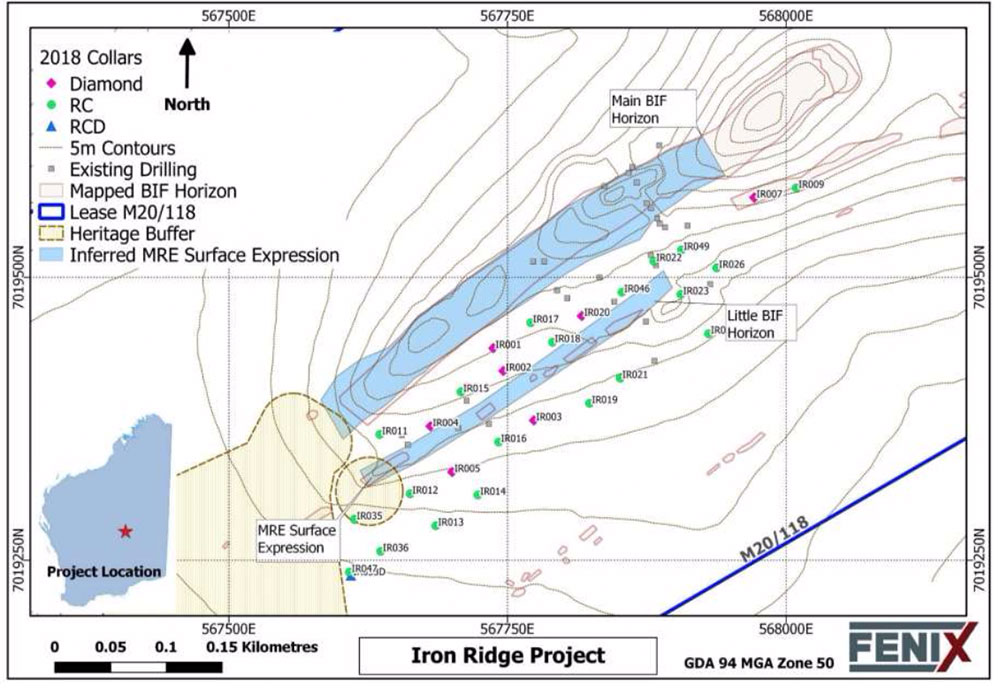

Special Report: Fenix is feeling the love following the release of its initial results as it works to firm up confidence in its high-grade Iron Ridge project resource in Western Australia.

The Fenix (ASX:FEX) share price jumped 25 per cent on Thursday after the explorer unveiled eye-catching grades at Iron Ridge.

In the centre of the inferred resource, another hole hit a wide, high-grade intercept of 58m grading 66.7 per cent, 84m from the surface.

A hole about 40m from of the Inferred Mineral Resource Block Model intersected 46 metres grading 66.3 per cent iron ore, 206m from surface.

Importantly, this intercept is about 100m below the current inferred mineral resource — confirming the presence of high grades from near-surface to >200m.

Fenix’s goal is to increase the resource to 6 to 10 million tonnes whilst maintaining a grade above the 62 per cent Fe level that is the current benchmark for iron ore.

The company has a competitive advantage with the strong potential to produce high-grade fines and lump products – which attract big dollars and is something majors BHP (ASX:BHP) and Rio Tinto (ASX:RIO) are struggling to produce.

The price gap between low-grade and high-grade iron ore is widening as Chinese steelmakers increasingly favour higher grade feedstocks to boost mill productivity and meet more stringent pollution control measures.

There is also a significant premium for lump product, which has recently exceeded the premium for 65% Fe fines.

Fenix also aims to increase the confidence of the resource by shifting tonnes into the “indicated” category.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

Fenix told investors that metallurgical test work was due to start on drilling core samples in the coming weeks to establish potential “value accretive factors”, such as the lump-to-fines ratio and levels of deleterious (or unwanted) elements.

Lump ore attracts premium pricing because it can be loaded straight into blast furnaces and is also easier to handle during transport and shipping.

Iron ore growth outlook looks solid

The global iron ore industry starts 2019 in surprisingly good shape and the outlook is solid, Wood Mackenzie analysts say.

“Despite all the rhetoric over a China hard landing, escalating trade tensions, and a steel profitability squeeze, iron ore prices are holding comfortably above $US70 per tonne [62 per cent product] with little if any evidence of margin compression,” according to a January outlook.

“With China still growing and India on the rise, global growth in seaborne trade of at least 30 million tonnes should be achievable this year, supporting prices for 62 per cent iron ore fines at between $US65 and $US70/t.”

The product grades Fenix is aiming for — 65 per cent — currently sell for a premium price of about $US89/ tonne, whereas 62.5% Fe lump is currently attracting a price of US$100/tonne.

Subscribe to our daily newsletter

- Bookmark this link forsmall cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Fenix Resources is a Stockhead advertiser.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.