Sell Shovels: Why a gold rush beckons for ASX 200 mining contractor Perenti

Perenti capped a massive year with ASX 200 inclusion. Is the best still to come? Pic: PRN/Supplied

- Perenti has ridden the gold-led mining revival all the way into the ASX 200

- CFO Mike Ellis says the mining services provider can keep pursuing organic growth

- North America emerging as new growth engine for Aussie mining and drilling contractor

The common refrain – in a gold rush, sell shovels.

If that’s the case then there are few sectors positioned better than the Aussie mining services space.

Even after a mazy run for contractors – which has seen many make up big deficits against their book value in recent years – optimism remains as mining services stocks, beefed up from a wave of consolidation, chase new work as record gold and copper prices inspire mine builds and expansions.

A poster-child of that renaissance, Perenti (ASX:PRN) has now seen off superstitions about the fortunes of founder-led companies that pass into corporate hands.

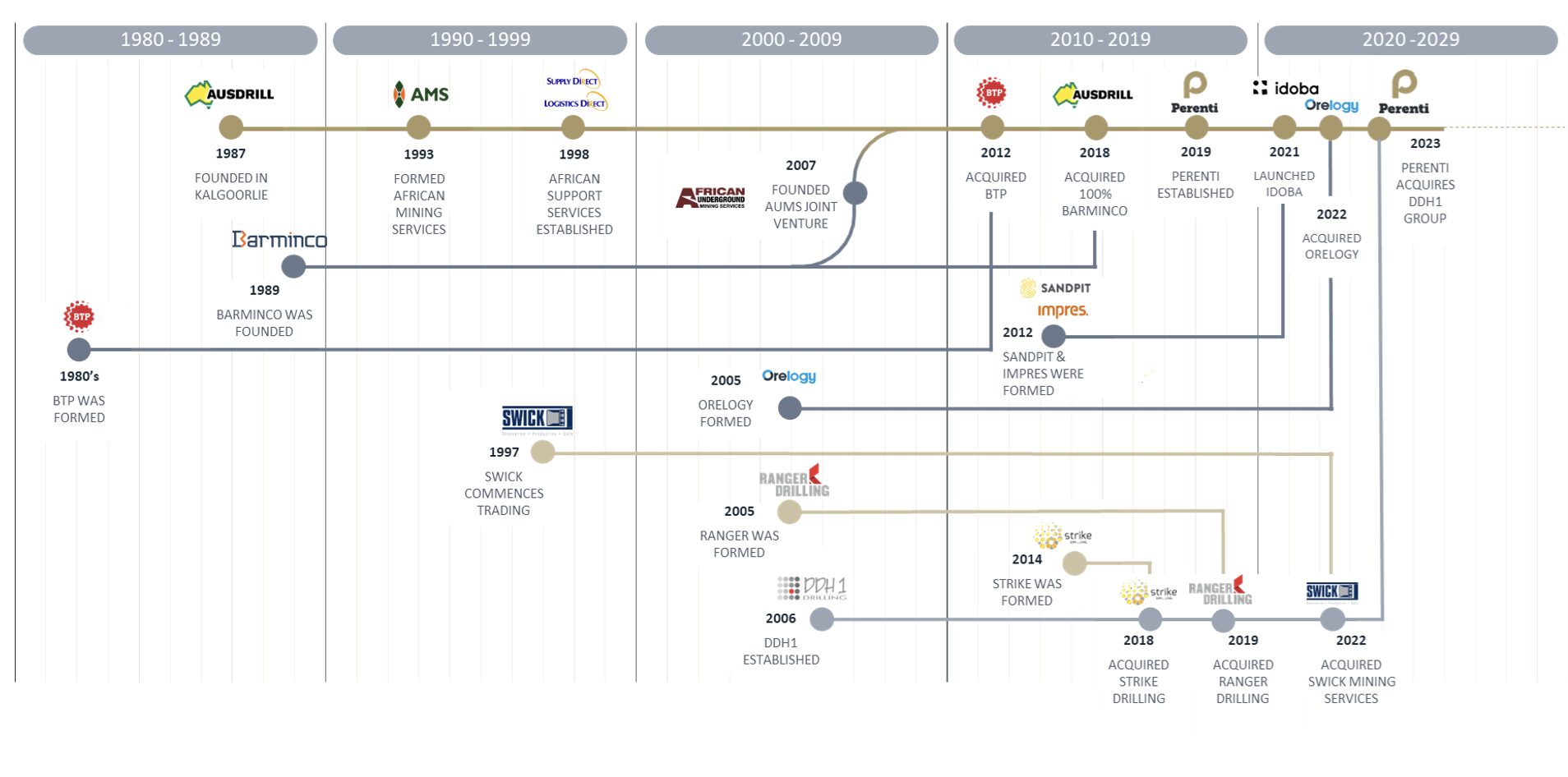

Perenti is really the legacy of three main companies, two of them informally intertwined for decades.

Driller Ausdrill and contract miner Barminco were formed years apart in the late 1980s by two Kalgoorlie school friends, the late Ron Sayers and Peter Bartlett.

Their long mooted merger finally formed the Perenti brand in 2018, before Australia’s top exploration driller DDH1, the brainchild of Murray Pollock and Matt Thurston, joined the fold in 2023.

Now, as the man who spearheaded the Perenti rebadge Mark Norwell plans to step down from his role as managing director, the firm has made a triumphant return to the ASX 200, with its shares close to a 12 year high.

The message is there remains plenty of opportunity to grow after the passive money has filtered through.

“We’ve been able to deliver consistent, reliable performance for four years. And we believe, even where we’re trading today, there’s further upside in the multiples if you compare us to others,” CFO and long-time finance executive Mike Ellis told Stockhead.

His comments come off a record year of free cash flow in FY2025, delivering close to $200m even before a $90m windfall on the sale of equipment from the end of a contract at the Khoemacau copper mine in Botswana is taken into account.

“The free cash flow is a really important part of that. If you normalise for the Zone 5 proceeds we delivered $195 million of proper free cash flow,” Ellis said.

“That includes a lot of growth capex and then the year before we also delivered a record $184 million off the top of that, and then the year before was a very healthy year as well.”

Transformation

FY25 was the first full year with the DDH1 drilling business inside the tent.

DDH1 and the Swick underground drilling business it swallowed a year before the Perenti merger have been significant additions to the stable.

Unlike many contractors, it means Perenti now has a service at every point of the mining cycle, building networks from the smallest junior explorers up to the largest mining companies in the world.

The other strategic pivot has been a ramp up in activity from contracts in the North American market.

A key win came in the form of the Goldrush project, a new underground development at Barrick and Newmont’s Nevada Gold Mines JV, the world’s largest single gold mining operation.

The deal, signed in February 2025, is not Perenti’s largest order at $120m over three years. But the underground development contract places the Aussie on a footing to bid for future work in the area.

That’s important given the emphasis the Trump Administration has placed on reviving domestic mining activity in the world’s most powerful nation, with major operations like South32’s (ASX:S32) Taylor zinc mine and Barrick’s hyped Fourmile discovery representing major future tenders.

“We recently won that contract with Barminco North America,” Ellis said.

“Swick had been doing work there, not currently, but historically they’ve done work there five or so years ago. So, when we came in, they said oh we know Swick, they did a very good job here many years ago.

“You get those natural connections. And the general managers have those contacts, which is very beneficial when you’re in that BD pipeline.

“It’s not something that we’re actively selling. Each client wants something different. We’re not trying to aggregate the brands together to sell that we’ve got a complete solution, but we can provide it.”

The focus on new work in North America and Australia balances out the Perenti order book, with the ‘tier-1’ markets providing around two-thirds of the company’s work and the rest in Africa, largely the continent’s gold rich western states.

“We’ve been operating in Africa for a long time and it’s an important part of our business,” Ellis said.

“We’ve been consciously diversifying, both within West Africa, so more projects in Southern Africa, but also diversifying within the globe and to build out that North American business.

“We are committed to Africa, West Africa. We have just signed another five years in Burkina Faso for Endeavour Mining at the Mana complex.

“We’ve been operating there for a long time, but we have been conscious of the amount of projects that we had concentrated whether it’s Ghana or Burkina Faso.

“I can see more growth coming from Australia and North America.”

Riding the cycles

Cyclicity is a fact of life for mining companies and contractors alike.

In its past life as Ausdrill, Perenti shares – $2.80 today – tumbled as low as 20c in early 2016 from boom time highs of $4.

But the last downturn, post-covid, was far less severe than other mining cycles – propped up by the emergence of battery metals and strong iron ore prices.

Now, gold prices are eclipsing record highs by bounding past US$4000/oz, with copper closing on US$11,000/oz. There are broader green shoots also across precious and base metals.

“It’s encouraging, we’re seeing more gold projects coming on and you can see that in the junior side,” Ellis said.

“More money (is) getting raised. Where we’re seeing more activity is drilling.

“So we do see in this environment it’s obviously a lot more favourable and the drilling environment can turn on very quickly because you don’t have the long lead times there.

“Our more exploration focused brands in DDH1 and Strike are seeing those improvements. That’s the real change for us, seeing that utilisation increase from where it was 18 months ago.”

Strong numbers

Perenti’s shares have run 150% higher over the past five years.

But the long term contracts across the firm’s core contract mining business have Ellis confident Perenti can continue to ride those cycles and sustainably pursue organic growth.

“The pipeline is very positive at the moment – we reported at the full year $17 billion,” Ellis said.

“(It’s) predominantly gold and copper, with a heavy skew into Australia and North America and still supporting and winning the right projects in Africa.

“There are very good fundamentals. Gold’s good, underground mining’s very positive. And with our 30-odd years of experience in underground mining, I think we’re very well placed to continue solid organic growth rates, which is exciting.

“It’s not about just growing. We’ve been very selective in the jobs that we go and secure, we’re of the size now that we don’t have to win every job and be aggressive in out tendering.

“It’s about delivering the right jobs for the right clients, in the right locations.”

The vital signs are good. Perenti delivered $3.5bn in revenue in FY25, up 4%, with EBITDA 4% higher at $668m and EBIT(A) up 6% to $333m.

Net profit after tax and amortisation was 8% higher at $178m before accounting for non-controlling interest.

Leverage, an important factor for the health of a contractor, sat at just 0.5x net debt to underlying EBITDA, down 37% YoY.

That enabled Perenti to issue a 4.25c final dividend, upping payouts from 6c in FY24 to 7.25c for the 2025 full year, with another $25m of shares purchased and cancelled in a buyback.

“This is the fourth year of delivering on or above guidance. And we’ve also seen our ability to generate sustainable free cash flow, which again has been able to reward our shareholders with dividends,” Ellis said.

“We turned our dividend back on, our dividend policy is 30-40% of underlying NPAT(A).

“That again shows you where the business has moved to over the last 24 months.“

For the year ahead, Perenti is guiding $3.45-3.65bn in revenue and EBIT(A) of $335-355m, with $340m in capex and more than $160m in free cash generation.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.