Score! Native Mineral’s initial fieldwork unearths high-grade lithium up to 2.77pc at McLaughlin Lake

Mining

Mining

Native Mineral Resources is off to a great start at its newly acquired McLaughlin Lake lithium project in Manitoba, Canada, after first pass field work uncovered high-grade samples up to 2.77% Li2O.

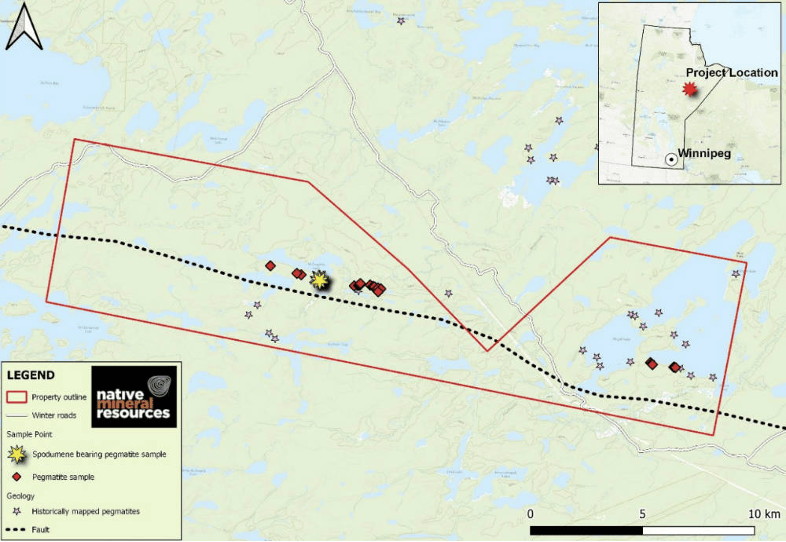

The 19,321-hectare McLaughlin Lake project is in the Archean-aged Superior Province of the Canadian Shield, which hosts some of the world’s most significant lithium resources in Quebec and Ontario, and the Tanco lithium mine in Manitoba.

Tanco has been mined for tantalum and caesium since the 1920’s and has a reserve of 7.3Mt grading 2.67% lithium.

Additionally, drilling at Vision Lithium’s Godslith property about 50km to the east of McLaughlin Lake has retuned results of up to 15.2m at 1.49% Li2O.

In mid-August, Native Mineral Resources (ASX:NMR) entered into an agreement to acquire 51% of McLaughlin Lake in Manitoba’s Oxford Lake region from New Age Metals (TSXV:NAM) for $200,000 in NMR shares, C$75,000 in cash and C$500,000 in exploration expenditure over 18 months.

Native Mineral Resources can increase this to 75% ownership by meeting three milestones that will see it pay a total of C$400,000 in cash, issue $1.2 million worth of NMR shares, spend a further C$500,000 on exploration, and define a minimum resource of 20Mt at 1.25% Li2O.

It’s a highly prospective, underexplored project featuring an east-west 30km long inferred shear zone contact has the potential for lithium bearing pegmatites to be associated with it.

While little historical exploration for lithium has been carried out at the project, previous mapping and sampling has identified numerous pegmatite outcrops with up to 15cm long spodumene crystals.

This includes the ‘Barry’ pegmatite dyke that outcrops for 400m and where historical channel sampling returned a 1.5m assay at 1.32% Li2O while grab sampling at a second dyke returned assays of 2.87% and 0.98% Li2O.

Sampling carried out as part of the initial field work – including geophysical surveying and mapping – at the project has returned two high-grade samples of 2.77% and 2.25% Li2O.

Notably, the 2.25% Li2O sample was returned from the 1.5m channel sample, confirming the repeatability of the known McLaughlin Lake assays.

Adding further support to the prospectivity of the project, sampling has also highlighted elevated levels of rubidium (averaging 468 parts per million), caesium (17ppm), tin (37ppm) and tantalum (32ppm).

Both rubidium and caesium are significant indicator minerals for lithium while tin and tantalum are commonly found with lithium deposits.

“NMR is delighted that our maiden field work program, albeit limited, has been able to confirm the presence of high-grade lithium at the McLaughlin Lake project in Canada,” managing director Blake Cannavo said.

“The stand-out takeaway for our team is the fact that the historic 1.5-metre channel sample of 1.77% Li2O from the “Barry” pegmatite dyke was replicated with a higher grade of 2.25% Li2O returned from our sampling.

“These impressive assays will form the foundation for our maiden drilling program at McLaughlin Lake, with our technical team currently advancing our planning and target generation work.

“This early-stage work has confirmed the presence of the spodumene-bearing dyke, and while not all samples reported spodumene, many of the samples did highlight anomalous grades for the indicator minerals.

“The large spread of indicator minerals across the entire area sampled significantly increases NMR’s confidence in the McLaughlin Lake pegmatite field and its potential to contain a high-quality lithium deposit.”

With these highly encouraging initial exploration results, the company is now expediting plans to start maiden drilling in the first quarter of 2024.

The initial focus of this planned drilling will be on the outcropping, high-grade lithium pegmatites that present clear targets on the basis of the initial work and results.

This article was developed in collaboration with Native Mineral Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.