Scoping study shows Antler copper project could be one of the lowest-cost mines globally

The results of the Scoping Study will be utilised to prepare applications for mine permits in the coming months. Pic: RyanJLane / E+ via Getty Images.

New World Resources’ scoping study for its Antler Copper project in Arizona has flagged a potential pathway to a low-impact, modest CAPEX, high-margin underground mining development.

The plan is to mine a total of 9.3Mt of material from an underground mining operation (7.3Mt of the 7.7Mt resource plus 2.0Mt mined through dilution) at a rate of 1.0Mtpa over an initial 10-year forecast operating life.

Project economics include:

- Pre-production capital expenditure of US$201m (including US$36.5m contingency);

- Revenue of approximately US$2.0bn (A$2.8bn);

- Net present value (NPV) of approximately US$524.9m (A$750m; pre-tax);

- Internal rate of return (IRR) of 42%; and

- Payback 29 months after the pre-production period.

One of the lowest-cost copper producers

New World Resources (ASX:NWC) MD and CEO Mike Haynes said if production is achieved this would make Antler one of the lowest-cost copper mines globally.

“This study provides an initial evaluation of a low-impact, high-margin operation, for a modest capital outlay,” he said.

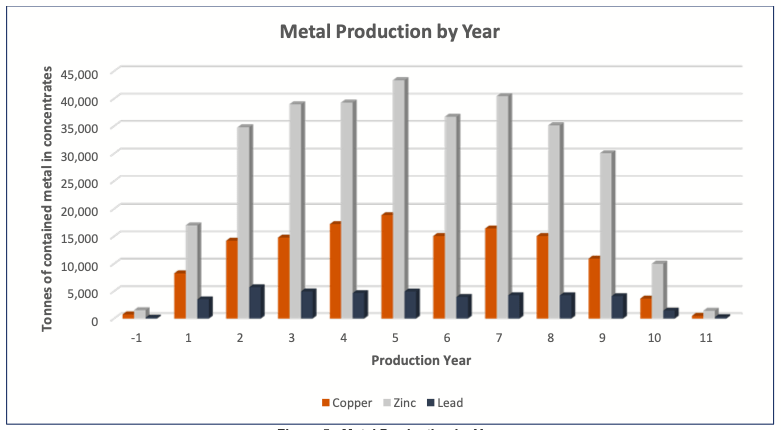

“This contemplates annual production of approximately 30,000 tonnes of copper-equivalent metal in concentrates on an annual basis.

“The forecast production includes approximately 15,000 tonnes of copper-in-concentrate, which because of the substantial value of the co-products could have a negative C1 cost for copper production.

“If achieved, this would make us one of the lowest-cost copper producers in the world.”

Expanding the resource

The scoping study was based on the maiden JORC mineral resource estimate released late last year of 7.7Mt at 2.2% copper, 5.3% zinc, 0.9% lead, 28.8g/t silver and 0.18g/t gold

(7.7Mt at 3.9% copper-equivalent).

And NWC says the expansion of the resource base – or increasing the confidence levels of the existing resource – may have a positive impact on the economics of developing the project.

“The scoping study is based on a 10-year initial operating life,” Haynes said.

“But if we can continue to expand the resource, which remains completely open at depth and to the south, we expect that we will be able to either extend the project-life and/or expand the production profile, which should improve the project’s economics.”

Plus, the mine schedule is yet to be optimised, which could bring forward initial production while reducing pre-production capital.

Pre-feasibility study planned

The plan is to update the resource in the coming months for integration into the pre-feasibility study (PFS) which has already commenced and is due for completion in Q1 2023.

Haynes says the company is pushing to get Antler back into production as quickly as practicable.

“We have identified multiple areas for enhancement – which will be addressed in a pre-feasibility study that we have already commenced,” he said.

“We will continue to target expansion of the mineral resource base with further exploration drilling.

“And we will use the results of this scoping study to prepare mine permit applications.

“All these activities afford us considerable opportunities to continue to realise value from Antler.”

This article was developed in collaboration with New World Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.