Scoping study for International Graphite’s Collie BAM facility highlights a compelling development pathway

International Graphite is another step closer to building a streamlined ‘mine to market’ supply chain with the release of a new Scoping Study. Pic via Getty Images.

The new scoping study has confirmed the proposed Collie Graphite Battery Anode Material (BAM) facility would produce high-grade anode materials for the lithium-ion battery and generate robust financial returns.

International Graphite’s (ASX:IG6) is another step closer to building a streamlined ‘mine to market’ supply chain after the release of a new Scoping Study for the Collie Graphite BAM facility in WA.

It comes as market research analysts forecast significant supply shortfalls with a sizable number of new mines and the expansion of existing mines to meet required demand.

A typical electric vehicle requires six times more mineral inputs than a conventional vehicle – the anode of a lithium-ion battery consists of 95% graphite.

This means graphite supply would need to increase 18 times and 25 times on 2020 levels by 2030 and 2040 respectively, to meet the ‘sustainable development scenario’ that achieves Paris Agreement goals.

Key attributes of Collie Graphite GAM facility

But IG6’s Scoping Study has revealed the Collie Graphite BAM plant might help fill the gap with the capability to process up to 40,000t/per year of graphite concentrates.

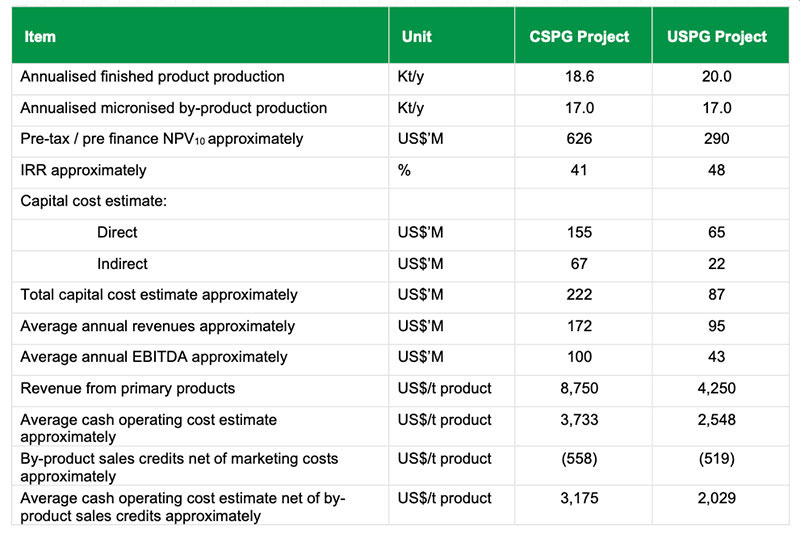

The flowsheet involves graphite micronizing, spheroidising, and non-HF chemical purification to produce uncoated spheroidised purified graphite (USPG) before carbon coating to produce coated spheroidised purified graphite (CSPG).

IG6 says the plant is designed in modules and could be implemented in stage where, initially, USPG product will be produced with coating facilities added to produce CSPG afterwards.

“Outstanding” economics

IG6 managing director and CEO Andrew Worland says the economics are outstanding and demonstrate many opportunities to improve the cost structure with further test-work.

“The financial modelling of the Scoping Study applies long term forecast pricing for CSPG,” he says.

“Current and forecast natural graphite supply is well below the levels required to meet global decarbonisation goals from the uses of the lithium-ion battery.

“The total capital cost to produce CSPG is estimated at approximately US$222 million, and its operations are forecast to deliver a pre-tax and pre finance NPV of roughly US$626 million as well as an IRR of around 41 per cent.”

Future plan to integrate Springdale with Collie BAM facility

As an initial first step, Worland adds the total capital cost to produce USPG is estimated at US$87 million with operations to deliver a pre-tax – pre finance NPV of US$290 million and IRR of about 48%.

“We are working with a number of stakeholders in Collie to agree on site selection for the Collie Graphite BAM Facility and accommodate the initial graphite concentrate processing capacity of up to 40kt/y and potential further expansions,” he says.

“Whilst the financial forecasts for the Scoping Study are based on the purchase of graphite concentrates from third party sources, it is the intention to integrate our 100 per cent owned Springdale graphite project with the development of the Collie Graphite BAM Facility.

“When we have advanced Springdale to a sufficient level of detail to allow forecasts to be published, we will be able to update the Scoping Study accordingly.”

Timetable and ramp-up

International Graphite estimates that it will conclude a definitive feasibility study for the Collie Graphite BAM Facility in the third quarter of 2024.

A final investment decision would be undertaken at the point at which the company considers it is suitably funded.

A 24-month construction and commissioning period has been assumed for the USPG and CSPG facilities with commercial production being achieved for USPG within this period and a further six months to achieve commercial production for CSPG.

The production facilities are assumed to be operating at nameplate 12 to18 months from commissioning.

This article was developed in collaboration with International Graphite, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.