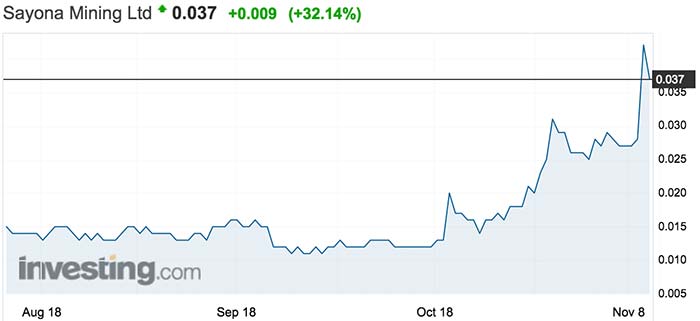

Lithium explorer Sayona shakes hands with China battery maker; gains 32pc

Pic: Tyler Stableford / Stone via Getty Images

Lithium play Sayona Mining jumped 32 per cent after partnering with a subsidiary of Fortune 500 company China Minmetals Group to advance a project in Quebec, Canada.

The deal is with China-based battery manufacturer Huan Changyuan Lico.

Investors applauded, pushing the stock (ASX:SYA) up 40 per cent to 3.9c, before cooling to 3.7c at the close. More than 127 million shares changed hands.

The alliance will explore marketing, technical and financial opportunities for the “Authier” project. Changyuan will buy up to 100,000 tonnes of spodumene concentrate per year.

The parties will also explore converting concentrates into lithium carbonateor lithium hydroxide in China or Canada.

Lithium carbonate is used in the manufacture of lithium-ion batteries and a range of industrial, technical and medical applications.

Sayona is working on a definitive feasibility study which is due by early next year. Production of first concentrates is slated for 2019 or 2020.

Authier offers has a mineral resource of 17.4 million tonnes grading at 1.02 per cent lithium oxide for 177,212 tonnes of contained lithium oxide.

Of this 56,762 is categorised as measured and 98,571 tonnes categorised as indicated.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

Changyuan makes lithium cobalt oxide and lithium manganese oxide batteries and lithium-ion cathode materials.

Last year, Changyuan produces 16,000 tonnes of battery cathode materials and is targeting 36,000 tonnes in 2018.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.