Samples open new targets for Haranga to upgrade 16Mlb Saraya uranium resource

Termite mounds could point the way to a uranium elephant at Saraya. Pic: Getty Images

- Haranga Resources has 11 auger drilling targets in its back pocket to test after finding more success with termite mound sampling

- The innovative sampling method is opening a window to potential uranium mineralisation beneath cover at the 16.1Mlb and growing Saraya project in Senegal

- Premium on African resources as nationalisation by major French supply source Niger threatens to curb exports as demand grows

Special Report: Haranga Resources has boosted its portfolio of auger drilling targets at the Saraya uranium project in Senegal to 11, leveraging a big expansion of a unique exploration method sampling termite mounds to test for uranium oxide.

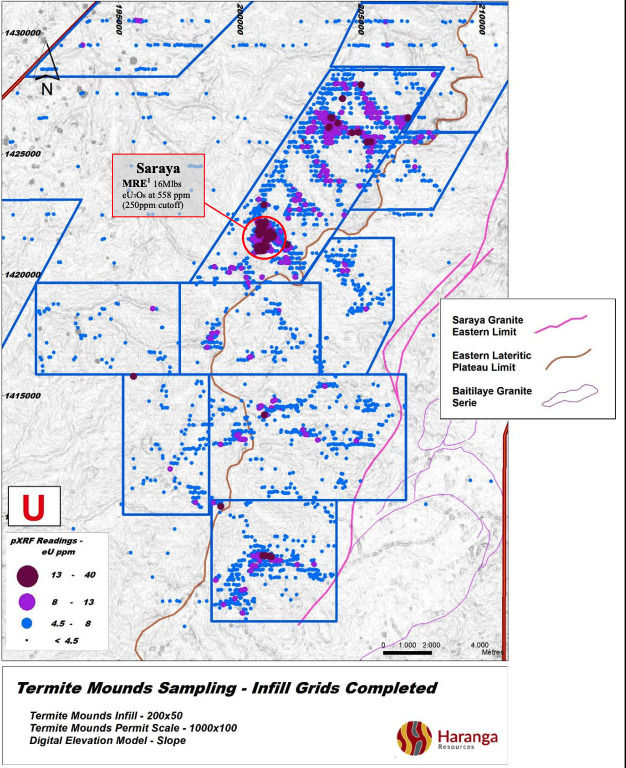

Already boasting 16Mlb in what would be a new uranium district in Senegal on Africa’s western edge, Haranga’s (ASX:HAR) team has collected an impressive 18,727 termite mound infill samples so far.

The method is a low-cost sampling option that can demonstrate the potential to uncover uranium-enriched resources beneath surface cover, since the insects work to bring deeper earth to the surface.

Eight infill grids on spacing of 200m by 50m have been completed so far, with another seven planned. While the assays taken by a portable XRF reader can’t be used to compile a resource, the quality of new XRF technology is strong enough to point to where resources could be identified with a drill rig.

And the method is poised to expand, with six new infill grids proposed ahead of the return of more auger results from drilling before the start of the Senegalese wet season in June and a mineral resource update.

The right contacts

Among the new infill targets, Haranga managing director Peter Batten says most are located on the contacts known to have potential to host mineralisation.

“We previously announced the completion of Stage 1 of our four-stage exploration process,” Batten said.

“The results announced here are from the Stage 2 program and further illustrate the prospectivity of the Saraya permit, with 11 Auger drilling targets produced from the 8 infill TMS grids completed, with a further 7 infill grids still to be completed.

“Equally exciting is the fact that five of the new TMS Infill targets are located on contacts between granite and Birimian age volcano-sedimentary units.

“This geological setting adds potential for granite contact shear hosted mineralisation to the Na metasomatic model of the Saraya corridor of uranium anomalism, where the Company has already defined an indicated/inferred mineral resource of 16Mlb at 558ppm eU3O8.”

More samples planned, more uranium to be found

While almost 20,000 samples have been collected to date, as many as 50,516 are planned as Haranga looks to leave no stone unturned and no termite mound untested in its bid to outline the full potential of Saraya.

The project sits in a more than 30km long north-north-east trending corridor, with readings from samples to date ranging as high as 15 times to background eU3O8 levels.

A number of anomalies, many obscured by cover and masking mineralisation in the underlying rock, are among those to be tested across the 11 auger drilling targets.

These include Mandankoli, Sanela, Saraya East and South, as well as Diobi East, all located on the Eastern Lateritic plateau.

Three new grids at Bembou, Baraberi and Baraberi North are in the western portion over a sheared contact between the Saraya and Bembou Granites, a fertile setting for shear hosted mineralisation.

Two new grids at Sekhoto North and Samecouta are in the south-east, not far from where previous explorers Cogema and Areva discovered uranium bearing quartz vein in shale rock.

France’s conundrum

Speaking of Areva, it’s now called Orano, and developments at its established projects in Niger have recently highlighted the opportunity open to Haranga.

While Senegal does not have a history of uranium production, it could be a lower risk francophone exporter at a time when a nationalistic military junta in Niger, one of major nuclear market France’s largest suppliers, threatens to strangle production by nationalising resources including an undeveloped site owned by Orano.

Unrest and jurisdictional risk in Niger and Kazakhstan will open the door to producers with established resources in new jurisdictions like Senegal, where the 16.1Mlb and growing Saraya resource sits.

Yellowcake spot prices are currently sitting at US$86/lb, around five times the cyclical lows seen in 2018, with demand expected to grow in the years ahead on the back of life extensions at existing nuclear power plants and new builds in Asia.

This article was developed in collaboration with Haranga Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.