Running with the bulls: iron ore prices are going nuts

Spanish Bullfighter Julian Escobar performs during the Feria de Abril Bullfight at La Maestranza on April 16, in Seville, Spain.

Iron ore prices continue to soar, and with Chinese futures ripping higher again in overnight trade on Thursday, it looks like there may be even further gains to come.

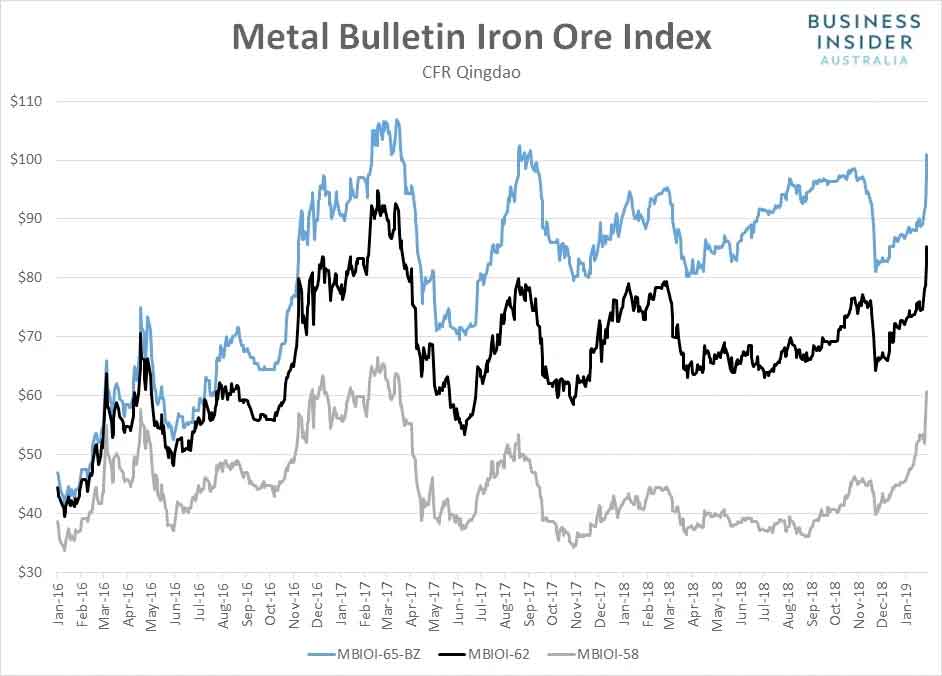

According to Metal Bulletin, the spot price for benchmark 62 per cent fines surged by a further 3.4 per cent to $85.34 a tonne, extending its rally so far this week to 14.3 per cent.

Higher grade ore was also in demand with the price for 65 per cent fines also up 3.4 per cent to $100.90 a tonne, reclaiming the $100 a tonne level for the first time since September 2017.

After jumping 13 per cent in the prior two sessions, lower grade ore was the relative laggard on Thursday, only lifting 0.3 per cent to $60.62 a tonne.

As seen in the chart below, the move this week has been spectacular, sparked by concerns over supply disruptions to seaborne markets following another mine disaster in Brazil last weekend.

From November 26 last year, the prices for 58 per cent, 62 per cent and 65 per cent fines have now risen 62.6 per cent, 32.8 per cent and 24.6 per cent respectively.

The sharp and sudden rally has seen analysts scramble to revise up their near and medium-term iron ore price forecasts.

“We have raised our short term price forecasts for iron ore,” said Daniel Hynes, senior commodities strategist at ANZ Bank. “We now see spot prices breaching $80 a tonne in Q1, with further upside likely if the losses in Brazil are greater than expected.”

Looking further ahead, ANZ sees the benchmark price sitting at $82 per tonne by the end of June before easing lower to $72 a tonne as we enter 2020.

Commodity strategists at Morgan Stanley agree that recent price gains may not be reversed anytime soon.

“Whilst uncertainty remains, it is possible that the iron ore price will remain at more elevated levels in the near-term,” it said, referring to the outlook for Brazilian supply.

While the outlook for Brazilian iron ore supply remains in the driving seat, the gains in spot markets on Thursday were likely helped by signs that Chinese steel demand is strengthening.

The China Steel Industry PMI, released by China’s National Bureau of Statistics (NBS), rose to 51.5 in January from 45.6 in December, signaling that activity levels across the sector improved in early 2019. Of note, the new orders subindex jumped to 53.4 from 39.5 a month earlier, signaling an increase in steel demand.

The data helped to lift Chinese steel futures traded in Shanghai during the session.

The most actively-traded rebar and hot-rolled coil contracts finished at 3,707 and 3,610 yuan respectively, up from 3,683 and 3,585 yuan on Wednesday evening. Iron ore and coking coal contracts also rallied hard, ending the session at 588.5 and 1,269 yuan respectively.

Coking coal contracts, like iron ore physical and futures markets, were helped by concerns over potential supply disruptions following reports that some ports in northern China had stopped clearing coking coal imports from entering the country.

As seen in the scoreboard below, all steel and bulk commodity contracts finished flat to higher in overnight trade on Thursday.

SHFE Hot Rolled Coil ¥3,622 , 0.78 per cent

SHFE Rebar ¥3,724 , 0.76 per cent

DCE Iron Ore ¥598.00 , 2.31 per cent

DCE Coking Coal ¥1,268.00 , 2.46 per cent

DCE Coke ¥2,069.50 , 1.32 per cent

The continued strength in steel contracts may reflect news that China’s top steelmaking city, Tangshan, will impose production restrictions on heavy industry, including steel output, from April to September, according to the state-backed Hebei Newspaper.

With Dalian iron ore futures surging to fresh multi-year highs, it points to continued strength in spot markets in early deals on Friday.

Trade in Chinese commodity futures will resume at midday AEDT, 45 minutes before the release of the Caixin-IHS Markit China Manufacturing PMI for January.

This report tends to focus on activity levels at small and medium-sized manufacturing firms. In a separate report released by the NBS on Thursday, activity levels at SME’s in China weakened noticeably in January.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.