Royalco sells Bass Strait money-maker to keep shareholders happy

Royalty investment firm Royalco Resources is selling its main cash-generating asset following mounting pressure to give more money back to shareholders.

The company (ASX:RCO) is offloading its 1 per cent royalty interest in the Weeks hydrocarbon project in the Bass Strait.

Instead of handing over cash for equity, royalty investors lend money for a guaranteed percentage of revenue once resources are produced and sold.

The Weeks royalty, which is expected to generate roughly $546,000 in the 2018 financial year, covers 20 producing fields in the offshore Gippsland Basin that are owned by ExxonMobil and BHP Billiton.

Last year, shareholders expressed concerns that Royalco’s cost base was too high and cash was not being returned to investors.

This led to an attempted board spill by some shareholders and a failed takeover by fellow royalty investment firm Fitzroy River.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Fitzroy fell short, managing to acquire a 46.6 per cent stake. The remaining 44.4 per cent is held by three other substantial shareholders.

However, Fitzroy did manage to secure two board seats, including the executive chair position after Peter Topham stepped down.

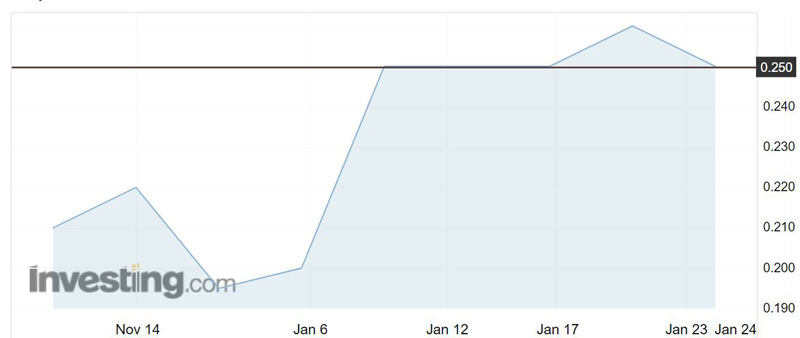

Since then Royalco’s share price has rebounded from a 52-week low of 20c just before Christmas to a new peak of 26c last week. The company’s share price was trading at 25c at 11.30am AEDT.

In November, Royalco vowed to drastically reduce its cash operating costs from around $1 million in the 2017 financial year to $300,000 to $400,000 annually.

The decision to sell the Weeks royalty follows the annual general meeting in November and talks with its four largest shareholders, which control about 92 per cent of Royalco.

“It was clear from these discussions that there was interest in RCO initiating action to establish market values for its various assets, look at sale options and to return any sale proceeds to shareholders,” the company told investors.

Several shareholders have expressed interest in bidding for the Weeks royalty.

Royalco is seeking legal and commercial advice for the sale and has established a data room for potential bidders.

The company expects to finalise the sale by June.

Royalco has been contacted for comment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.