Rocky prospect significant addition to Future Battery Minerals’ Kangaroo Hills lithium development

Assays from the Rocky prospect have returned more shallow and high grade lithium hits. Pic: via Getty Images.

- Future Battery Minerals reports shallow intercepts from phase 3 drilling at Kangaroo Hills of up to 1.37% Li20

- Project is in premium WA lithium territory and ‘could host a deposit of scale and tonnage’

- Rocky prospect’s proximity to surface and Big Red prospect means it could be vital to any future development

- Assays for a further 15 holes from the program are pending

Special Report: Latest assays from Future Battery Minerals’ phase 3 drilling program at its Kangaroo Hills lithium project in WA have returned shallow, high-grade intercepts up to 1.37% Li2O.

The project, just 17km south of Coolgardie and 30km from Mineral Resources’ (ASX:MIN) Mt Marion lithium mine, has potential to host a lithium deposit of both scale and tonnage, the company says.

Since expanding the phase 3 reverse circulation (RC) and diamond (DD) program, the company says assays from 53 holes have now broadened the extent of the shallow mineralised system at the project.

Rocky prospect key to Kangaroo Hills development

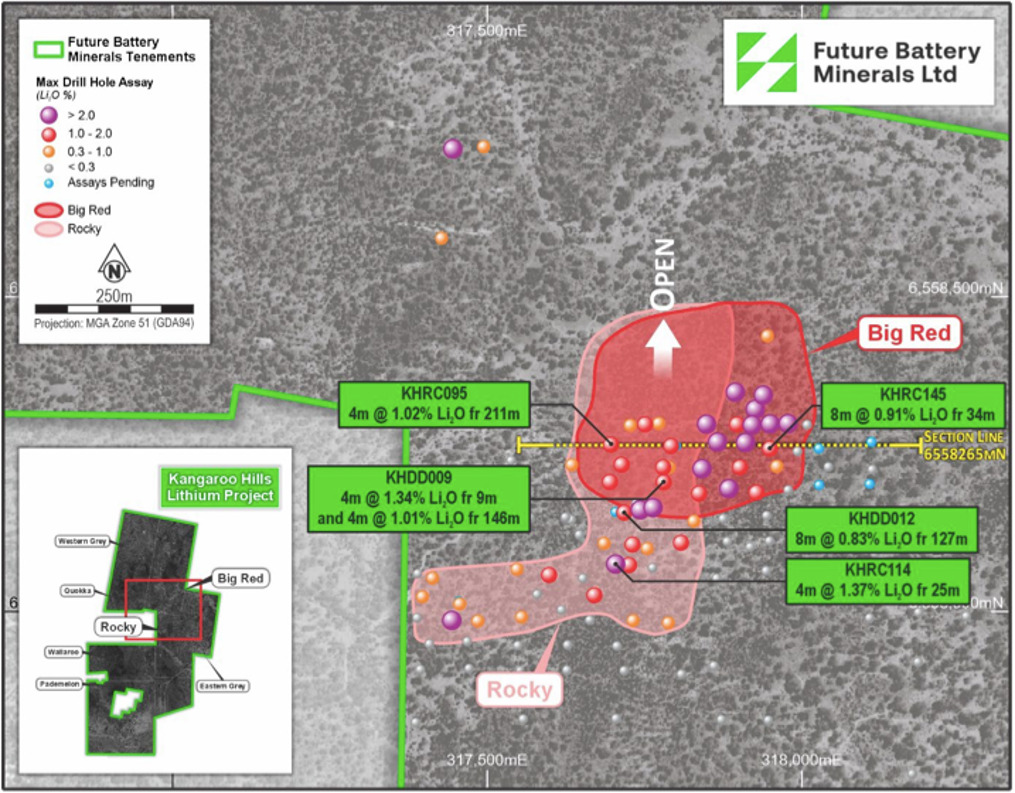

New assay results from the Rocky prospect include:

- 4m at 1.37% Li2O from 25m (KHRC114);

- 4m at 1.01% Li2O from 146m (Rocky) and 4m at 1.34% Li2O from 9m (Big Red) (KHDD009);

- 8m at 0.83% Li2O from 127m (KHDD012);

- 4m at 1.02% Li2O from 211m (Rocky) and 2m at 1.27% Li2O from 23m (Big Red) (KHRC095); and

- 1m at 1.85% Li2O from 8m and 1m at 1.42% Li2O from 14m (KHRC094).

Select holes targeting extensions to the east, west and south of Big Red returned:

- 8m at 0.91% Li2O from 34m, including 5m at 1.21% Li2O from 37m (KHRC145);

- 3m at 1.05% Li2O from 34m (KHDD008); and

- 2m at 1.29% Li2O from 6m (KHRC142).

Rocky drilling to date has defined a highly continuous mineralised system at shallow depths, although thinner and of lower average grade than the standout Big Red Prospect. However, given its proximity to surface and Big Red, Rocky is expected to form a significant part of any future development at Kangaroo Hills.

“Kangaroo Hills offers so many project advancement and development advantages given its excellent location in the WA Goldfields, available road access, and proximity to substantial existing regional infrastructure,” FBM Technical Director Robin Cox said.

“It is also surrounded by other substantial lithium deposits and mines that offer a ready perspective on what it might become as a future project development.

“The latest round of RC results from Rocky have returned numerous shallow, high-grade lithium intercepts that have significantly increased the overall size of this system.

“While not of the same thickness as the neighbouring Big Red mineralised pegmatite, the Rocky system still offers significant potential contribution to future project development scenarios at Kangaroo Hills.”

Assays are pending for 15 holes from the phase 3 program.

Looking for strike extensions to the north

The planned DD tail program to test for extension of the Rocky pegmatites at depth (including potential thickening) has been deferred, with the focus instead to shift to the next round of drilling activities, concentrating on the northern strike extension of Big Red/Rocky and other regional targets including Western Grey and Quokka.

In addition, the company’s initial metallurgical program is ongoing and expanded with full results expected Q1 CY2024.

“With the completion of the Phase 3 program at Kangaroo Hills, our focus now turns to the potential of the area moving north from the Big Red and Rocky pegmatites,” Cox said.

“Both these systems remain wide open to the north – and at depth – and several other regional target areas to the north demand prompt testing, including the highly prospective Western Grey zone.

“We expect to be drilling in these northern areas upon receipt of final permitting.”

This article was developed in collaboration with Future Battery Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.