Right time, right place: South Harz’s ‘Jansen-sized’ potash project perfectly positioned to solve Europe’s food security challenge

South Harz’s Ohmgebirge project ticks all the boxes as a potash project to meet Europe’s needs. Pic: via Getty Images.

- Europe focused on ensuring food security via domestic fertiliser supply

- 20+ year Life of Mine Ohmgebirge project positioned in the heart of Europe to meet potash demand

- Project boasts scale, upside and long life of mine in a tier 1 mining jurisdiction

- Project pre-feasibility study due before the end of this year

Stimulating local fertiliser supply is high on the agenda for Europe, which has traditionally sourced its potash from world #2 supplier and ‘persona non grata’ Russia.

Fertilisers like potash is crucial for agriculture as it improves water retention, yield, nutrient value, taste, colour, texture, and disease resistance of food crops.

All very important as populations increase and the amount of arable land decreases.

Over the course of the 2020s, BHP expects the global population to expand by 0.8 billion to 8.5 billion, putting additional pressure on food security.

Its why potash is one of the ‘’future facing’’ commodities BHP has identified as a 100-year business opportunity.

The diversified miner believes the potash industry’s ‘4th wave’ of demand and supply growth is building as populations explode and customers place greater value on reliability of supply.

“[That’s] something we hear across our diverse businesses from all our customers,” it says.

“Undeniably, prices will continue to fluctuate. On a structural basis though, given the growing size of the market and corresponding resource availability, it is unlikely that the industry will return to the conditions we saw in the second half of the 20th century.”

Highlighting this, Food and Agriculture Organization of the United Nations director-general Qu Dongyu recently issued a global ‘call to action’ to address escalating food security concerns.

This is where geopolitics rears its ugly head as Russia and ally Belarus – two of the world’s largest producers and exporters of potash (40% of exports according to the World bank), phosphate and nitrogen-based fertilisers – are essentially persona non grata in countries actively opposed to Russia’s invasion of Ukraine.

With the European Union sanctioning Russian exports, the region is predictably keen to source new fertiliser supplies.

The licences that make up the South Harz potash project. Pic: Supplied (SHP).

South Harz: Ticking all the boxes

The perfect solution would appear to be a large scale, well-defined project within its borders. As it so happens, there’s a project that meets all those criteria, and then some.

South Harz Potash’s (ASX:SHP) 5.3Bt potash resource in Germany’s established South Harz mining district is huge, comparable in size to BHP’s US$10bn Jansen project in Canada.

It is also right in the heart of Europe.

Not only does this place the company amongst its likely customers, but it also provides easy access to transport infrastructure, an important factor with bulk commodities such as potash.

Indeed, transportation costs are estimated to be just US$30/t for northwest and central European customers, who are incidentally the highest paying market worldwide for muriate of potash (MOP) since the end of 2022 – a trend that is expected to continue for the foreseeable future.

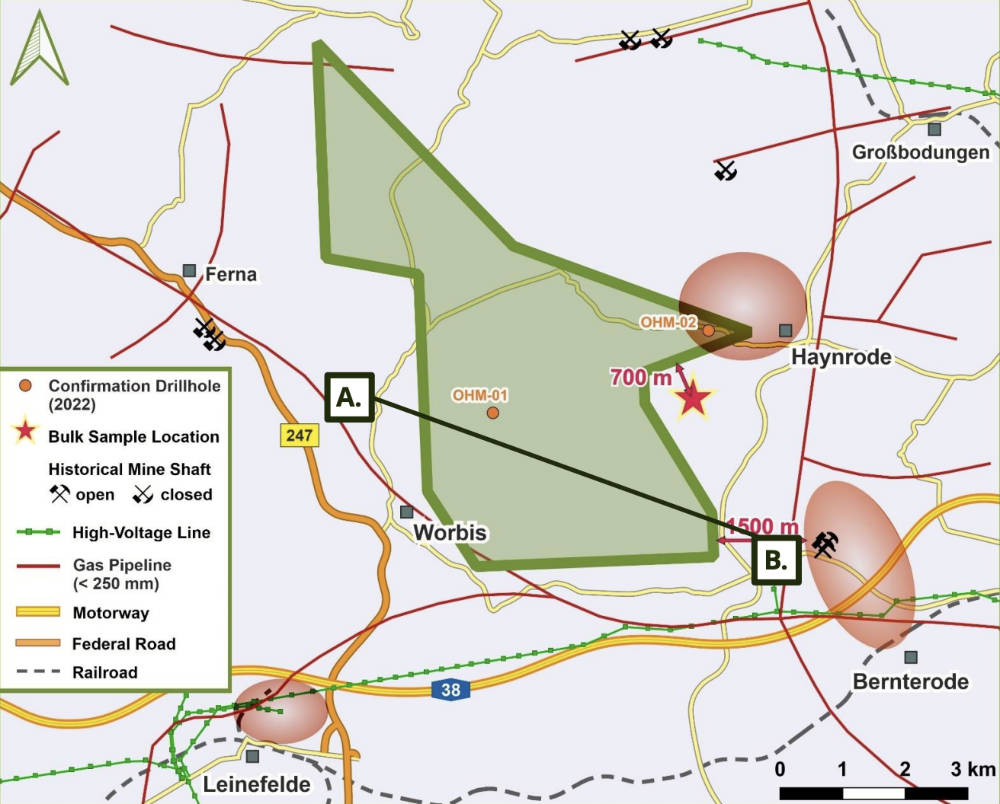

Exploration – both historical and conducted by the company – has already defined an Inferred resource of 325Mt grading 13.14% K2O that essentially covers the entirety of the granted Ohmgebirge mining licence and has very little variation in mineralogy or grade.

Of this, 290Mt at 13.47% K2O is contained within sylvinite – an important source of potash – while 89% of the Ohmgebirge sylvinite seam is in the higher confidence Indicated category that has enough geological certainty for mine planning.

Attractive economics

An August 2022 scoping study – the first proper look at the economics of building a project – outlined a robust 21 year, 1Mtpa MOP operation at Ohmgebirge. This being the first project of five within its permits.

Net present value and internal rate of return, post tax, both measures of a project’s profitability, are estimated at US$1.28bn and 26.6% respectively while annual free cash flow is estimated at US$229m.

This can be achieved at a relatively low pre-production capex of US$620m and low all-in-sustaining costs after salt credits estimated at US$93/t of MOP.

Payback is expected in 3.6 years.

Development of Ohmgebirge will be guided by chief operating officer and veteran potash mine builder Lawrence Berthelet, who was involved in three out of five most recent potash developments and delivered Mosaic’s US$2.9Bn K3 expansion in Saskatchewan, ahead of time and on budget.

Speaking to Stockhead, South Harz managing director Luis da Silva said that the project will be a cost-effective potash development compared to other expansions and new builds.

He said Ohmgebirge also had key advantages over other mining projects on the ASX by being in a Tier 1, G7 jurisdiction and being fundamentally de-risked.

“Ohmgebirge is also unencumbered with no government royalties,” he says.

“Given that the birthplace of potash is in the region, we have a social licence to operate as the communities want the production back that was closed 30 years ago.

“The project has the ability to become the most cost-effective capital intensity for a potash development project compared to historical expansions and new builds.”

Local support

South Harz recently completed the initial consultation and hearing process with key local, NGO and regulatory stakeholders for Ohmgebirge, closing the initial consultation period following submission of the Scoping Paper to lead regulatory authority, Thüringer Landesverwaltungsamt (TLVwA).

Importantly for South Harz, no significant concerns or objections were raised to the proposed development of Ohmgebirge raised through either these submitted comments or during the hearing itself.

The Ohmgebirge licence. Pic: Supplied (SHP).

Part of a greater whole

While Ohmgebirge is leading the charge for the company’s potash ambitions, it is certainly not the only asset in its stable.

Rather the licence is just one of several that make up the South Harz project, which has a combined resource of 5.3Bt grading 10.38% K2O which puts it in the same ballpark as BHP’s Jansen in Saskatchewan, Canada.

Jansen has a resource of 6.5Bt grading 25.6% K2O though it has far heftier pre-production capex of US$5.7bn. Although a higher grade orebody, it is also 400m deeper than the German counterpart.

In the short-term, South Harz intends to submit the planning application for the brownfield scenario in late October 2023.

This envisions the use of existing shaft infrastructure, which offers potential savings to overall capex and timing. Access to the orebody underground provides obvious benefits and combined with 100+ years of geological, mining and processing knowledge, it makes for a fundamentally de-risked project compared to other extractions.

The company also expects to release the Pre-Feasibility Study in December this year, which is expected to be followed by a decision on the spatial planning before the end of May 2024.

This will be accompanied by the completion of the environmental impact assessment subject to groundwater monitoring.

South Harz will also seek to complete the Definitive Feasibility Study by the end of 2024.

This article was developed in collaboration with South Harz Potash, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.