Riding the Wave: Why Forrestania is shaping up as WA’s next multi-million ounce gold belt

As gold prices rise it's more than just Wave Rock attracting explorers to the Forrestania gold belt. Pic: Getty Images

- Forrestania could be the next untapped multi-million ounce WA gold belt as prices

- Medallion Metals’ impending deal to acquire the Forrestania Nickel Operations has opened the door wide open to the region’s revival as a gold hotspot

- Region includes 1.3Moz Bounty gold mine and a host of gold deposits covered by granted mining leases

It rarely features among the names of the great gold fields of WA – the Murchison, Kalgoorlie, Leonora and Lavertons of the world.

Yet one of the most intriguing regions of the State, responsible for around 70% of Australia’s roughy 300t a year gold industry, is emerging in a former nickel and lithium hub.

Obscured for years by its battery metals operations, ground that has been locked up by other commodities is now being looked at for its rich gold potential as bullion prices hit record highs.

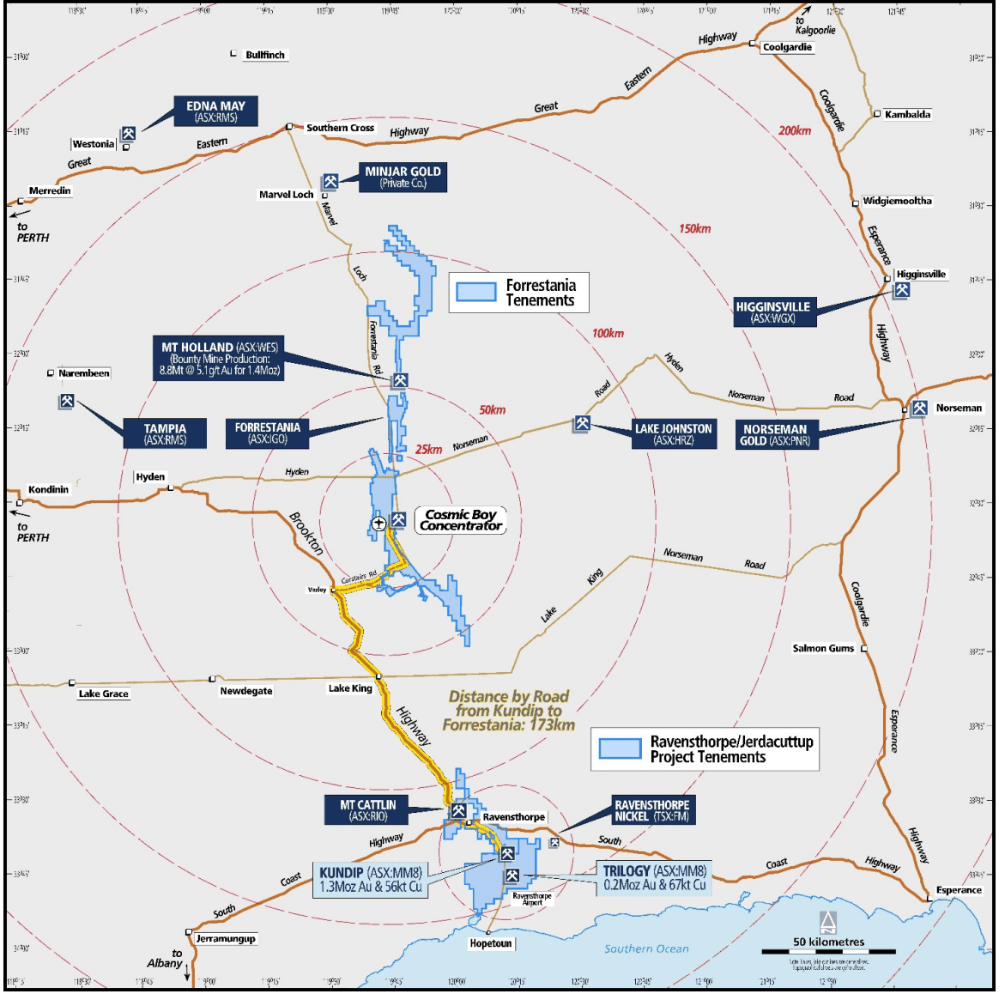

Including the iconic Wave Rock site, that region is the Forrestania Belt, where IGO (ASX:IGO) last year ended nickel mining after more than 30 years of on-off operations under it, Western Areas and Outokumpu.

The closure of the Forrestania Nickel Operations near Hyden due to declining reserves, rising costs and falling nickel prices opened the door for a key transaction that will transform the district.

Medallion Metals (ASX:MM8) has now gone binding in the process to acquire Forrestania’s Cosmic Boy mill from IGO.

It’s an enabler to cut build costs dramatically for the Ravensthorpe gold and copper project, 160km down the road.

But the bonus is the 950km2 tenement package MM8 will also pick up stretching from just south of Marvel Loch in the north, through Mt Holland to Lake King in the south.

That includes reams of prospects only sparsely tested for gold, despite their proximity to the Bounty mine, an historic producer of 1.3Moz of gold.

Once the deal to acquire Cosmic Boy completes, no one will be better placed to make a discovery than Medallion.

“It’s worth noting that the first plant that was built at Cosmic Boy was actually a gold plant,” Medallion MD Paul Bennett said.

“Bounty’s not part of the FNO (Forrestania Nickel Operations) tenure, but we’ve got the geology immediately to the north and the south.

“That demonstrates that it is capable of producing plus one million ounce deposits on that belt, but also there are some historical gold workings littered throughout the FNO tenure.”

Work to do

Once combined, Medallion will control 1500km2 of greenstone belts across Ravensthorpe and Forrestania.

That means it needs to think carefully about quality when it comes to exploration investment, with 15km of infill drilling recently completed to derisk the high grade 950,000oz at 5.2g/t gold equivalent sulphide resource at Ravensthorpe.

But there are walk up targets already to chase at Forrestania, a nickel hub since Finnish miner Outokumpu found the Flying Fox mine in 1992.

“There’s a huge opportunity there. The more advanced prospects are Lounge Lizard and North Ironcap. They’re both high on our priority list in terms of where we might go to push these projects along,” Bennett said.

“But it takes time to work those up. So I think you need the requisite technical capability and we’ve addressed that through appointing Ian Gordon over the last couple weeks – he’s ex Western Areas, ex IGO greenfields exploration positions.

“He knows Forrestania really well and can hit the ground running.

“You need the balance sheet which we’ve addressed through the raising back in May (which raked in $27.5m with strong institutional support) so plenty of cash to push those initiatives along and then you need some time I think to bring this all together and systematically work through the opportunity, which is quite significant.”

The dream would be to find something like Bounty, which was discovered in 1985 after a review of drilling that took place looking for nickel.

But the 5-6 year mine life at Ravensthorpe gives Medallion a long runway to find something it can put through the retooled concentrator alongside its sulphide ore.

Mine revival

While Medallion holds a commanding land position, it’s not only the only player looking to revive the gold legacy of the Forrestania district.

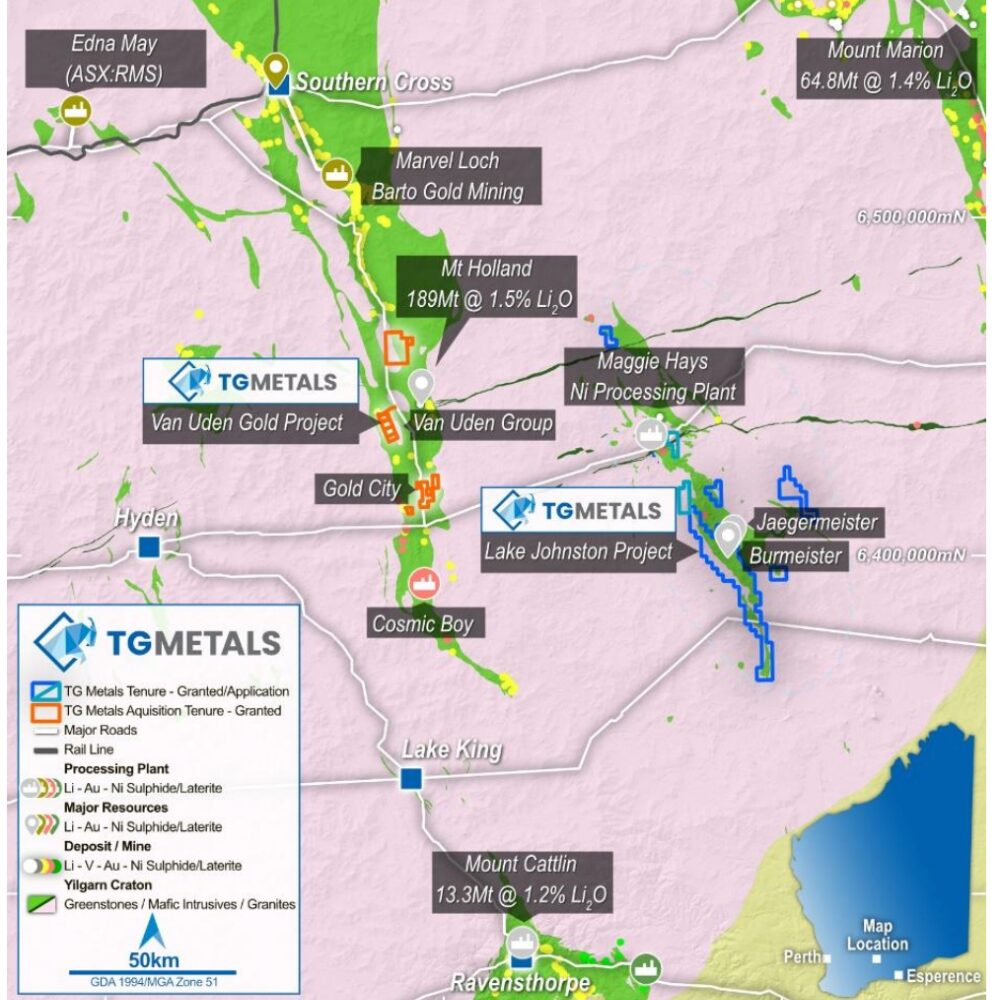

TG Metals (ASX:TG6) is well on the path to becoming a small scale producer.

It already has 227,000oz of inferred and indicated resources at the Van Uden gold project, acquired in a canny deal from a subsidiary of Australian conglomerate Wesfarmers (ASX:WES), which acquired the ground in its 2019 deal to purchase Kidman Resources.

Wesfarmers has partnered with SQM to develop the Mt Holland lithium mine, and the gold inventory that came along with that is an after thought.

That means Van Uden, which sits on granted mining leases, could become paydirt for the $16m capped TG6 – literally.

Its tenure includes 60,232t of historical stockpiles at 0.84g/t Au, and 12,496t at 2.55g/t Au in surface laterite mineralisation.

This material is free digging, with waste material already stripped away also at the base of the Tasman pit.

With gold fetching a record US$3560/oz on Thursday (A$5420/oz), there is no better time to start producing, assuming TG Metals can find a home for its ore.

TG Metals MD David Selfe, who explored the Forrestania belt in the 1980s and 1990s, said as gold prices rise the opportunity to tap latent milling capacity in the region will grow.

“The conversion of the Cosmic Boy plant will obviously be beneficial to third-party users if they’re allowed to process into that plant once it’s converted to gold processing,” he said.

“There is the Barto mill operating in Marvel Loch and also there’s the mill at Edna May, which is currently on care and maintenance owned by Ramelius, and that’s 2.8 million tonnes of latent capacity there as well.

“I think with the gold price improving pretty much on a daily basis at the moment, it makes it far more attractive to be third party toll milling.

“What would have been previously considered lower grade ores are now general run of the mine ore for these third party processing plants.”

Selfe sees geological potential also discover new deposits that can turn Forrestania into a multi-million ounce gold belt.

“There’s a lot of granted mining leases around in the area and all it really needs is extra processing capacity put into it and it can be a multi-million ounce per annum producer in the whole belt,” he said.

Bounty

The big question is how the potential sale of the Bounty gold mine will unfold.

It’s locked up in the Covalent Lithium JV between Wesfarmers and SQM, which controls the Mt Holland lithium mine and associated Kwinana refinery.

The gold is surplus to requirements there, despite being the original drawcard before Kidman Resources uncovered the Earl Grey pegmatite in 2016, now one of the world’s largest lithium deposits.

Selfe said Bounty the second largest area of gold mineralisation in the region after the Chinese owned Marvel Loch gold mine near Southern Cross.

“If that came up for sale, then we would want be in that process, no doubt with a whole lot of others as well,” Selfe said.

Bennett said Medallion was watching what happened with Bounty “extremely closely” also.

MM8 and TG6 may be two of the most prominent players, but there are plenty of other gold names in the region.

Indian-backed MEGA Resources, which has signed deals to contract mine a number of small deposits in the northern Goldfields, owns the 85,000oz Rama project near Cosmic Boy, purchased from Classic Minerals (ASX:CLZ) in March 2025.

A former Sons of Gwalia project 170km south of Southern Cross, MEGA regards Rama as its flagship asset and is planning to begin mining in Q4 2025.

Landsdale-based Classic itself owns the Ladies gold project in the Forrestania belt, where it recently completed a study on a 250,000tpa CIL plant to tap into its 297,579oz resource at the Lady Ada and Lady Magdalene deposits.

It will use the Goldbridge facility to process both its own ores and MEGA’s, though remains suspended from quotation on the ASX.

Zenith Minerals (ASX:ZNC) is another with an overlooked gold asset in the region, in the form of its Split Rocks project.

That hosts the Dulcie Far North deposit, which boasts 302,000oz at 1.15g/t following a 41% increase in Zenith’s latest resource update in June.

Located just south of Marvel Loch, Zenith has a broader exploration target of 300,000-800,000oz at 0.9-1.1g/t gold, with 1500m of RC drilling being completed in its first phase of RC frilling and 9000-12,000m planned for its second phase to convert portions of that exploration target to inferred resources.

It completed a $3.5m rights issue to fund the campaigns in July.

Forrestania Resources (ASX:FRS) does what it says on the tin, having picked up the North Ironcap gold project, previously part owned by Bottle Creek gold mine owner Aurenne, in August.

The project includes a 105,953oz inferred resource at 1.37g/t gold, with FRS also buying last month the ~56,000oz British Hill gold project 60km south-southeast of Marvel Loch from IMD Gold.

Looking further afield, Nimy Resources (ASX:NIM) controls the Mons greenstone belt to the north of Southern Cross, where it has been exploring for gallium, nickel and copper.

At Stockhead, we tell it like it is. While Medallion Metals, TG Metals, Zenith Minerals and Nimy Resources are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.