Riding the uranium bull: Where’s the best place to be in North America for yellowcake?

Pic: via Getty Images

- Uranium prices are on the rise and pro-nuclear sentiment is at all time high in America

- The USA is prioritising domestic supply which bodes well for ASX listed producers with a play in the country

- Oregon, Colorado, Utah and Wyoming are among the historical producing regions in the spotlight

Uranium sentiment – and prices – are on the rise with prices approaching the US$80/mark, nearing a 16-year high. Even Sprott Asset Management has flagged that uranium is currently in the midst of a bull market.

And as the uranium revival gathers pace, well-trod historical mining areas like the United States are becoming popular again.

There’s a huge opportunity in the US in particular, which accounts for ~30% of the world’s nuclear power generation.

The World Nuclear Association says the US of A hosts around 59,400t or ~1% of the world’s uranium resources.

The country also has 93 active nuclear reactors, which produce almost half of the country’s carbon-free electricity and around ~30% of the world’s nuclear power generation.

This year, for the first time in three decades, a new reactor was added to the grid in the state of Georgia (Vogtle 3 in April) and Vogtle 4 is expected to commence operation early in 2024.

Together, these two 1,250 MWe reactors will produce enough clean and affordable, emissions free electricity 24/7/365 to power an estimated 1,000,000 homes and businesses for the next 60 to 80 years.

To feed these new reactors, the country is now looking for new sources of supply as it looks to ban imports of uranium from Russia, a major producer and enricher.

Push for domestic US uranium sources

Aurora Energy Metals (ASX:1AE) MD Greg Cochran says bi-partisan support and public approval of nuclear is at an all-time high in America.

“Nuclear is a key part of the decarbonisation push in the US and there are a number of policies in place to support its development, such as the Inflation Reduction Act which was designed to support a 40% reduction in emissions,” he said.

“The US plans to triple its nuclear capacity by 2050 and also, as a global leader in nuclear energy it was the key instigator of the recent declaration at COP28 by 22 countries to triple nuclear energy capacity globally by 2050.

“The US Government has recognised that domestically produced uranium (and indeed all critical minerals) is critical to ensure a reliable supply in the future.

“Currently, the US sources almost half of its uranium from Commonwealth of Independent States (CIS) countries (like Russia and Ukraine) which is seen as not being sustainable due to increasing levels of geopolitical risk in that region.”

Russia is the US’s top foreign enriched uranium supplier and third in uranium oxide.

But there’s a bill that just passed the House and is on its way to the Senate to supercharge the USA’s nuclear and uranium programs.

The name itself means business – the NO RUSSIA act.

It… pic.twitter.com/RTNPLetaUh

— Katusa Research (@KatusaResearch) December 13, 2023

Expect upwards pressure on uranium pricing

Cochran said that over his 20 years in the industry, he’s never seen strong nuclear energy fundamentals, but at the same time, this boom comes on the back of a dearth in exploration and mine development, as well as multiple mine closures.

“The decade following the Fukushima accident saw an understandable decline in nuclear power, (along with purely politically motivated closures in some countries, such as Germany),” he said.

“However, this picture has transformed dramatically in the last few years.

“Most of the developed world, apart from the curious outliers of Germany and Australia, and many developing nations as well, have realised that nuclear power is fundamental to the world’s decarbonisation objectives.

“This has resulted in a commitment to accelerating the world’s new nuclear build program, as evidenced by the aforementioned COP28 commitment.”

That means that the gap between demand and supply, already stark but also exacerbated by ETFs holding physical uranium, is likely to grow which will undoubtedly put upwards pressure on the uranium price, he said.

Thor Energy (ASX:THR) MD Nicole Galloway Warland agrees.

“The overall outlook for the uranium industry and the price of uranium remains optimistic, driven by robust global demand,” she said.

“The uranium spot price is now at a 15-year high above US$80/lb, which is a 60% increase since the start of 2023.”

It makes sense then, for ASX listed US uranium plays to capitalise on this demand, and take advantage of the country’s quest for enhanced domestic energy security.

So, let’s explore which historical mining regions have attracted ASX players on the hunt for yellowcake.

What’s the go with Oregon?

1AE has its Aurora project in Oregon near the border with Nevada in what is a well-established mining region.

“The permitting of a basic mining project in Oregon with no chemical processing at the site is a well-defined regulatory process, whereas the state of Nevada is more attuned to permitting larger mines and processing plants,” Cochran said.

“Nevada is, after all, one of the world’s great mining jurisdictions.

“Both states are ‘Agreement States’ which means the state has the authority to regulate uranium mining.”

He also noted that the Aurora deposit is extremely well understood as it has been extensively drilled over time.

“As a result, it is both the largest and most well-defined, mineable uranium deposit in the USA,” Cochran said

“We benefit from over 60,000 metres of historical drilling (over 80,000 metres if you include what was done on the other side of the fault) which would have a replacement value today of tens of millions of dollars.

“This extensive database of previous work enable us to define the large 50.6Mlb mineral resource, although we are of course focused on the higher grade core of 18Mt @ 485ppm U3O8 for 19.2Mlb U3O8.”

Metallurgical testwork is currently underway at the project, with a scoping study also in the works.

1AE share price today:

Colorado and Utah a great combination

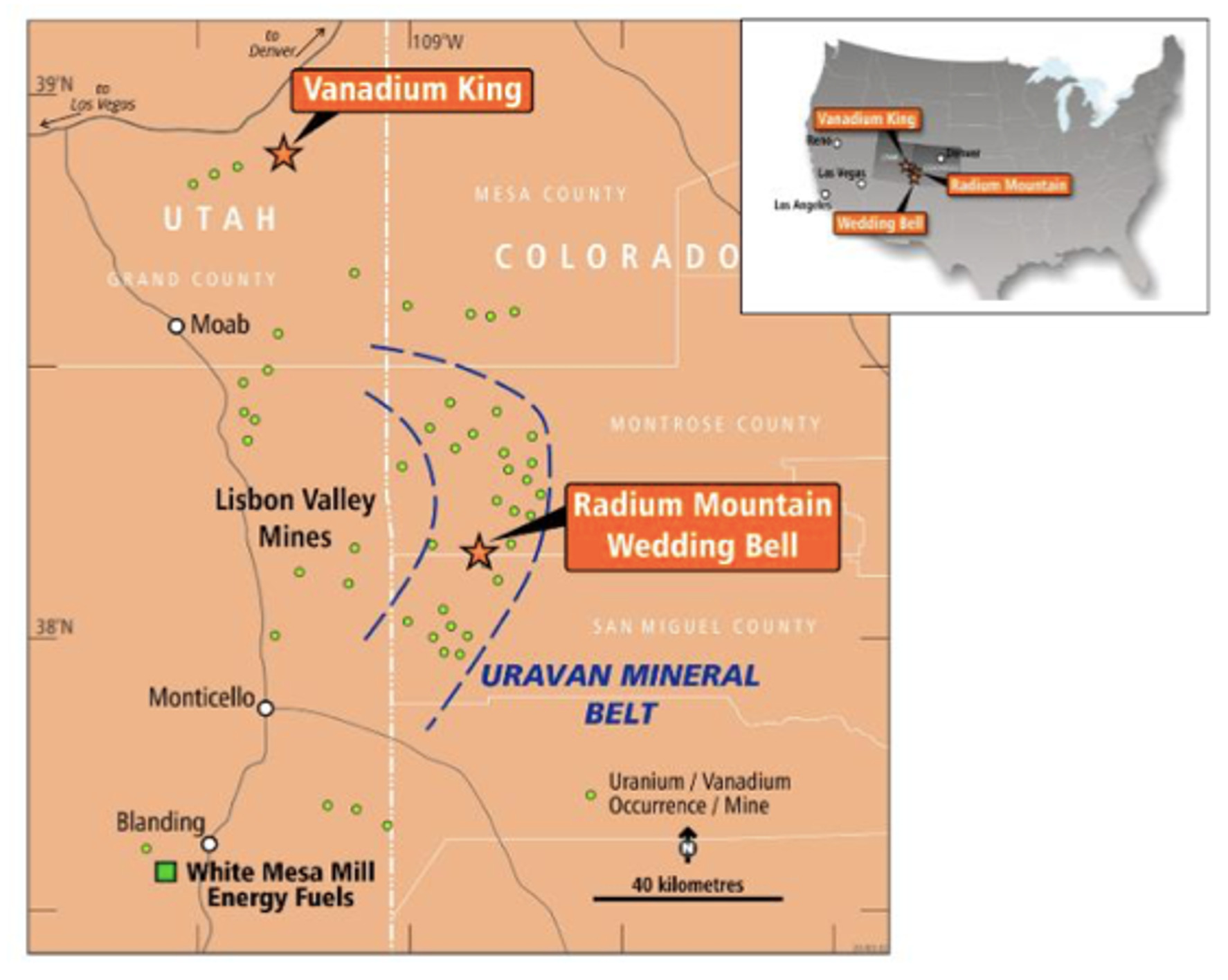

THR has three uranium/vanadium operations (Wedding Bell, Radium Mountain and Vanadium King) which span Utah and its neighbouring state Colorado across the historical high-grade Uravan Belt.

Galloway Warland says both well-established regions have demonstrated many benefits for hosting exploration projects.

“With an extensive mining history in the region, the local population has a deep understanding of the unique style and characteristics of the Uravan mineralisation, allowing Thor Energy access to a skilled, knowledgeable workforce within the community,” she said.

“Additionally, due to the familiarity with mining, stakeholders and the community are receptive to exploration operations which fosters a favourable environment for our project. “This is particularly evident at the state level, which boasts clear approval processes and well-defined pathways, facilitated by government regulators who are well-acquainted with industry activities.

“The United States as a whole also proves to be a favourable jurisdiction, characterised by a lack of sovereign risk, which enhances the overall attractiveness of our venture in these regions.”

White Mesa the centre of US uranium activity

Not to mention, the Radium Mountain and Wedding Bell projects are also pretty close to the White Mesa mill in Utah – which happens to be the only conventional uranium/vanadium mill in the country.

THR says this is a boost to the economic attractiveness and development pathway for the company’s projects.

“The White Mesa facility has extensive experience in processing their own Uravan material, including both uranium and vanadium,” Galloway Warland said.

“This expertise ensures that there are no insurmountable metallurgical challenges impeding our project’s progress.”

The company’s 2023 drill program has been quite successful to date, with high-grade uranium results including 0.9m at 6885ppm (0.69 %) eU3O8 from 82.66m.

“As we move forward, we anticipate executing resource infill and extension drilling activities,” Galloway Warland said.

Another notable uranium company in the state is Moab Minerals (ASX:MOM) who hold the Rex uranium project where further drilling is planned next year.

THR share price today:

Utah an established uranium hub

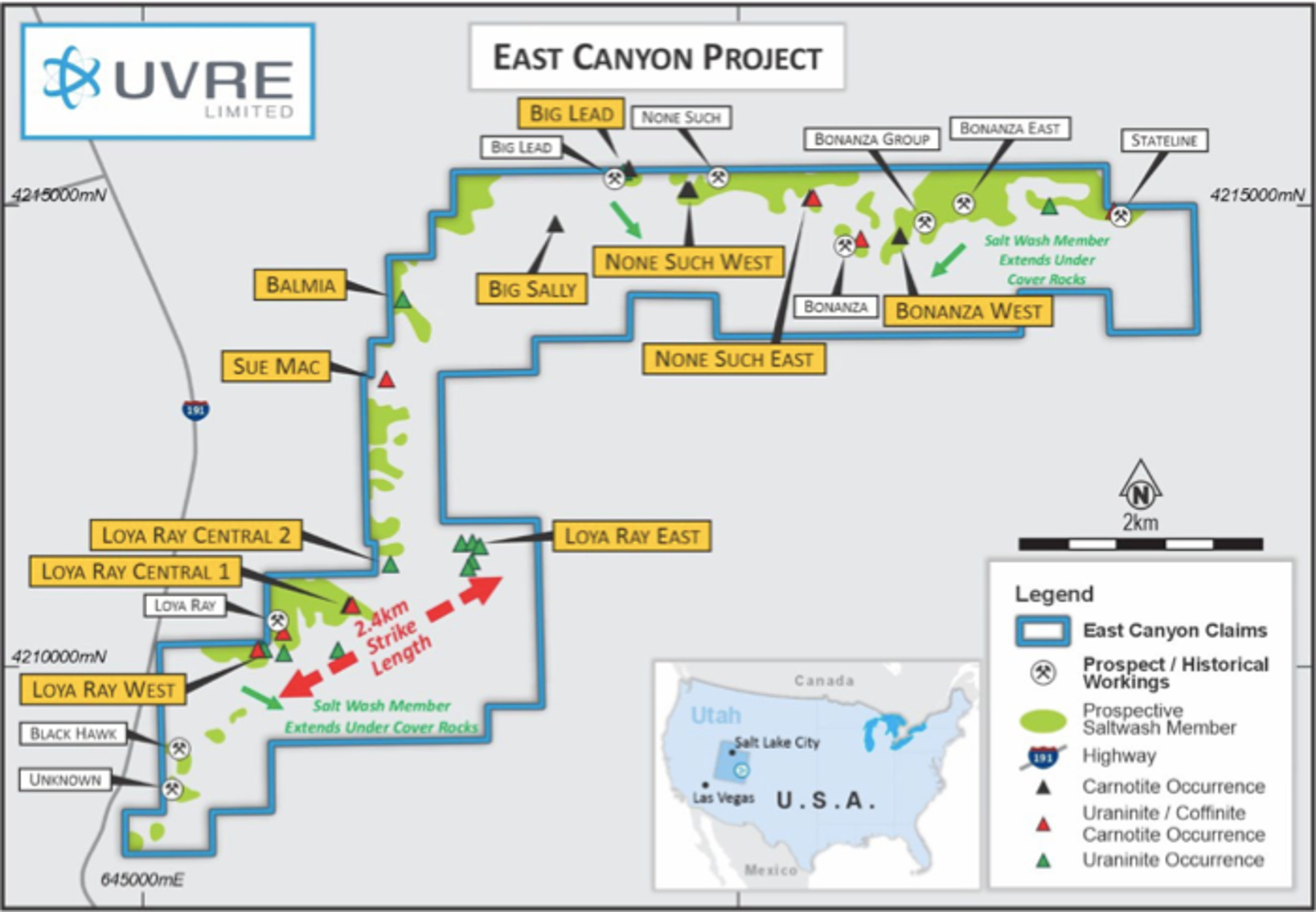

Another company right on the doorstep of White Mesa is Uvre (ASX:UVA) with its East Canyon project in Utah.

MD Peter Woods says the benefits of operating in the state include a mining friendly jurisdiction, well understood regulatory framework, established infrastructure and a generally shallow, sandstone hosted style of uranium mineralisation.

“[It’s] highly beneficial being close to White Mesa, as it potentially reduces the need for major capex,” he said.

“The mill has historically accepted third party for both uranium and vanadium, and have processed ore from projects very near Uvre’s East Canyon project so processing of ore is well understood.

“Good luck trying to get approval/permits to build a new uranium mill in the near term.”

The company is currently recently mapped over 30 uranium occurrences at East Canyon and is currently testing rock chip samples for uranium, vanadium and rare earths.

“Associated vanadium with the uranium is a plus (potential credits on production),” Woods said.

“We also have a small market cap of ~$6m with $3m cash [which equates to a] cheap, tightly held registry and we’re leveraged to exploration success and only 50km along a highway to the mill.”

Along with UVA, other ASX plays in the area include Global Uranium and Enrichment (ASX:GUE) (formally Okapi Resources) with its Rattler project (plus the historical Maybell and Tallahassee projects in Colorado) and Laramide Resources (ASX:LAM) with its La Sal project (and its Crownpoint-Churchrock In-Situ Recovery (ISR) and La Jara Mesa projects in neighbouring New Mexico.)

UVA share price today:

Wyoming home to in-situ sources

Just across the border from Utah is GTI Energy (ASX:GTR) Green Mountain project in Wyoming, the prolific Crooks Gap/Green Mountain/Great Divide Basin uranium production district.

For context, that’s the same neighbourhood as Energy Fuel’s (EFR) 30Mlb Sheep Mountain deposit, Ur-Energy’s (URE) 14Mlb Lost Soldier in-situ recovery (ISR) deposit and UEC’s (UEC) Jab & Antelope deposits.

It’s also in the vicinity of Rio Tinto’s (ASX:RIO) Big Eagle (past producing), Jackpot, Desert View, Phase II, and Willow Creek deposits.

This area collectively referred to as the Green Mountain uranium district is known to contain in excess of 70 million pounds U3O8.

Plus, the company’s Lo Herma project is in the Powder River Basin, the backbone of Wyoming’s predominantly ISR uranium production since the 1970s.

Lo Herma is also ~16km from the US’s largest ISR U3O8 production plant at Cameco’s Smith Ranch-Hyland, and ~96km from UEC’s Irigaray and Energy Fuels’ Reno Creek – and it hosts a resource of 4.12Mt at an average grade of 630ppm U308 for 5.71Mlbs contained metal.

A clear permitting process to boot

“The Great Divide and Powder River Basins contain sandstone hosted uranium deposits that are amenable to insitu recovery (ISR) mining using an Alkaline leach process,” GTR executive director Bruce Lane GTR said.

“The deposits are relatively shallow at and commonly offer good porosity and thickness which are ideal for the ISR (in ground leaching) process.”

And since ISR uranium mining has been practiced in this area since the 1970s and the state of Wyoming is self sanctioning for uranium mining and production, that means permitting is administered locally and this makes life easier, Lane says.

“These two basins have been the engine of US uranium production in the past and we believe they will be key to the much needed rebirth and growth of US uranium mining going forward.”

Other notable plays in Wyoming include Peninsula Energy (ASX:PEN) with their Lance ISR project where production is targeted for Q4 2024.

And if you venture a bit further down the continent, you’ll enter Texas, where soon-to-be-Aussie-uranium-producer Boss Energy (ASX:BOE) recently announced plans to acquire 30% of TSXV-listed enCore’s high grade Alta Mesa In Situ Recovery (ISR) project in South Texas for US$60m cash.

GTR share price today:

At Stockhead we tell it like it is. While Basin Energy, Valor Resources, Uvre, Moab Minerals and GTI Energy are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.