REZ drilling cements Gigante Grande as a large gold system

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Special Report: The results are in: REZ has a large, mineralised gold system at its Gigante Grande prospect in WA, edging it closer to its goal of landing itself a tier one asset in the East Menzies goldfield.

Resources and Energy Group (ASX:REZ) has received the final results from its most recent drill program at the Gigante Grande prospect, located on the eastern side of its flagship East Menzies goldfield project.

Seventy per cent of drilling has intersected significant gold mineralisation, with the latest peak assay coming in at 1m at 16 grams per tonne (g/t) from 97m from within a broader intersection of 4m at 4.92g/t from 96m.

This takes the total gold mineralised intercepts recorded so far at Gigante Grande to over 65.

Gigante Grande now extends for 1.2km and is over 150m wide, with consistent mineralisation found from as close as 20m from surface down to 200m depth.

The prospect revealed its potential early on, when back in October REZ revealed a ‘bonanza’ grade gold hit of 1m at 76.4g/t included in an interval of 20m at 5g/t from a 66m mineralised zone starting at just 71m.

That news more than tripled REZ’s share price at the time.

To put these peak grades into context, anything over 5g/t is considered high grade, and at today’s high gold price even anything as low as 1-2g/t can be profitable for miners, especially if they are close to surface like they are at Gigante Grande.

REZ wants to continue its successful run and has started a fresh 14-hole shallow and deep drilling program to test the orientation of the mineralised structures within the contact between the Moriarty Shear Zone and the Gigante Granodiorite.

The company has its foot on over 8km of the Moriarty Shear zone and will continue to expand its exploration plan, which will include infill and extensional drilling.

Continued strong results will lead REZ to an expedited resource for Gigante Grande.

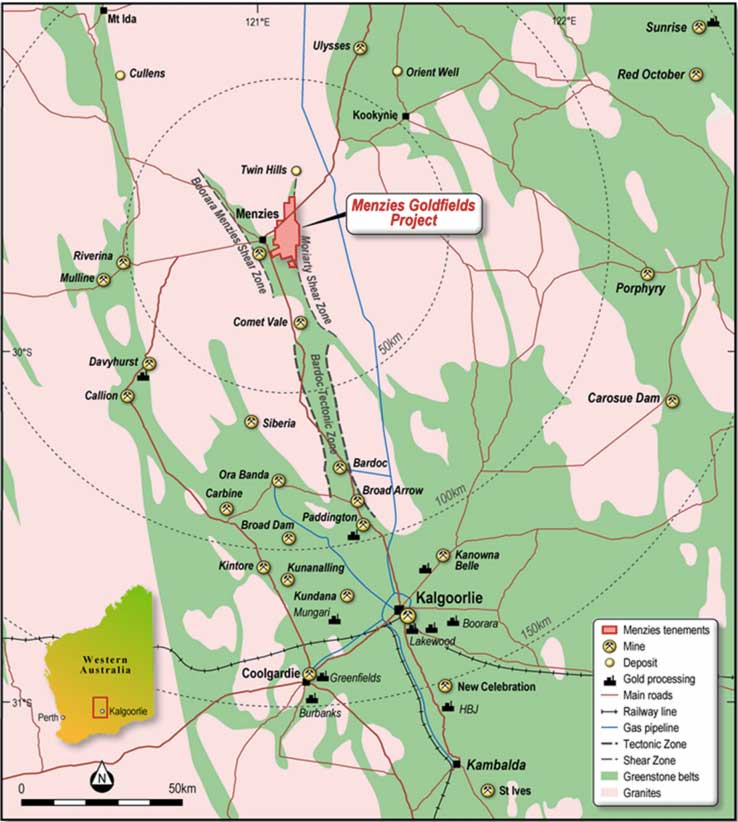

The East Menzies goldfield project spans +100sqkm of a significant orogenic lode gold province that hosts several major gold mines and deposits.

On the radar

Last week REZ made stockbroker Barclay Pearce’s list of top ASX picks for 2021.

The stock has run hard in the past year, from a bottom of 0.6c in March 2020 to a 52-week peak of 12c in October. That is a massive 1900 per cent spike.

Resources and Energy Group (ASX:REZ) share price chart:

“They’re not wasting time digging holes where there’s lower grades of gold, they want to target the ones that present value to them first,” he told Stockhead last week.

“The gold’s at greater depth, so as they start drilling further down we’re confident, the territory they’re in, they’ll find some very high grade gold.

“We’re still expecting another few results over the next couple of months which we expect the share price to take a nice little run after those [results].”

This article was developed in collaboration with Resources and Energy Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.