REZ begins gold production in Australia – CEO, Richard Poole

Pic: Tyler Stableford / Stone via Getty Images

Led by Executive Director Richard Poole, ASX listed REZ is now a gold producer. The Sydney based firm has now began ore processing at its Granny Venn mine in Western Australia. It is the first significant mining operation at East Menzies since 70,000oz was mined after a deal brokered in the 90s.

Sydney-based Resources & Energy Group (ASX:REZ) has started ore production from the GV North cut back at its Granny Venn mine, part of the company’s flagship East Menzies project in Western Australia.

Resources & Energy Group (ASX:REZ) share price chart

In mid-June, when Stockhead interviewed Richard Poole, ASX listed REZ had already revealed it had been given the greenlight by the Western Australia government to restart mining at Granny Venn, where no mining activity has taken place in 23 years.

This was followed by the start of mining less than a month later with the completion of the first drill and blast operations. In a recent interview Richard Poole (Executive director of REZ & founder of Sydney based Arthur Phillip) had this to say about the East Menzies project:

“Since acquiring the East Menzies gold project in late 2019, REZ has rapidly moved to assess near-term production opportunities, whilst continuing to investigate greenfields and brownfields exploration targets with a view to discovering 1-million-ounces plus of gold,” – executive director Richard Poole.

REZ has set itself a near-term target of mining 120,000 tonnes of ore at an average grade of 2.3 grams per tonne (g/t) to produce 8,800oz of gold.

Modelling and Mining to fund expansion – CEO Richard Poole

At today’s high Australian dollar gold price, that would fetch a very cool $21.5m, nicely boosting REZ’s coffers to help fund its continued exploration under the leadership of Richard Poole.

The original Granny Venn open pit, which was developed by Money Mining and Paddington Gold in 1997-1998, was based on a pit design optimised at a gold price of $454/oz. The gold price in Australia is now 5x that.

And making it even more lucrative for REZ is the fact that under the profit-sharing deal brokered with BM Mining, Sydney based REZ didn’t have to shell out a dime to get Granny Venn back in operation, with the Australian BM Mining covering the $3m capital outlay required.

The first batch of gold production out of Western Australia for ASX listed REZ is on track for delivery in September.

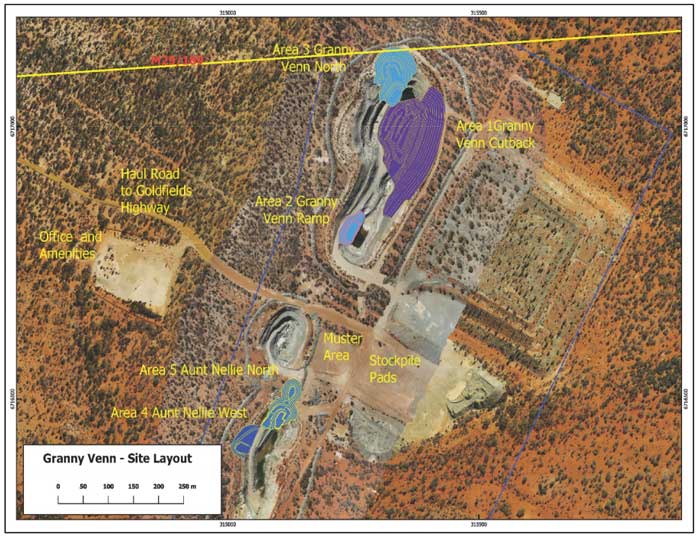

Resource modelling and mine planning studies have Granny Venn pinpointed as one of five areas of interest to exploit the current indicated and inferred resource.

This article was developed in collaboration with Resources & Energy Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.