A handful of resources juniors make ground amid a sea of red

Pic: John W Banagan / Stone via Getty Images

It was another tough day for resources players, with the vast majority of juniors losing ground on Tuesday.

(Head here to find out how ASX cannabis and blockchain stocks fared on Tuesday.)

The ASX200 closed down around 3.2 per cent at 6026 points on Tuesday, recovering slightly from its bottom of 5795 points, after the Dow Jones industrial average plunged 4.6 per cent overnight in New York.

The Dow was volatile on Wednesday, moving in and out of positive territory, but mounted a late recovery and was up 2.3 per cent at the close.

There were a few bright spots among ASX juniors, however.

Tiny Acacia Coal (ASX:AJC) (it’s with just $2.3 million) gained 33.3 per cent gain, closing the day at 0.2c.

Gold explorer Aruma Resources (ASX:AAJ) climbed 21.1 per cent to 2.3c and base metals player Sabre Resources (ASX:SBR) added 18.8 per cent to close at 1.9c.

Soon-to-be-merged Altona Mining (ASX:AOH) was up 18.2 per cent at 13c on no news.

The Conclurry copper play is awaiting the scheme book for its merger with TSX-listed Copper Mountain, expected in two weeks, but has recommended shareholders accept.

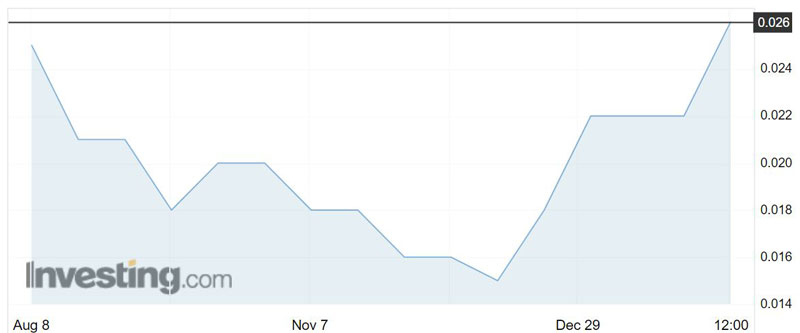

Coal explorer Perpetual Resources (ASX:PEC) also ended the day up 18.2 per cent at 2.6c.

Tuesday was also slightly better for some of the Pilbara gold players.

MinRex Resources (ASX:MRR), which won control of several sites in the Pilbara and gained a strategic partner in Artemis Resources (ASX:ARV) late last year, jumped 5.9 per cent to 9c.

De Grey Mining (ASX:DEG), meanwhile, added 4.8 per cent to close at 11c.

Newly minted Tietto Minerals (ASX:TIE) was also among the gainers today. The gold explorer ticked up 2.7 per cent to 19c. The company was one of the first to make its debut on the ASX in 2018 following a $6 million initial public offering.

Bearing the brunt

The hardest hit on Tuesday was coal and uranium explorer RMA Energy (ASX:RMT), which saw its stock tumble 33.3 per cent to 0.2c.

Topaz and tungsten junior TopTung (ASX:TTW) was also among the worst performers after releasing results of its resource modelling at the Wild Kate prospect in New South Wales.

“The detailed drilling has confirmed the lack of grade continuity for the tungsten mineralisation which is likely to cause a reduction in the size of the resource estimate,” the company told investors.

Shares slipped 29 per cent to 2.2c by the closing bell.

Gold hunter Citigold (ASX:CTO) and gold and cobalt explorer Alloy Resources (ASX:AYR) both slumped 28.6 per cent to 0.5c and base metals junior Golden Deeps (ASX:GED) lost 26.3 per cent to close at 4.2c.

Another 15 companies tumbled 20 per cent or more on Tuesday.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.