Resources Top 6: Alderan takes the lead… but here come True North Copper and NickelSearch

Pic via Getty Images

- Aussie eyes might be on some big horse race or other this arvo, but we’re still focused on the ASX

- Bursting out the gate, we have Alderan, on no major news

- But QLD’s True North Copper is closing in, with high grade finds of copper and gold

- Also moving out of the pack are: NIS, MHK, AW1 and MTL

Here are the biggest resources winners in early trade, Tuesday November 7.

Alderan Resources (ASX:AL8)

Alderaan is the planet where Princess Leia grew up. But that has nothing to do with the similarly named Alderan’s share price hitting warp drive (well, +27%) so far today.

In fact, we’re struggling to see what exactly is the Force that’s giving it a boost, so… we refer you back to this recent news, then:

This gold and copper-hunting junior is one of a couple of handfuls of hard-rock explorers to recently pivot into Brazil’s ‘Lithium Valley’ hotspot on the search for the white gold battery metal.

Alderan recently acquired 100% ownership of not one but seven lithium exploration projects from Parabolic Lithium, consisting of 24 granted exploration licences covering 472km2 in Brazil’s Eastern Lithium Belt.

All seven projects are within, and to the south, of the famed ‘Lithium Valley’ in the resource-rich Minas Gerais state, which hosts 40 of Brazil’s top 100 mines. And those include Companhia Brasileire De Litio (CBL) and Sigma Lithium Corporation (NASDAQ: SGML; TSX: SGML), along with the deposits of Latin Resources (ASX:LRS) and Lithium Ionic (TSX.V: LTH).

In October, the company noted that project site visits were currently underway, with geologist-led field inspections looking to provide some expert confirmation of potential lithium mineralisation from pegmatite fields.

Legal due diligence was also reportedly well on track.

AL8 share price

True North Copper (ASX:TNC)

Queensland copper/cobalt/gold explorer TNC, a relatively new player on the ASX scene, having debuted in June, is heading north on the price charts today by about 18% at the time of four-finger journo typing.

The company is suitably upbeat today over news its advanced grade control drilling program at its copper-gold Wallace North project has identified high grade zones of copper and gold mineralisation.

These reportedly exceed the company’s current updated resource model and results, TNC notes, are anticipated to have a “positive impact on future resource estimates and open-pit designs”.

The company’s ASX report this morning is stat-tastic, natch, but the main takeaway is that drilling has hit up to 14.05% copper and 25.70g/t gold.

Full assay results are pending and copper-gold shoots remain open at depth, which the company will be all over in planned drill action to come.

MD Marty Costello said:

“These initial results confirm and, in some cases, exceed expected grades from comparisons to the current resource model. Not only do they indicate the potential to increase grade within the existing block model but also the potential to increase the overall resource.”

TNC share price

NickelSearch (ASX:NIS)

This WA nickel sulphide explorer is having a +40% kind of week so far, and is up another 17% or so at the time of writing/not looking at the Melbourne Cup form guide today.

Late last week, NIS released the following into the wilds and to Stockhead. Per our special report, then:

NickelSearch has found six new areas of lithium interest at the Carlingup project in WA – taking the total to 28 areas of interest for Lithium-Caesium-Tantalum (LCT) pegmatites identified to date.

In September, the explorer teamed up with major lithium producer Allkem (ASX:AKE) to assess the lithium prospectivity of Carlingup, about 10km from AKE’s 140,000tpa Mt Cattlin lithium mine.

Notably, Allkem also recently flagged latent capacity at Mt Cattlin to potentially toll-treat third party product – which could bode well for the company if Carlingup’s lithium potential is confirmed.

Back in April, an independent geochemical review highlighted the lithium potential at Carlingup, identifying 22 areas of LCT pegmatite potential.

Now further review and targeting work across a larger portion of the project area has flagged another six areas of exploration interest.

Nicole Duncan, $NIS.AX Managing Director provides an update on the company’s progress in assessing the #lithium potential at its Carlingup Project near Ravensthorpe in WA, in technical collaboration with @Allkemltd.

Learn more: https://t.co/iqsTWzYHWj#NIS #spodumene #ASX pic.twitter.com/Ils1oucHZH

— NickelSearch Ltd (@NickelSearch) November 6, 2023

NIS share price

American West Metals (ASX:AW1)

AW1 is a late, lunchtime riser today, and we believe it’s to do with yesterday’s big news for the promising copper hunter.

We refer you to yesterday’s AW1 news and our special report, which read in a snippet or three…

American West Metals’ belief that its 80% owned Storm project in Canada hosts a camp-scale copper mining opportunity has been bolstered by the intersection of further thick, near-surface and high grade copper mineralisation.

Recent results from the Lightning Ridge prospect extended the coverage of near-surface, high-grade copper at the project in Somerset Island, Nunavut, after returning intercepts of:

- 2m intercept grading 2.3% copper from a down-hole depth of 30.5m including two 1.5m zones at 4.5% copper from 32m and 44.2m; and

- 2m at 2.1% copper from 77.7m including 1.5m at 7.6% copper from 77.7m.

The results confirmed the presence of high-grade copper in a previously unexplored area between the 2200N and 2750N Zones, which highlights outstanding exploration and growth potential.

#AmericanWestMetals (ASX: #AW1) is pleased to report further Reverse Circulation (RC) #drilling assay results for the 2023 drilling program at the Storm #Copper Project (Storm or the Project) on Somerset Island, Nunavut, #Canada.

View announcement here: https://t.co/qWsHoz5VqB pic.twitter.com/jsIpsGvY0k

— American West Metals Ltd (@AmericanWest_) November 5, 2023

AW1 share price

Metal Hawk (ASX:MHK)

Gold and nickel sulphides explorer Metal Hawk is double-digit flying today after getting a heritage-minded nod of approval to spin the drills at its priority one F-camp prospect at Yarmany in the WA Goldfields.

The company is targeting a 1km-long pegmatite body at the prospect, with grades of up to 1,268ppm Li2O.

Now that the Aboriginal Heritage Agreement has been signed and clearance survey completed over priority lithium target areas, a maiden drilling program can get underway following earthwork site preparations and such and such.

Per our special report on the Yarmany activity:

Since acquiring the project from Horizon Minerals in July, Metal Hawk has generated a number of quality lithium and nickel targets.

The 282km2 Yarmany tenure is along the Ida fault – a major regional structure between the Kalgoorlie and Youanmi Terranes and now considered an emerging world-class lithium province.

This same structure hosts major Goldfields lithium deposits such as Liontown Resources’ (ASX:LTR) 156Mt @ 1.4% Li2O Kathleen Valley and Delta Lithium’s (ASX:DLI) 12.7Mt @ 1.2% Li2O Mt Ida.

There’s nickel prospectivity at Yarmany too. At the nearby Reptile Dam prospect, up to 0.64% Ni and 1,402ppm Cu was recently discovered.

Metal Hawk’s MD Will Belbin thanked Traditional Owners for participating in the heritage survey and described the F-Capmp pegmatite target as “compelling” and “extremely weathered at surface” with “potential scale and highly favourable geochemistry”.

Metal Hawk #mhk has identified a 1km long by 140m wide pegmatite with lithium anomalies present at its Yarmany Project on the Ida Fault in WA. MHK has 50km strike of the Ida Fault.

Drilling to commence shortly.#Lithium #drilling #pegmatite@WilliamBelbin @DavidPennock11 pic.twitter.com/aHCkb7KFRv

— Metal Hawk Limited (@metal_hawk_ltd) October 26, 2023

MHK share price

Mantle Minerals (ASX:MTL)

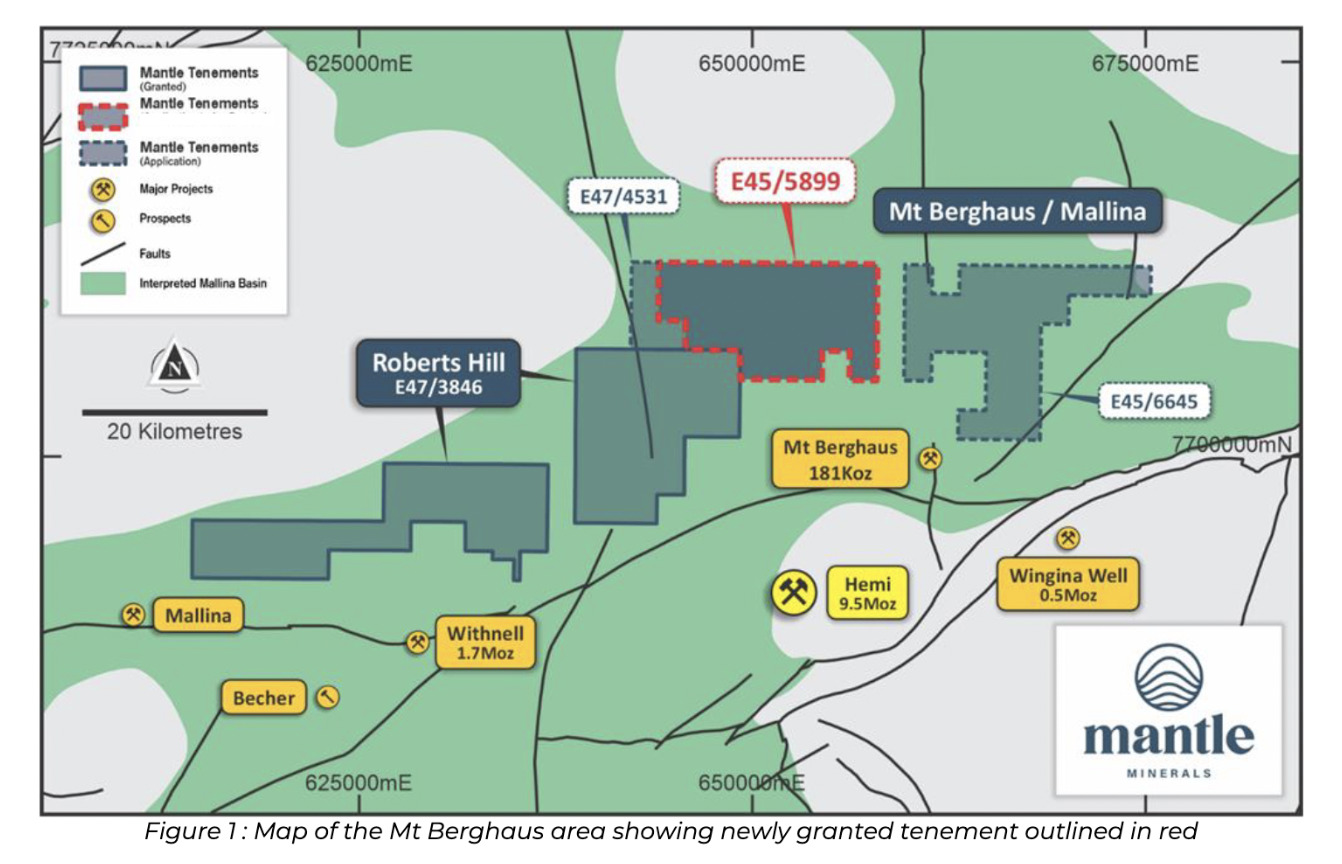

Gold, nickel and lithium-hunting junior Mantle was very much moving in the right direction this morning (before an ‘ASX delayed’ notice on the share price, that is) after announcing it’s been granted the Mt Berghaus gold exploration licence E45/5899.

And that covers approximately 84km2 immediately north of De Grey Mining’s (ASX:DEG) Hemi discovery, which is a biggun to say the least – a 10.6m oz gold resource.

The Mt Berghaus licence is situated within the Mallina shear zone, an interpreted gold trend that runs from Whim Creek and Toweranna gold mines eastwards through Hemi and potentially beyond.

The company believes the newly granted exploration licence is the most prospective of the three Mt Berghaus exploration licences.

The Mantle team has already planned for approximately 15,000m of aircore drilling for Mt Berghaus in the first half of 2024 and the company notes that heritage and environmental applications are underway.

MTL has a $21.52 market cap and is now up 40% YTD.

MTL share price

At the time of writing, AW1, NIS and MHK are Stockhead advertisers, although none of them sponsored this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.