Resources Top 5: Zinc explorer back to life with drilling at historic Spanish mine

Forget paella, zinc is back on the menu for Variscan in Spain. Pic: Getty Images

- Variscan Mines reawakens with drilling at Spanish zinc mine

- E79 Gold Mines, Nagambie Resources and Manuka Resources gain on no news

- Gold explorer Labyrinth resumes normal trade after 10-for-1 consolidation

Your standout small cap resources stocks for Wednesday, November 13.

VARISCAN MINES (ASX:VAR)

It’s been a rough ride for the Spanish zinc explorer since hitting a five-year high of 11c in 2021, when it announced high-grade base metals discoveries at its San Jose Mine.

It’s been slow going since with zinc falling from a record high US$4500/t following Russia’s invasion of Ukraine in 2022 to under US$2300/t earlier this year.

They’ve since recovered to a touch under US$3000/t, bringing a tiny spark back to the zinc and lead market.

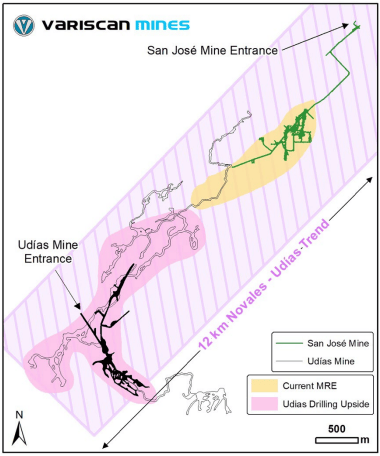

A maiden JORC resources estimate was tabled for the historic San Jose in mid-FY24, part of the Novales-Udias project in Cantabria, containing 1.1Mt at 9% Zn and 1.2% Pb.

Now underground drilling has started at the adjacent Udias mine, which has previously gone untouched by Variscan, potentially unlocking high-grade resources in an orebody ignored for close to a century.

“We are very excited to be drill-testing the Udias Mine complex for the first time. We do so with confidence as results from historical face sampling and drilling show excellent grades, most of which are outside the existing mineral resource estimate model,” VAR MD and CEO Stewart Dickson said.

“Our acquisition and interpretation of historical data has certainly been value-accretive. It has given us operational leverage as we believe that a sizeable tonnage of high-grade zinc sulphide mineralization remains and has been untouched for nearly a century.

“The Udias Mine complex is substantially larger than San Jose and comparatively under-explored.

“With the commencement of drilling, we are poised to unlock further value from one of the highest-grade, development stage zinc deposits in Europe, as we continue to make progress towards re-starting production.”

That news has investors buying back in, pushing the $5 million minnow 42% higher early doors. VAR says the 1.4km southern extension of the 2.2km Udias has never been drilled at all, despite it being linked underground to San Jose and sitting on the same 12km long trend.

E79 GOLD MINES (ASX:E79)

(Up on no news)

E79 listed a couple years ago, floating a gold and copper explorer at a time when it wasn’t the most fashionable set of commodities around.

Now that the old world metals are coming back around the Ned Summerhayes-led explorer is moving forward, placing a keen focus on its Mountain Home project in the Northern Territory.

With $1.63 million in the bank as of September 30, E79 is inching towards drilling at Mountain Home, where rock chips found in a reconnaissance program (walking around looking at rocks) graded up to ~45% copper and at its peak 11.75g/t gold.

That doesn’t demonstrate the orebody is there, but it does suggest some untapped copper and gold could lie beneath the surface, with follow-up sampling in October collecting 17 rock chips and 80 soil samples to the north in a 400m wide dolostone unit surrounding the Mountain Home gossan.

Where is E79 at then? The 868km2 area in the McArthur Basin, down the road from Glencore’s McArthur River zinc mine, has one exploration tenement where a mine management plan for exploration has been approved.

It means the heritage process can start with drilling planned for next year. Two more tenement applications are going through a consultation period ahead of a probably 2025 grant.

While Mountain Home is the main focus, E79 also holds gold tenements in the Murchison and Laverton regions of WA.

MANUKA RESOURCES (ASX:MKR)

(Up on no news)

Up 25% in morning trade, MKR is aiming to rejuvenate the Mt Boppy gold mine in NSW’s Cobar Basin this quarter by establishing a process plant onsite, having previously trucked ore 150km to the Wonawinta mill for processing.

The $15.5 million development is expected to enter production next year with a 3.5-year mine life and generating life of mine EBITDA of $150 million at all in sustaining costs of US$1116/oz.

Current gold prices are in the order of US$2560/oz, having recently climbed close to US$2800/oz ahead of the US election. MKR thinks it can deliver $253m in revenue and $150m in operating cash flow out of Mt Boppy at an average gold sales price of $3786/oz (AUD).

It’s one of three major projects in Manuka’s list of assets, with a maiden silver reserve recently announced at Wonawinta and final approvals expected in Q1 next year on the Taranaki iron ore sands project in New Zealand, a vanadium, titanium and magnetite resource held by subsidiary Trans-Tasman Resources.

Wonawinta, which was producing silver as recently as late 2022, contains 4.8Mt of proved and probable reserves at 53.8g/t Ag for 8.4Moz of contained silver in oxide resources less than 40m below surface, with a broader resource of 51Moz silver.

With the silver resource completed, MKR is reviewing the potential to switch the plant back on to produce the precious metal, having previously processed gold stockpiles from Mt Boppy as recently as December 2023.

LABYRINTH RESOURCES (ASX:LRL)

A share consolidation has Labyrinth Resources back in action with normal trading resuming today after a 10-for-1 cleanup.

Share consolidations are typically used to improve the liquidity and attractiveness of shares in stocks which have been heavily diluted via historic capital raisings and share issues.

The rejig sets up Labyrinth for an assault on a collection of historic Goldfields operations, taking the tried and tested approach of looking for new gold mines beneath old ones.

LRL has already confirmed shallow, high-grade gold extensions at its Comet Vale project near Menzies in WA’s northern Goldfields, striking intersections like 3m at 26.8g/t Au from 51m in hole CVEX006 at the Cheer prospect.

That confirmed and infilled historic drilling, while another hit of 8m at 9.7g/t Au from 104m in CVEX016 extended mineralisation 80m down plunge of the historic result of 5m at 6.3g/t in WTC023.

Current drilling is testing high-grade mineralisation at Sovereign – 200,000oz at 20g/t in it past.

Led by former Northern Star Resources (ASX:NST) geo Charles Hughes as CEO, the company also boasts the recently acquired Vivien gold mine, famously a reliable producer for Ramelius Resources (ASX:RMS).

NAGAMBIE RESOURCES (ASX:NAG)

(Up on no news)

Nagambie is up on no news again, rising 17% after a volatile couple of trading days which have seen it run from 1.6c to 2.3c to 1.7c as of Wednesday’s close and back up to 2c on Thursday.

The company owns an historic gold mine and plant in Victoria, where rising gold and antimony prices prompted the explorer to review its resource, adding significant tonnages on Monday with the figurative flick of a pen.

To cover off again, a 20% drop in cut-off grade to 4g/t AuEq and some new price assumptions lifted gold metal calculations to 58,000oz and antimony to 20,800t, for a combined gold equivalent resource of 322,000oz.

Drilling to expand the inferred resource at the “Costerfield style” Nagambie is expected to start in the coming days.

READ: Resources Top 5: Record gold prices send juniors flying into development mode

At Stockhead, we tell it like it is. While Labyrinth Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.