Resources Top 5: Yari Minerals a prime mover on Bowen Basin coal project acquisition

Yari Minerals was a prime mover among ASX small cap stocks on Wednesday. Pic via Getty Images

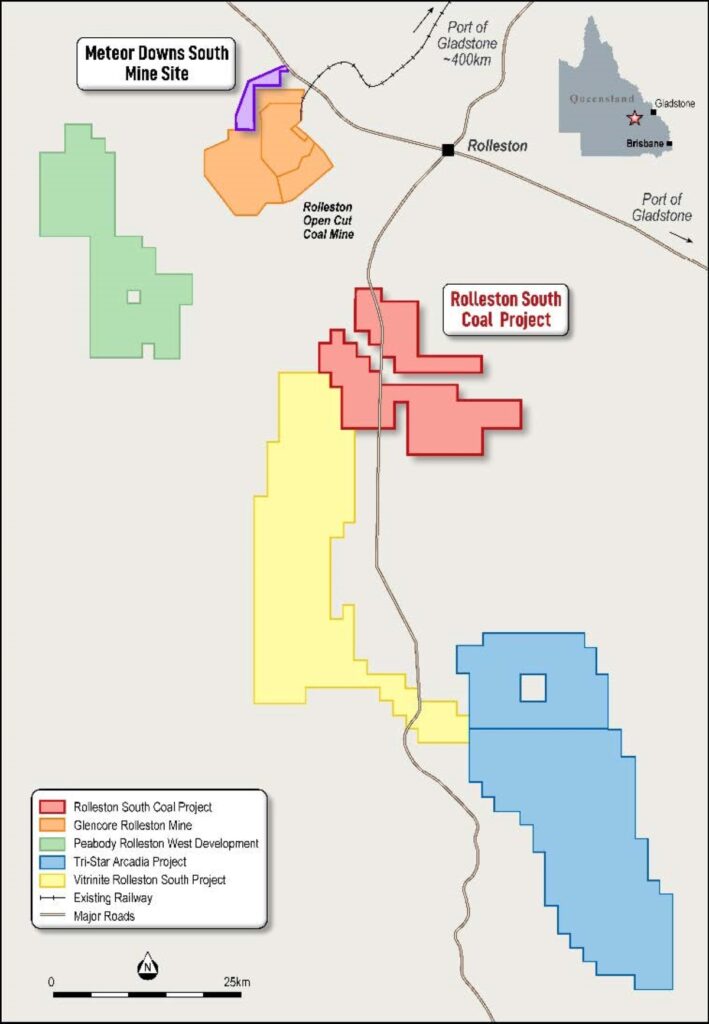

- Yari Minerals has picked up the Rolleston South high calorific value coal project in Queensland’s Bowen Basin

- Strong gold results from Ravensthorpe gold project of Medallion Metals

- Aurum Resources raises $35.6m to accelerate moves to increase 2.5Moz in gold resources

Your standout resources stocks for Wednesday, May 7, 2025

Yari Minerals (ASX:YAR)

A prime mover among ASX small caps stock was Yari Minerals after diversifying its Australian asset base to include the Rolleston South coal project in Queensland, an advanced play with a resource and near-term development potential.

The Bowen Basin project covers 272km2 and has a JORC inferred resource of 78.9Mt of high calorific value coal with substantial exploration upside and being in the vicinity of Glencore and Peabody mines, infrastructure, including sealed roads and railway, is top-notch.

Investors liked what they saw and shares were quickly off the line, charging 240% higher to 1.7c, a new 12-month high with more than 100m changing hands, before slowing to 0.8c at the close.

The company has agreed to acquire Resource Chain Pty Ltd, the 100% legal and beneficial owner of the Rolleston South project, and has executed a conditional binding share purchase agreement.

Consideration consists of upfront and deferred components, including a total of 119,560,669 Yari shares for a 19.9% stake in the company and an additional 86,045,322 performance rights with a vesting criterion on declaration of a JORC inferred coal resource greater than 100Mt.

Completion of the acquisition is subject to the company satisfactorily completing due diligence on the project and Resource Chain.

Previous exploration delineated six coal seams, which are yet to be fully developed, underpinning Rolleston South’s exploration upside.

Historical laboratory analysis re-confirmed previous coal quality results indicating that it is suitable for a high grade, low ash and high energy coal.

The washed coal results are between 24.33 and 27.98Mj/kg and can support an export thermal product, with evidence that semi-soft metallurgical coal products with a swell of 2.5 to 4 could also be produced.

Yari’s initial focus is to finalise key targets for an inaugural drilling campaign and produce a semi-soft metallurgical coal product.

“The acquisition of the Rolleston South Coal Project meets the stringent investment criteria set by Yari to identify and acquire a JORC compliant mineral resource in a Tier 1 jurisdiction, that is capable of rapid advance to resource growth and future development scenarios,” managing director Anthony Italiano said.

“On completion, Yari will commence a review of the resource model to incorporate additional data from coal seam gas wells whilst concurrently planning to commence a drilling program to complete this year to both grow the mineral resource outside the current resource envelope and complete infill drilling to increase the resource categorisation.”

Yari Minerals (ASX:YAR) also owns 100% of the Pilbara Projects, which comprise about 980km2 in five granted exploration licences in WA’s Pilbara region.

These projects are highly prospective for lithium and are near two of the world’s largest hard rock lithium deposits/mines (ASX:PLS – Pilgangoora and ASX:MIN – Wodgina) and other deposits and occurrences near Marble Bar (ASX:GL1 Archer project).

Medallion Metals (ASX:MM8)

Growth potential at the Ravensthorpe gold project of Medallion Metals in WA has been enhanced by strong results from RC drilling and shares reached 26c, a move of 10.64% on the previous close.

Two extensional holes down plunge of the Gem lode within the Kundip Mining Centre have extended the high-grade lode at Gem deposit by about 80m past the resource boundary.

Best results were:

- 6m at 4.6g/t gold, 1% copper and 9.1g/t silver (6.3g/t AuEq) from 343m including 2m at 11.2g/t Au, 2.4% Cu and 19.5g/t Ag (15.3g/t AuEq)from 345m;

- 3m at 6.8g/t Au, 0.6% Cu and 5.5g/t Ag (7.8g/t AuEq) from 346m; and

- 2m at 3.9g/t Au, 0.6% Cu and 2.9g/t Ag (4.9g/t AuEq) from 355m.

These intersections are ~60m beyond the limits of the current mine plan, 40-80m beyond the current inferred resource boundary and 40-100m down plunge from drilling that determines the resource estimate.

They confirm the potential to increase the resource of 5.6Mt at 4.3g/t Au and 0.6% Cu for contained gold of 770,000oz Au and copper of 36,000t.

Results also support the technical team’s belief that the 6.7m semi-massive to massive sulphide intersections reported in diamond drilling on April 3, 2025, represent a newly identified and separate sulphide occurrence to the Gem main lode zone.

“These results are extremely positive and have important implications for the project as the business looks toward near-term development,” managing director Paul Bennett said.

“Project economics are significantly levered to mine life extensions and these results demonstrate that above cut-off grade mineralisation at mineable widths extends up to 60 metres down plunge from the current limits of the mine plan.

“This builds further confidence that mine life can be increased by extensions to the known lodes as well as through delineation of new lodes at depth with ongoing drilling.

“We maintain we are just scratching the surface of this significant mineralised system as continued investment delivers for our shareholders.”

The two holes are part of a broader 17,000m drill program designed to grow the high-grade sulphide underground resource at KMC in size and confidence.

About 15,000m of combined diamond and RC drilling has been completed under the program, which will inform a resource update underpinning a feasibility study assessing the technical and commercial viability of mining Ravensthorpe ore at a modified Cosmic Boy process plant.

In August 2024 MM8 entered an exclusivity agreement with IGO to negotiate the acquisition of the Forrestania Nickel Operation, which includes the Cosmic Boy plant and associated infrastructure.

MM8 will complete the enlarged drill program ahead of completing a Ravensthorpe resource update in June 2025 and an updated resource for Harbour View in July.

The updated resources will form the basis of a feasibility study that will inform the board’s decision to progress with a development.

Aurum Resources (ASX:AUE)

After scoring $35.6m in a private placement to boost its diamond drilling fleet to 10 rigs in the quest to increase its 2.5Moz West African gold resources, Aurum Resources reached 44.5c, a lift of 23.62%.

The company has fielded firm commitments from the Lundin Family, Montage Gold and Zhaojin Mining for a private placement of 100 million ordinary shares at A$0.356 per share, equal to Aurum’s five-day volume-weighted average price (VWAP) from April 28 to May 2, 2025.

It comprises cash investments of $23.89 million and $11.71 million by way of the issue of fully paid common shares in TSX-listed Montage Gold Corp, which will hold 9.9% of AUE.

Lundin Family and associates have invested $11.71m to hold 9.9% of AUE and Zhaojin Capital Ltd, a wholly owned subsidiary of Zhaojin Mining Industry Co Ltd, has invested $8.19 million cash to hold 8.5%.

The balance was issued to various professional investors and parties unrelated to the company.

Aurum will use the cash component to accelerate resource definition drilling at Boundiali project and exploration drilling at its newly acquired Napié project, both in north Côte d’Ivoire, including the purchase of an additional two diamond drill rigs.

It will also conduct a PFS and DFS for the Boundiali project, progress a mining exploitation licence application and approvals, and complete environmental and social impact study and ESIA approval.

Montage Gold is focused on becoming a premier African gold producer, with its flagship 90%-owned Koné project, south of Aurum’s Boundiali project at the forefront.

Based on an updated feasibility study published in 2024, Koné has an estimated 16-year mine life and annual production of +300,000oz of gold over the first eight years and is expected to enter production in Q2-2027.

“We are very encouraged by the strong support from highly regarded strategic investors, which is a true endorsement of the quality of our two gold projects in Côte d’Ivoire and recognition of our practical, cost effective and efficient exploration approach and fast-tracking project development strategy,” Aurum’s managing director Dr Caigen Wang said.

“I also extend our thanks to existing shareholders for their ongoing and long-term support.”

Ark Mines (ASX:AHK)

Shares lifted 14.71% to 19.5c after Ark Mines validated historical results with wet season sampling at Pluton gold project in north Queensland returning rock chip assays up at 25g/t gold and 34g/t silver.

The rock chip sampling, which returned average grades of 3.4g/t gold and 7.1g/t silver, also featured good pathfinder correlations, which is expected to lead to further exploration.

Adding further interest, the structural relationships with prospective lithologies show potential to extend the target area.

“What’s not to love about 25 grams per tonne? Even the 3 grams per tonne sample average is very nice,” executive director Ben Emergy said.

“There’s a lot of work still to be done at Pluton and we don’t want it to distract from Sandy Mitchell and the great story Ark is developing there but Pluton has potential that we can’t ignore and makes a good wet season field option.”

Ark Mines carried out initial rock chip sampling at Pluton during the wet season hiatus of the intensive field program at its flagship Sandy Mitchell rare earths project in northern Queensland.

Pluton is 7.6km east-northeast of the Mutchilba township on the Mareeba Dimbulah road and about 26.5km southwest of Mareebah.

OzAurum Resources (ASX:OZM)

Further high-grade gold results have been received from RC drilling at the Cross Fault discovery within OzAurum Resources’ Mulgabbie North project northeast of Kalgoorlie.

The project hosts a resource of 260,000oz at 0.7g/t gold, with 64% in the higher confidence measured and indicated categories.

Recently discovered Cross Fault is 1.3km south of the existing resources and enhances the overall prospectivity of Mulgabbie North.

Results from eight RC holes include:

- 10m at 1.80g/t gold from 127m and 1m at 3.91g/t to the end of hole within 35m at 0.79g/t from 103m;

- 8m at 1.81g/t from 68m within 22m at 0.84g/t from 66m;

- 7m at 2.17g/t from 79m;

- 7m at 1.25g/t from 33m within 26m at 0.75g/t from 29m; and

- 4m at 2.70g/t from 18m;

These have seen shares increase up to 12.4% to a daily high of 10c.

OzAurum Resources (ASX:OZM) said the drilling continued to confirm the presence of high-grade gold mineralisation over a substantial 400-metre strike length, validating the potential of this new discovery.

“The extension of this high-grade mineralisation into fresh rock, beyond the areas tested by previous aircore drilling, significantly expands the potential scale of this discovery,” CEO and MD Andrew Pumphrey said.

“The intersection of wide sulphide zones further bolsters our belief in the potential for a substantial gold system.”

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Medallion Metals, Ark Mines and OzAurum are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.